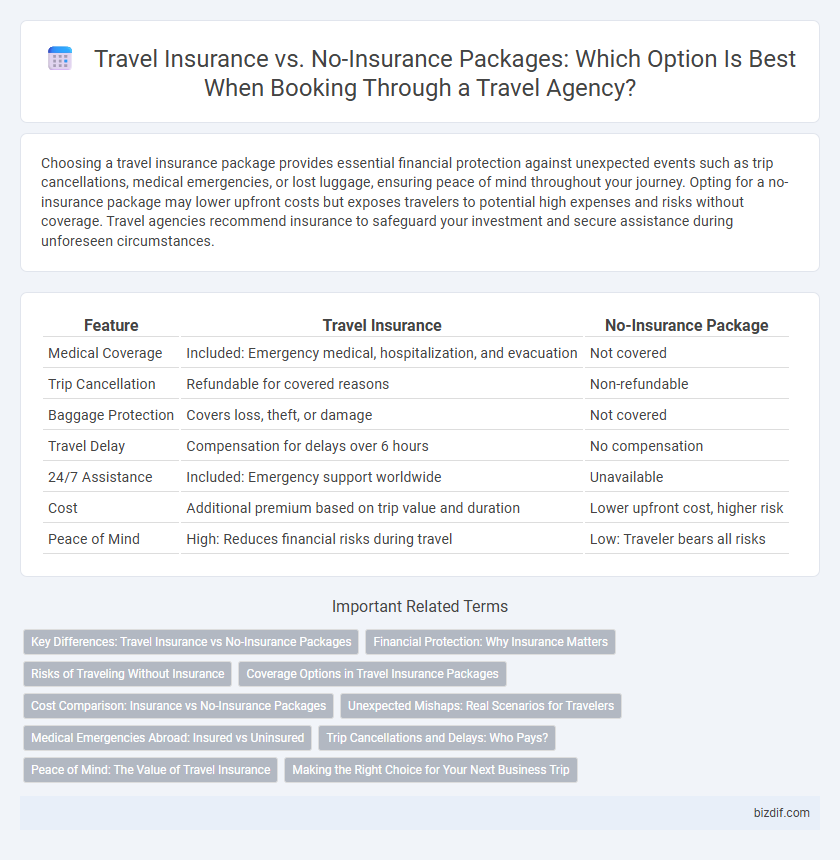

Choosing a travel insurance package provides essential financial protection against unexpected events such as trip cancellations, medical emergencies, or lost luggage, ensuring peace of mind throughout your journey. Opting for a no-insurance package may lower upfront costs but exposes travelers to potential high expenses and risks without coverage. Travel agencies recommend insurance to safeguard your investment and secure assistance during unforeseen circumstances.

Table of Comparison

| Feature | Travel Insurance | No-Insurance Package |

|---|---|---|

| Medical Coverage | Included: Emergency medical, hospitalization, and evacuation | Not covered |

| Trip Cancellation | Refundable for covered reasons | Non-refundable |

| Baggage Protection | Covers loss, theft, or damage | Not covered |

| Travel Delay | Compensation for delays over 6 hours | No compensation |

| 24/7 Assistance | Included: Emergency support worldwide | Unavailable |

| Cost | Additional premium based on trip value and duration | Lower upfront cost, higher risk |

| Peace of Mind | High: Reduces financial risks during travel | Low: Traveler bears all risks |

Key Differences: Travel Insurance vs No-Insurance Packages

Travel insurance provides comprehensive coverage for trip cancellations, medical emergencies, lost luggage, and travel delays, protecting travelers from unforeseen financial losses. No-insurance packages often have lower upfront costs but leave travelers exposed to potential risks such as medical expenses, trip disruptions, and personal property loss. Choosing travel insurance ensures peace of mind and financial security during unexpected situations compared to the uncertainty of no-insurance travel packages.

Financial Protection: Why Insurance Matters

Travel insurance provides critical financial protection by covering unexpected expenses such as trip cancellations, medical emergencies, and lost luggage, which no-insurance packages leave travelers fully exposed to. Without insurance, travelers risk bearing substantial out-of-pocket costs that can quickly escalate, especially during international trips where medical bills or last-minute changes are often costly. Investing in travel insurance ensures peace of mind and safeguards your financial investment against unforeseen disruptions.

Risks of Traveling Without Insurance

Traveling without insurance exposes travelers to significant financial risks, including high medical expenses from accidents or emergencies abroad. Without coverage, unexpected trip cancellations, lost luggage, and travel delays can lead to substantial out-of-pocket costs. Comprehensive travel insurance mitigates these risks by providing protection against unforeseen events, ensuring peace of mind during the journey.

Coverage Options in Travel Insurance Packages

Travel insurance packages offer comprehensive coverage options including trip cancellation, medical emergencies, lost luggage, and travel delay protection that a no-insurance package lacks. Coverage can be tailored to include high-risk activities, emergency evacuations, and pre-existing condition waivers, providing peace of mind for various travel scenarios. Without insurance, travelers assume full financial risk for unforeseen events, often resulting in significant out-of-pocket expenses.

Cost Comparison: Insurance vs No-Insurance Packages

Travel insurance packages typically add 5-10% to the overall trip cost but provide financial protection against trip cancellations, medical emergencies, and lost luggage, potentially saving thousands in unexpected expenses. No-insurance packages may appear cheaper upfront but carry significant risk, as travelers must bear full costs of emergencies or disruptions without reimbursement. Choosing insurance reduces financial uncertainty, making a small additional investment worthwhile compared to the high potential out-of-pocket expenses from uninsured travel mishaps.

Unexpected Mishaps: Real Scenarios for Travelers

Travel insurance provides crucial coverage for unexpected mishaps such as lost luggage, medical emergencies, or trip cancellations, which can otherwise lead to significant financial losses for travelers. Without insurance, travelers often face out-of-pocket expenses that can overshadow the cost of the trip, especially during unforeseen events like flight delays or accidents. Real scenarios show insured travelers receiving timely assistance and reimbursement, highlighting the value of comprehensive travel insurance packages over no-insurance options.

Medical Emergencies Abroad: Insured vs Uninsured

Travel insurance provides critical coverage for medical emergencies abroad, including hospital stays, emergency evacuations, and specialist treatments, protecting travelers from exorbitant out-of-pocket expenses. Uninsured travelers face significant financial risks and potential delays in receiving care due to lack of immediate coverage and support during urgent medical situations. Choosing an insured travel package ensures access to comprehensive medical assistance, reducing stress and safeguarding health while traveling internationally.

Trip Cancellations and Delays: Who Pays?

Travel insurance covers trip cancellations and delays, reimbursing non-refundable expenses when unexpected events occur, while no-insurance packages leave travelers responsible for all costs. Insurance policies often include compensation for accommodation, transportation, and prepaid activities affected by delays or cancellations. Without coverage, travelers face financial losses and must rely on service providers' goodwill or credit vouchers.

Peace of Mind: The Value of Travel Insurance

Travel insurance provides crucial peace of mind by covering unexpected events such as trip cancellations, medical emergencies, and lost luggage, ensuring travelers face minimal financial risk. Without insurance, travelers bear full responsibility for unforeseen costs, which can lead to significant stress and financial burden. Investing in a travel insurance package safeguards your journey, allowing you to focus on enjoying the experience rather than worrying about potential mishaps.

Making the Right Choice for Your Next Business Trip

Selecting travel insurance for your next business trip safeguards against unforeseen expenses such as flight cancellations, medical emergencies, and lost luggage, ensuring financial protection and peace of mind. Opting for a no-insurance package may reduce upfront costs but increases vulnerability to unexpected disruptions that can disrupt your itinerary and incur significant expenses. Assessing the risk factors and the specific needs of your business travel helps determine the most cost-effective and secure option for your journey.

Travel insurance vs No-insurance package Infographic

bizdif.com

bizdif.com