Travel insurance provides comprehensive coverage for unexpected events such as medical emergencies, trip cancellations, and lost luggage, offering financial security during travel disruptions. Trip protection plans focus more on cancelation and interruption benefits, often including coverage for delays and missed connections but with limited medical support. Choosing between the two depends on the level of coverage needed and the specific risks associated with your trip.

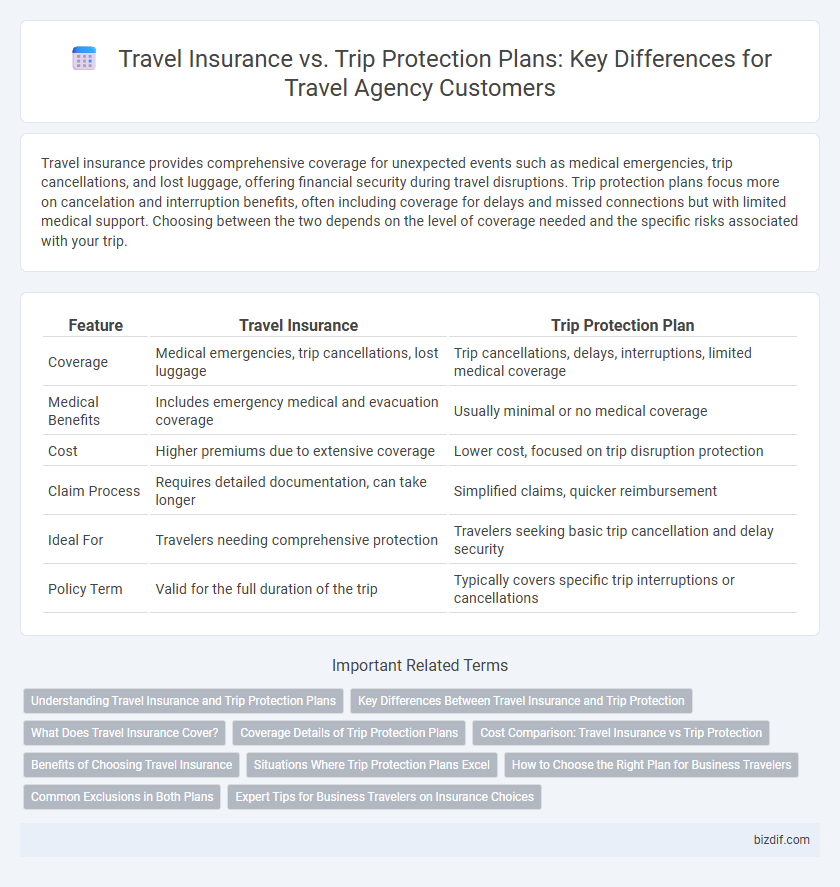

Table of Comparison

| Feature | Travel Insurance | Trip Protection Plan |

|---|---|---|

| Coverage | Medical emergencies, trip cancellations, lost luggage | Trip cancellations, delays, interruptions, limited medical coverage |

| Medical Benefits | Includes emergency medical and evacuation coverage | Usually minimal or no medical coverage |

| Cost | Higher premiums due to extensive coverage | Lower cost, focused on trip disruption protection |

| Claim Process | Requires detailed documentation, can take longer | Simplified claims, quicker reimbursement |

| Ideal For | Travelers needing comprehensive protection | Travelers seeking basic trip cancellation and delay security |

| Policy Term | Valid for the full duration of the trip | Typically covers specific trip interruptions or cancellations |

Understanding Travel Insurance and Trip Protection Plans

Travel insurance provides coverage for unforeseen events such as medical emergencies, trip cancellations, and lost luggage, safeguarding travelers from financial losses. Trip protection plans often include additional services like 24/7 travel assistance and itinerary changes but may have limited or no medical coverage. Understanding the differences helps travelers choose the appropriate plan based on risk tolerance, destination, and trip complexity.

Key Differences Between Travel Insurance and Trip Protection

Travel insurance primarily covers unforeseen events such as medical emergencies, trip cancellations due to illness, and lost luggage, providing financial reimbursement for unexpected risks. Trip protection plans focus more on non-refundable trip costs and offer benefits like trip delay assistance, offer fewer medical benefits, and sometimes include concierge services. Understanding these key differences helps travelers choose coverage based on the level of risk protection needed and the specific circumstances of their travel plans.

What Does Travel Insurance Cover?

Travel insurance typically covers trip cancellations, medical emergencies, lost luggage, and trip interruptions, providing financial protection against unforeseen events. It often includes coverage for emergency medical treatment, evacuation, and accidental death, crucial for international travel. Trip protection plans may offer some similar benefits but usually focus more on service-related issues like travel delays and baggage delays, with less comprehensive medical coverage compared to full travel insurance.

Coverage Details of Trip Protection Plans

Trip protection plans typically offer comprehensive coverage including trip cancellation, trip interruption, missed connections, and baggage loss, often with fewer exclusions than standard travel insurance policies. These plans may also cover pre-existing medical conditions, travel delays, and provide emergency assistance services tailored to specific trip needs. Coverage limits, claim procedures, and included benefits can vary significantly, making it essential to review each plan's terms carefully before purchase.

Cost Comparison: Travel Insurance vs Trip Protection

Travel insurance typically offers comprehensive coverage for medical emergencies, trip cancellations, and lost luggage, often at a higher premium ranging from 4% to 10% of the trip cost. Trip protection plans generally focus on cancelation and interruption coverage with lower premiums, averaging between 3% and 5% of the trip price but may lack extensive medical benefits. Comparing costs, travelers must weigh the breadth of coverage versus price, considering factors like trip destination, duration, and risk tolerance to select the most cost-effective option.

Benefits of Choosing Travel Insurance

Travel insurance provides comprehensive coverage, including trip cancellation, medical emergencies, lost luggage, and travel delays, offering financial security and peace of mind during unforeseen events. Unlike trip protection plans, travel insurance typically covers a wider range of scenarios such as pre-existing medical conditions and emergency evacuations, ensuring better protection abroad. Choosing travel insurance safeguards your investment by reimbursing non-refundable expenses and covering unexpected costs that trip protection plans may exclude.

Situations Where Trip Protection Plans Excel

Trip protection plans excel in covering unexpected travel disruptions such as trip cancellations, interruptions, and delays caused by factors like severe weather, airline strikes, or sudden illness. These plans often include coverage for lost luggage, emergency medical expenses, and travel assistance services, offering greater peace of mind during complex travel situations. Unlike standard travel insurance, trip protection plans provide comprehensive benefits tailored to the multifaceted risks faced by modern travelers.

How to Choose the Right Plan for Business Travelers

Business travelers should evaluate travel insurance policies by assessing coverage for trip cancellations, medical emergencies, and lost luggage specific to frequent work trips. Trip protection plans often offer tailored benefits such as reimbursement for missed flights due to work delays and flexible rescheduling options essential for business commitments. Comparing policy details, including coverage limits, exclusions, and claims processes, helps select the ideal plan that balances cost with comprehensive protection for professional travel needs.

Common Exclusions in Both Plans

Travel insurance and trip protection plans often exclude coverage for pre-existing medical conditions, high-risk activities such as extreme sports, and losses due to fraud or criminal acts. Both plans typically do not reimburse for cancellations caused by work-related obligations, mental or emotional disorders, or government travel advisories. Understanding these common exclusions helps travelers choose the most suitable protection to avoid unexpected out-of-pocket expenses.

Expert Tips for Business Travelers on Insurance Choices

Business travelers should carefully evaluate travel insurance policies versus trip protection plans, focusing on coverage for trip cancellations, medical emergencies, and lost baggage. Choosing plans that offer comprehensive protection tailored to frequent business trips, such as emergency evacuation and missed connection coverage, enhances security and peace of mind. Expert tips recommend prioritizing flexibility in cancellations and reimbursement, ensuring seamless adjustments to changing travel schedules.

Travel insurance vs Trip protection plans Infographic

bizdif.com

bizdif.com