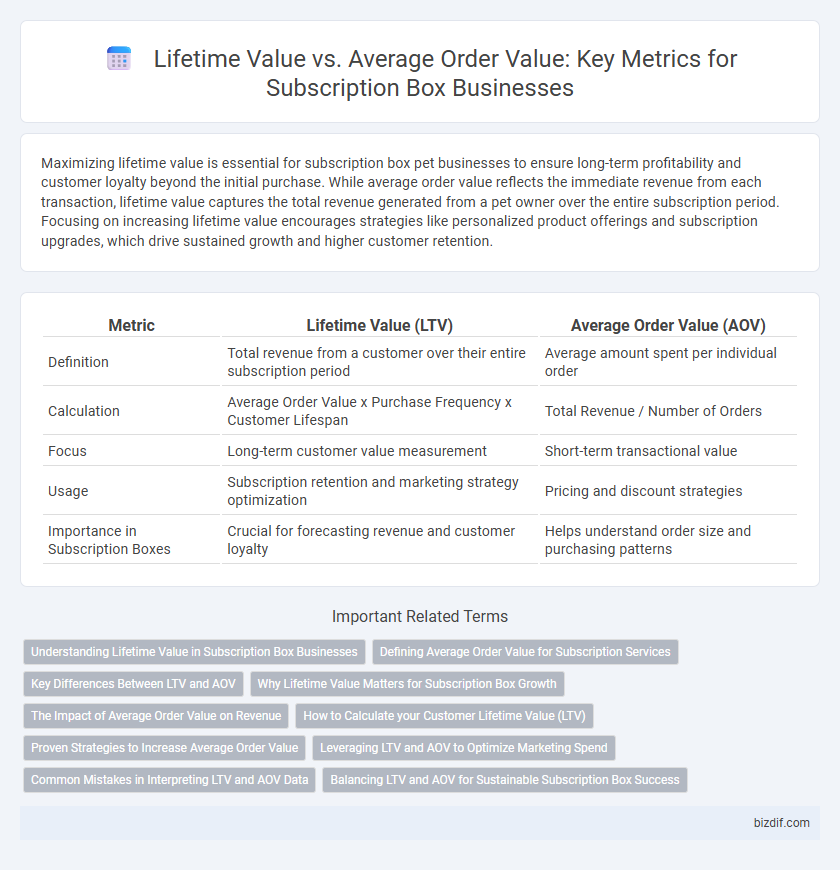

Maximizing lifetime value is essential for subscription box pet businesses to ensure long-term profitability and customer loyalty beyond the initial purchase. While average order value reflects the immediate revenue from each transaction, lifetime value captures the total revenue generated from a pet owner over the entire subscription period. Focusing on increasing lifetime value encourages strategies like personalized product offerings and subscription upgrades, which drive sustained growth and higher customer retention.

Table of Comparison

| Metric | Lifetime Value (LTV) | Average Order Value (AOV) |

|---|---|---|

| Definition | Total revenue from a customer over their entire subscription period | Average amount spent per individual order |

| Calculation | Average Order Value x Purchase Frequency x Customer Lifespan | Total Revenue / Number of Orders |

| Focus | Long-term customer value measurement | Short-term transactional value |

| Usage | Subscription retention and marketing strategy optimization | Pricing and discount strategies |

| Importance in Subscription Boxes | Crucial for forecasting revenue and customer loyalty | Helps understand order size and purchasing patterns |

Understanding Lifetime Value in Subscription Box Businesses

Lifetime value (LTV) in subscription box businesses measures the total revenue generated from a customer throughout their entire subscription period, providing deeper insight than average order value (AOV) which only captures revenue per transaction. Accurate LTV calculation helps businesses predict long-term profitability, optimize marketing spend, and improve customer retention strategies. By focusing on increasing LTV, subscription services can enhance sustainable growth and maximize customer lifetime engagement beyond individual purchases.

Defining Average Order Value for Subscription Services

Average Order Value (AOV) for subscription services measures the average revenue generated per transaction, reflecting the typical spend each subscriber makes during a billing cycle. It is calculated by dividing the total revenue by the number of orders within a specific period, providing insight into customer purchasing behavior and pricing strategy effectiveness. Understanding AOV alongside Lifetime Value (LTV) helps businesses optimize subscription offerings and increase customer profitability over time.

Key Differences Between LTV and AOV

Lifetime Value (LTV) measures the total revenue a customer generates throughout their entire relationship with a subscription box service, while Average Order Value (AOV) calculates the average amount spent per transaction. LTV provides insight into long-term customer profitability and retention strategies, whereas AOV focuses on optimizing individual purchase amounts. Understanding these key differences helps subscription businesses tailor marketing efforts to boost both customer loyalty and transaction size.

Why Lifetime Value Matters for Subscription Box Growth

Lifetime value (LTV) measures the total revenue a customer generates over their entire relationship with a subscription box, offering deeper insights into long-term profitability compared to average order value (AOV), which only reflects single transaction amounts. Higher LTV indicates sustained customer loyalty and recurring revenue, essential for scaling subscription businesses and optimizing marketing spend. Prioritizing LTV enables companies to invest strategically in retention and personalized experiences, driving ongoing growth beyond initial sales.

The Impact of Average Order Value on Revenue

Average Order Value (AOV) directly influences Revenue by determining the amount spent per transaction, making it a critical metric for subscription box businesses aiming to maximize profitability. While Lifetime Value (LTV) reflects total revenue per customer over time, increasing AOV drives immediate revenue growth and improves cash flow. Optimizing product bundles and upselling within subscription boxes can significantly elevate AOV, enhancing overall revenue potential without relying solely on customer retention.

How to Calculate your Customer Lifetime Value (LTV)

Customer Lifetime Value (LTV) is calculated by multiplying the Average Order Value (AOV) by the purchase frequency and the average customer lifespan, providing a clear measure of total revenue a customer generates over time. For subscription boxes, track the average order value of each shipment and multiply it by the average number of months a subscriber remains active. This metric helps optimize marketing spend and retention strategies by forecasting long-term profitability per subscriber.

Proven Strategies to Increase Average Order Value

Increasing Average Order Value (AOV) in subscription boxes directly impacts customer Lifetime Value (LTV) by enhancing overall revenue per subscriber. Proven strategies include offering tiered subscription plans, bundling complementary products, and implementing personalized upsell recommendations based on purchase history. Optimizing pricing models and leveraging limited-time offers also effectively boost order values and extend customer engagement.

Leveraging LTV and AOV to Optimize Marketing Spend

Maximizing marketing efficiency in subscription boxes hinges on leveraging lifetime value (LTV) and average order value (AOV) to allocate budgets effectively. A higher LTV indicates prolonged customer engagement and recurring revenue, guiding marketers to invest more confidently in acquisition channels. Balancing this with AOV insights enables tailored promotional strategies that boost immediate purchase size while sustaining long-term profitability.

Common Mistakes in Interpreting LTV and AOV Data

Confusing Lifetime Value (LTV) with Average Order Value (AOV) often leads subscription box businesses to overestimate customer profitability by equating a single purchase amount with long-term revenue potential. Ignoring customer churn rates or subscription renewals skews LTV calculations, while averaging order values across different segments obscures true purchasing behaviors. Accurate segmentation and incorporating retention metrics are crucial for meaningful analysis of LTV versus AOV in subscription models.

Balancing LTV and AOV for Sustainable Subscription Box Success

Balancing Lifetime Value (LTV) and Average Order Value (AOV) is critical for sustainable subscription box success, as LTV measures the total revenue a customer generates over their subscription period while AOV tracks the average spend per transaction. Subscription box businesses must optimize pricing strategies and product offerings to increase AOV without negatively impacting customer retention, ultimately enhancing LTV. Focusing on personalized experiences and consistent value delivery helps maintain a healthy balance between LTV and AOV, ensuring long-term profitability and growth.

lifetime value vs average order value Infographic

bizdif.com

bizdif.com