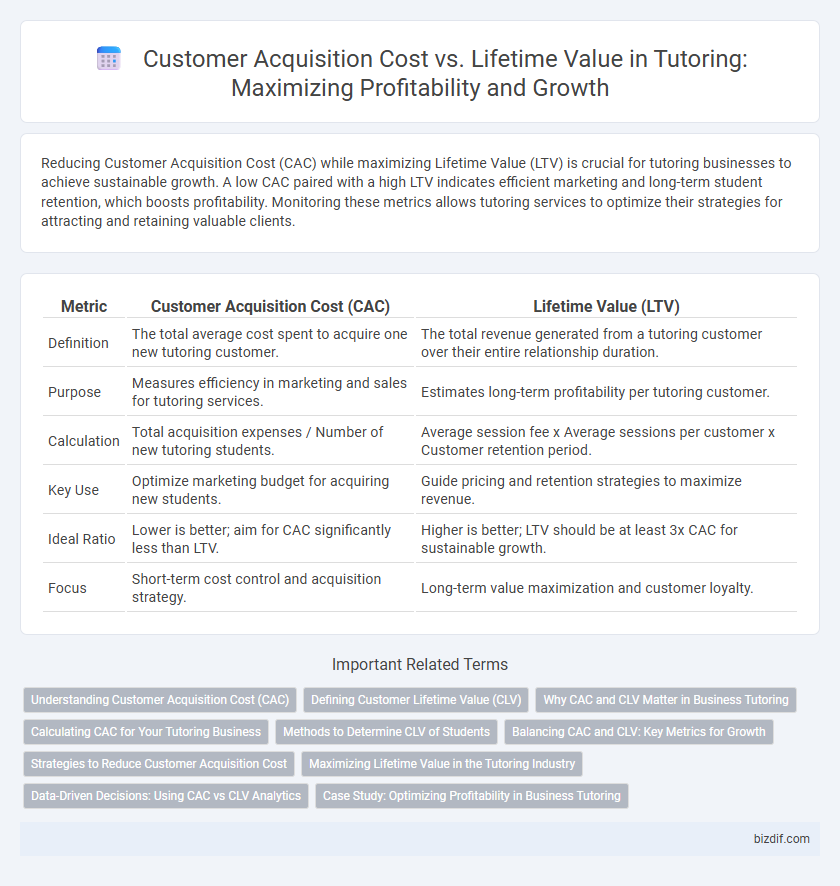

Reducing Customer Acquisition Cost (CAC) while maximizing Lifetime Value (LTV) is crucial for tutoring businesses to achieve sustainable growth. A low CAC paired with a high LTV indicates efficient marketing and long-term student retention, which boosts profitability. Monitoring these metrics allows tutoring services to optimize their strategies for attracting and retaining valuable clients.

Table of Comparison

| Metric | Customer Acquisition Cost (CAC) | Lifetime Value (LTV) |

|---|---|---|

| Definition | The total average cost spent to acquire one new tutoring customer. | The total revenue generated from a tutoring customer over their entire relationship duration. |

| Purpose | Measures efficiency in marketing and sales for tutoring services. | Estimates long-term profitability per tutoring customer. |

| Calculation | Total acquisition expenses / Number of new tutoring students. | Average session fee x Average sessions per customer x Customer retention period. |

| Key Use | Optimize marketing budget for acquiring new students. | Guide pricing and retention strategies to maximize revenue. |

| Ideal Ratio | Lower is better; aim for CAC significantly less than LTV. | Higher is better; LTV should be at least 3x CAC for sustainable growth. |

| Focus | Short-term cost control and acquisition strategy. | Long-term value maximization and customer loyalty. |

Understanding Customer Acquisition Cost (CAC)

Customer Acquisition Cost (CAC) in tutoring measures the total expense of attracting new students, including marketing, sales, and onboarding costs. A precise understanding of CAC helps tutoring centers allocate budgets efficiently and tailor marketing strategies to reduce spending while attracting high-quality students. Lowering CAC without compromising student quality increases profitability and supports sustainable business growth.

Defining Customer Lifetime Value (CLV)

Customer Lifetime Value (CLV) measures the total revenue a tutoring business can expect from a single client throughout their entire relationship. Accurately defining CLV involves analyzing the average session frequency, retention rate, and the typical duration a student remains enrolled. Understanding CLV helps optimize marketing strategies by balancing acquisition costs against the long-term profitability of each customer.

Why CAC and CLV Matter in Business Tutoring

Customer Acquisition Cost (CAC) and Lifetime Value (CLV) are critical metrics in business tutoring because they directly impact profitability and growth strategies. Understanding CAC helps tutors allocate marketing budgets efficiently, while analyzing CLV ensures long-term client engagement and retention. Balancing CAC and CLV enables tutoring businesses to optimize resource allocation and maximize sustainable revenue streams.

Calculating CAC for Your Tutoring Business

Calculating Customer Acquisition Cost (CAC) for your tutoring business involves dividing total marketing and sales expenses by the number of new students acquired within a specific period. Accurately tracking expenses like online ads, referral incentives, and promotional events ensures precise CAC estimation. Regularly analyzing CAC alongside Lifetime Value (LTV) helps optimize marketing strategies and maximize profitability in the competitive tutoring market.

Methods to Determine CLV of Students

Calculating the Customer Lifetime Value (CLV) of students requires analyzing their enrollment frequency, average tutoring session spend, and retention duration to estimate total revenue per student. Methods include cohort analysis to track student behavior over time, predictive modeling using historical data to forecast future value, and segmentation to identify high-value student groups for targeted marketing. Accurate CLV determination helps optimize Customer Acquisition Cost (CAC) by aligning marketing investments with expected returns from student lifetime revenue.

Balancing CAC and CLV: Key Metrics for Growth

Balancing Customer Acquisition Cost (CAC) and Customer Lifetime Value (CLV) is critical for sustainable growth in the tutoring industry. Efficiently managing CAC ensures that marketing and outreach expenses do not exceed the revenue generated from long-term student relationships measured by CLV. Optimizing this balance helps tutoring businesses allocate resources effectively, improve profitability, and scale operations while maintaining high student retention and satisfaction rates.

Strategies to Reduce Customer Acquisition Cost

Implement targeted digital marketing campaigns using SEO and paid ads to attract qualified leads at a lower cost. Leverage referrals and reviews from satisfied students to enhance brand credibility and reduce reliance on expensive advertising. Optimize onboarding processes and personalize engagement to increase retention, thereby maximizing lifetime value relative to acquisition expenses.

Maximizing Lifetime Value in the Tutoring Industry

Maximizing Lifetime Value (LTV) in the tutoring industry involves enhancing student retention through personalized learning plans and consistent progress tracking, which encourages long-term engagement and referrals. Investing in quality tutors and flexible scheduling directly increases client satisfaction, leading to higher retention rates and increased LTV. Strategic marketing efforts that target high-potential student segments reduce Customer Acquisition Cost (CAC) while amplifying overall profitability by optimizing the balance between CAC and LTV.

Data-Driven Decisions: Using CAC vs CLV Analytics

Analyzing Customer Acquisition Cost (CAC) against Customer Lifetime Value (CLV) enables tutoring businesses to optimize marketing budgets by identifying channels that yield the highest long-term returns. Data-driven decisions derived from CAC vs CLV analytics improve student enrollment strategies and enhance client retention through targeted campaigns. Leveraging these metrics ensures scalable growth and maximizes profitability in competitive tutoring markets.

Case Study: Optimizing Profitability in Business Tutoring

Business tutoring firms reduce Customer Acquisition Cost (CAC) by leveraging targeted marketing and referral programs, lowering the average CAC from $150 to $90 per client. Lifetime Value (LTV) increases significantly when personalized curriculum and ongoing support boost client retention rates, raising LTV from $1,200 to $2,800 over three years. This case study demonstrates a profit margin improvement of 40%, highlighting the critical balance between CAC and LTV for sustainable growth in tutoring services.

Customer Acquisition Cost vs Lifetime Value Infographic

bizdif.com

bizdif.com