Travel insurance provides comprehensive coverage for unforeseen events such as medical emergencies, lost luggage, and travel delays, ensuring peace of mind throughout your journey. Trip cancellation insurance specifically reimburses non-refundable expenses if you need to cancel your trip due to covered reasons like illness or natural disasters. Choosing the right option depends on your risk tolerance and the level of protection desired for your travel investment.

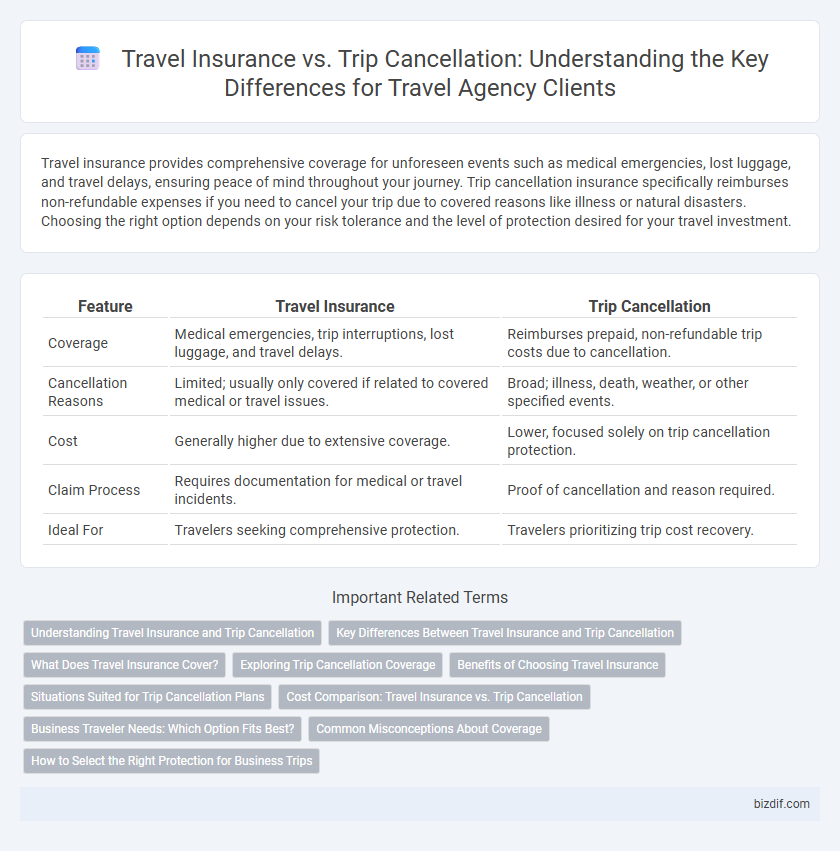

Table of Comparison

| Feature | Travel Insurance | Trip Cancellation |

|---|---|---|

| Coverage | Medical emergencies, trip interruptions, lost luggage, and travel delays. | Reimburses prepaid, non-refundable trip costs due to cancellation. |

| Cancellation Reasons | Limited; usually only covered if related to covered medical or travel issues. | Broad; illness, death, weather, or other specified events. |

| Cost | Generally higher due to extensive coverage. | Lower, focused solely on trip cancellation protection. |

| Claim Process | Requires documentation for medical or travel incidents. | Proof of cancellation and reason required. |

| Ideal For | Travelers seeking comprehensive protection. | Travelers prioritizing trip cost recovery. |

Understanding Travel Insurance and Trip Cancellation

Travel insurance provides comprehensive coverage that protects travelers against unforeseen events such as medical emergencies, lost luggage, and flight delays, ensuring financial security throughout the trip. Trip cancellation insurance specifically covers the non-refundable costs if a trip is canceled due to covered reasons like illness, natural disasters, or other emergencies. Understanding the distinction between overall travel insurance and trip cancellation policies helps travelers make informed decisions to safeguard their investments effectively.

Key Differences Between Travel Insurance and Trip Cancellation

Travel insurance offers comprehensive coverage, including medical emergencies, trip interruptions, and lost luggage, while trip cancellation insurance specifically reimburses non-refundable expenses if you cancel your trip due to covered reasons. Travel insurance typically covers a wider range of unforeseen events, such as illness, accidents, or natural disasters, whereas trip cancellation is limited to protecting your initial payments when plans change before departure. Understanding these key differences helps travelers choose the right protection based on their risk tolerance and travel plans.

What Does Travel Insurance Cover?

Travel insurance covers a range of unexpected events including medical emergencies, trip interruptions, lost baggage, and travel delays, providing financial protection and peace of mind during your journey. It typically includes coverage for emergency medical expenses, evacuation, accidental death, and sometimes trip cancellation or interruption due to unforeseen circumstances like illness or natural disasters. Understanding the specific policy details is crucial, as travel insurance may also cover travel delays, lost passports, and rental car damage, whereas trip cancellation insurance specifically reimburses prepaid costs if you must cancel your trip before departure.

Exploring Trip Cancellation Coverage

Trip cancellation coverage protects travelers by reimbursing non-refundable trip costs if unforeseen events, such as illness or natural disasters, force them to cancel their plans. Travel insurance often includes trip cancellation as a crucial component along with other protections like medical emergencies and lost luggage coverage. Understanding policy specifics and covered reasons is essential to maximize benefits and avoid potential claim denials.

Benefits of Choosing Travel Insurance

Travel insurance provides comprehensive coverage for unexpected events such as medical emergencies, lost luggage, and trip delays, ensuring financial protection beyond trip cancellation. Its benefits include reimbursement for non-refundable expenses and access to emergency assistance services worldwide, offering peace of mind throughout your journey. Choosing travel insurance safeguards your investment by covering a wider range of risks compared to trip cancellation policies alone.

Situations Suited for Trip Cancellation Plans

Trip cancellation plans are ideal for travelers facing uncertainties such as sudden illness, family emergencies, or unexpected work commitments that force them to cancel their trips. These plans refund prepaid, non-refundable expenses like flights, hotels, and tours if cancellation occurs before departure. Travel insurance broadly covers trip cancellation along with medical emergencies, lost baggage, and travel delays, but trip cancellation plans specifically target reimbursement for canceled journeys due to covered reasons.

Cost Comparison: Travel Insurance vs. Trip Cancellation

Travel insurance typically costs between 4% to 10% of the total trip price, offering comprehensive coverage including trip cancellation, medical emergencies, and baggage loss. Trip cancellation protection is usually cheaper, averaging around 1% to 5% of the trip cost, but only reimburses non-refundable expenses due to trip cancellations. Choosing between them depends on budget and coverage needs, with travel insurance providing broader financial security at a higher price point.

Business Traveler Needs: Which Option Fits Best?

Business travelers benefit more from travel insurance that covers medical emergencies, trip interruptions, and lost luggage, ensuring comprehensive protection during unpredictable work trips. Trip cancellation policies specifically reimburse prepaid, non-refundable expenses if a business trip is canceled due to covered reasons like illness or corporate directives. Evaluating the nature of the business trip and risk tolerance helps determine whether broader travel insurance or targeted trip cancellation coverage aligns best with professional priorities and financial security.

Common Misconceptions About Coverage

Travel insurance often gets confused with trip cancellation coverage, but they serve distinct purposes; travel insurance provides broader protection including medical emergencies, lost luggage, and travel delays, whereas trip cancellation coverage specifically reimburses prepaid, non-refundable trip costs if you must cancel for covered reasons. Many travelers mistakenly assume trip cancellation insurance covers all travel mishaps, not realizing exclusions often apply, such as pre-existing conditions or work-related cancellations. Understanding the fine print and coverage limits ensures adequate protection and prevents surprises during claims.

How to Select the Right Protection for Business Trips

Selecting the right protection for business trips requires understanding the key differences between travel insurance and trip cancellation coverage. Travel insurance offers comprehensive protection, including medical emergencies, lost luggage, and trip interruptions, while trip cancellation specifically reimburses non-refundable expenses if the trip is canceled due to covered reasons. Business travelers should evaluate risk factors such as health coverage needs, potential itinerary changes, and company policies to determine the most suitable plan that balances cost with necessary benefits.

Travel Insurance vs Trip Cancellation Infographic

bizdif.com

bizdif.com