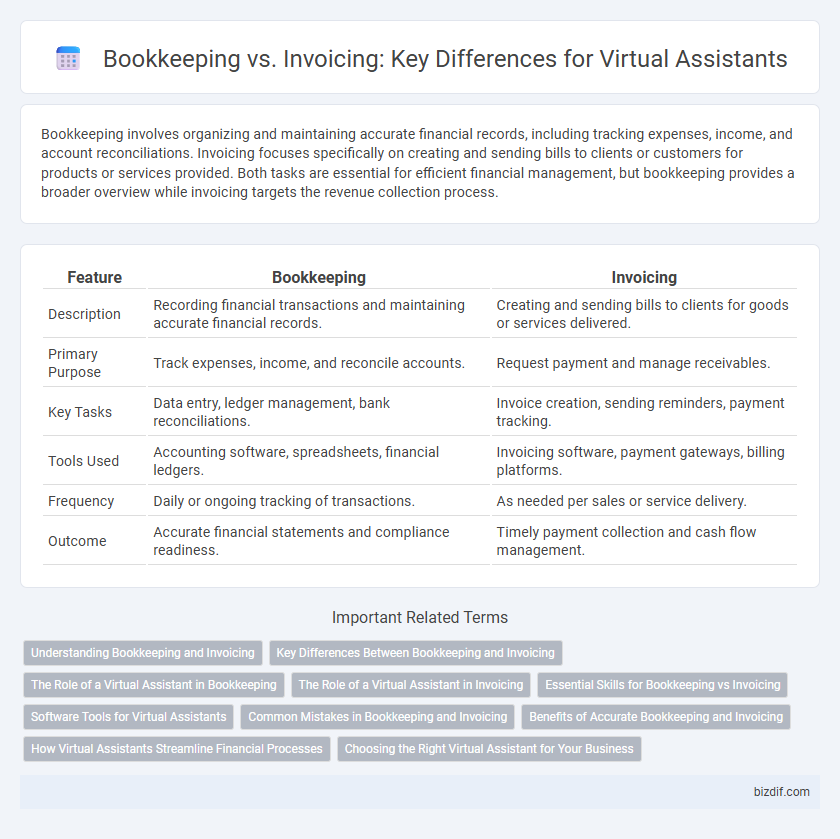

Bookkeeping involves organizing and maintaining accurate financial records, including tracking expenses, income, and account reconciliations. Invoicing focuses specifically on creating and sending bills to clients or customers for products or services provided. Both tasks are essential for efficient financial management, but bookkeeping provides a broader overview while invoicing targets the revenue collection process.

Table of Comparison

| Feature | Bookkeeping | Invoicing |

|---|---|---|

| Description | Recording financial transactions and maintaining accurate financial records. | Creating and sending bills to clients for goods or services delivered. |

| Primary Purpose | Track expenses, income, and reconcile accounts. | Request payment and manage receivables. |

| Key Tasks | Data entry, ledger management, bank reconciliations. | Invoice creation, sending reminders, payment tracking. |

| Tools Used | Accounting software, spreadsheets, financial ledgers. | Invoicing software, payment gateways, billing platforms. |

| Frequency | Daily or ongoing tracking of transactions. | As needed per sales or service delivery. |

| Outcome | Accurate financial statements and compliance readiness. | Timely payment collection and cash flow management. |

Understanding Bookkeeping and Invoicing

Bookkeeping involves systematically recording all financial transactions to maintain accurate and organized financial records, essential for business accounting. Invoicing focuses on generating and sending bills to clients or customers, detailing the products or services provided and payment terms. Both processes are crucial for cash flow management and financial accountability within any business operation.

Key Differences Between Bookkeeping and Invoicing

Bookkeeping involves systematically recording all financial transactions to maintain accurate and comprehensive financial records, while invoicing specifically refers to generating and sending bills to clients for goods or services provided. Bookkeeping encompasses a broader scope including tracking expenses, revenues, and reconciliations, whereas invoicing focuses solely on requesting payment and managing accounts receivable. Key differences include bookkeeping's role in overall financial management and reporting versus invoicing's function in cash flow and client billing processes.

The Role of a Virtual Assistant in Bookkeeping

Virtual assistants play a crucial role in bookkeeping by managing financial records, tracking expenses, and organizing transaction data to ensure accurate and up-to-date accounts. They often use specialized software like QuickBooks or Xero to automate data entry, reconcile bank statements, and generate financial reports. This support helps businesses maintain compliance, improve financial decision-making, and save time on routine accounting tasks.

The Role of a Virtual Assistant in Invoicing

A virtual assistant streamlines invoicing by generating accurate bills, sending timely payment reminders, and managing client records to ensure consistent cash flow. They use accounting software such as QuickBooks or FreshBooks to track payments and reconcile accounts efficiently. Their role in invoicing reduces administrative workloads, improves financial accuracy, and supports smooth business operations.

Essential Skills for Bookkeeping vs Invoicing

Bookkeeping requires strong attention to detail and proficiency in managing financial records, including recording transactions and reconciling accounts. Invoicing demands skills in creating accurate bills, tracking payments, and handling client communications effectively. Both roles benefit from familiarity with accounting software and time management to ensure timely financial processing.

Software Tools for Virtual Assistants

Virtual assistants use specialized bookkeeping software like QuickBooks and Xero to manage financial records accurately and efficiently, ensuring real-time transaction tracking and reporting. For invoicing, tools such as FreshBooks and Zoho Invoice streamline the process by automating invoice creation, payment reminders, and client management. Integrating these software solutions enhances productivity and accuracy in financial tasks critical for virtual assistant services.

Common Mistakes in Bookkeeping and Invoicing

Common mistakes in bookkeeping include inaccurate data entry, failure to reconcile accounts regularly, and neglecting to categorize expenses correctly, which can lead to financial discrepancies and compliance issues. Invoicing errors often involve late billing, incorrect client information, and missing payment terms, resulting in delayed payments and strained customer relationships. Using automated virtual assistant tools can significantly reduce these errors by ensuring timely, accurate, and organized financial record management.

Benefits of Accurate Bookkeeping and Invoicing

Accurate bookkeeping ensures precise financial records, enhancing tax compliance and cash flow management, while invoicing streamlines payment collection and improves client trust. Together, they provide a comprehensive financial overview that aids in budgeting, forecasting, and reducing errors. This integration helps businesses maintain financial health and make informed decisions.

How Virtual Assistants Streamline Financial Processes

Virtual assistants streamline financial processes by automating bookkeeping tasks such as data entry, transaction categorization, and bank reconciliation, ensuring accurate and up-to-date financial records. Invoicing becomes more efficient with virtual assistants generating, sending, and tracking invoices, reducing errors and accelerating payment cycles. This integration minimizes manual workload, improves cash flow management, and enhances overall financial organization for businesses.

Choosing the Right Virtual Assistant for Your Business

Selecting the right virtual assistant for your business hinges on understanding the distinct roles of bookkeeping and invoicing. Bookkeeping involves detailed financial record keeping, ensuring accuracy in expenses, revenues, and tax documentation, while invoicing focuses on generating and managing customer bills for timely payments. Opting for a virtual assistant skilled in both areas can streamline financial operations, improve cash flow management, and reduce administrative burdens.

Bookkeeping vs Invoicing Infographic

bizdif.com

bizdif.com