Comparing CPA (Cost Per Acquisition) and LTV (Lifetime Value) is essential for optimizing subscription box pet services. Lowering CPA while maximizing LTV ensures sustainable growth and profitability by attracting high-value customers who continue their subscriptions over time. Focusing on strategies that boost customer retention and upselling opportunities increases LTV, making initial acquisition costs more effective and beneficial.

Table of Comparison

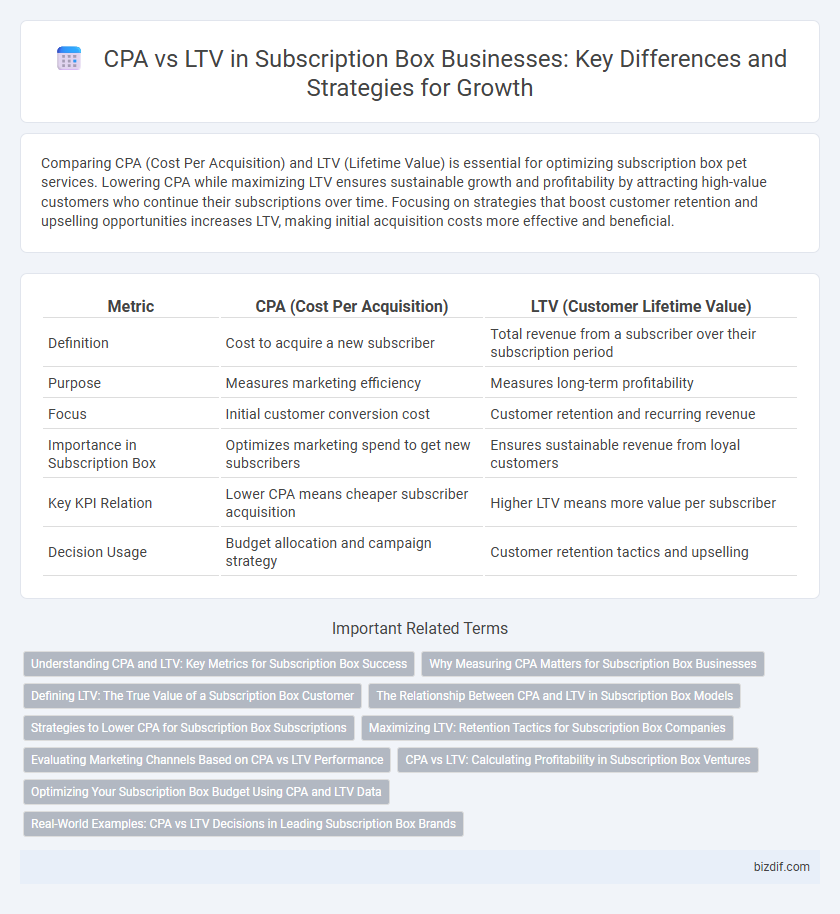

| Metric | CPA (Cost Per Acquisition) | LTV (Customer Lifetime Value) |

|---|---|---|

| Definition | Cost to acquire a new subscriber | Total revenue from a subscriber over their subscription period |

| Purpose | Measures marketing efficiency | Measures long-term profitability |

| Focus | Initial customer conversion cost | Customer retention and recurring revenue |

| Importance in Subscription Box | Optimizes marketing spend to get new subscribers | Ensures sustainable revenue from loyal customers |

| Key KPI Relation | Lower CPA means cheaper subscriber acquisition | Higher LTV means more value per subscriber |

| Decision Usage | Budget allocation and campaign strategy | Customer retention tactics and upselling |

Understanding CPA and LTV: Key Metrics for Subscription Box Success

Cost Per Acquisition (CPA) measures the expense of gaining a new subscriber, while Lifetime Value (LTV) estimates the total revenue generated from a subscriber over their entire engagement. Tracking CPA helps optimize marketing budgets, ensuring efficient spending to attract customers, whereas LTV guides strategies to enhance subscriber retention and maximize revenue. Balancing CPA and LTV is crucial for subscription box businesses to achieve sustainable growth and profitability.

Why Measuring CPA Matters for Subscription Box Businesses

Measuring Cost Per Acquisition (CPA) is crucial for subscription box businesses to ensure efficient customer acquisition spending and maintain profitability. By comparing CPA with Customer Lifetime Value (LTV), companies can determine if the cost of gaining a subscriber is justified by the revenue generated over time. Tracking CPA helps optimize marketing strategies, reduce churn, and maximize long-term growth in the competitive subscription box market.

Defining LTV: The True Value of a Subscription Box Customer

Lifetime Value (LTV) measures the total revenue a subscription box customer generates throughout their entire relationship, reflecting repeat purchases, subscription renewals, and upsells. Unlike Cost Per Acquisition (CPA), which only accounts for the initial customer acquisition cost, LTV provides a deeper understanding of long-term profitability and customer loyalty. Accurate LTV calculation enables subscription box businesses to allocate marketing budgets efficiently and optimize customer retention strategies.

The Relationship Between CPA and LTV in Subscription Box Models

The relationship between Customer Acquisition Cost (CPA) and Lifetime Value (LTV) in subscription box models determines profitability and growth potential. A sustainable subscription box business requires LTV to consistently exceed CPA, ensuring that the revenue generated from a subscriber over time justifies the initial acquisition expense. Optimizing marketing strategies to reduce CPA while enhancing customer retention directly increases LTV, driving long-term revenue stability in subscription services.

Strategies to Lower CPA for Subscription Box Subscriptions

Lowering CPA for subscription box subscriptions involves optimizing targeting by leveraging customer data to refine audience segments and reduce ad spend waste. Implementing upselling and cross-selling strategies increases average order value, indirectly boosting LTV and improving overall campaign efficiency. Streamlining onboarding processes and offering exclusive introductory discounts can enhance conversion rates, significantly driving down the cost per acquisition.

Maximizing LTV: Retention Tactics for Subscription Box Companies

Maximizing Customer Lifetime Value (LTV) in subscription box companies depends heavily on effective retention tactics, such as personalized product curation and exclusive member benefits. Reducing churn rates through proactive customer support and engaging content marketing directly boosts LTV by encouraging long-term subscription renewals. Investing in data-driven retention strategies ensures higher profitability compared to solely optimizing Customer Acquisition Cost (CPA).

Evaluating Marketing Channels Based on CPA vs LTV Performance

Evaluating marketing channels through the lens of Cost Per Acquisition (CPA) versus Customer Lifetime Value (LTV) reveals critical insights into subscription box profitability. Channels with a low CPA but higher LTV indicate sustainable growth by acquiring customers who generate recurring revenue over time. Optimizing marketing spend by prioritizing channels with favorable LTV-to-CPA ratios enhances long-term subscription retention and maximizes return on investment.

CPA vs LTV: Calculating Profitability in Subscription Box Ventures

Understanding the balance between Cost Per Acquisition (CPA) and Lifetime Value (LTV) is crucial for maximizing profitability in subscription box ventures. A lower CPA combined with a higher LTV indicates stronger customer retention and efficient marketing spend. Accurately calculating these metrics allows subscription businesses to optimize acquisition strategies and forecast revenue growth effectively.

Optimizing Your Subscription Box Budget Using CPA and LTV Data

Optimizing your subscription box budget requires balancing Customer Acquisition Cost (CPA) against Customer Lifetime Value (LTV) to ensure profitability. By analyzing CPA data, you can refine marketing spend to acquire high-value subscribers efficiently, while LTV insights help in forecasting long-term revenue from each customer. Prioritizing campaigns with lower CPA and higher LTV maximizes return on investment and sustains growth in subscription box businesses.

Real-World Examples: CPA vs LTV Decisions in Leading Subscription Box Brands

Leading subscription box brands like FabFitFun and Birchbox demonstrate the critical balance between CPA and LTV by optimizing customer acquisition costs while maximizing long-term value through personalized offerings and retention strategies. FabFitFun's targeted marketing campaigns have reduced CPA by 20%, achieving a higher LTV through exclusive seasonal products and member engagement programs. Birchbox leverages data-driven decisions to lower CPA and enhance LTV by focusing on tailored beauty samples and subscription flexibility, driving sustained subscriber growth and profitability.

CPA vs LTV Infographic

bizdif.com

bizdif.com