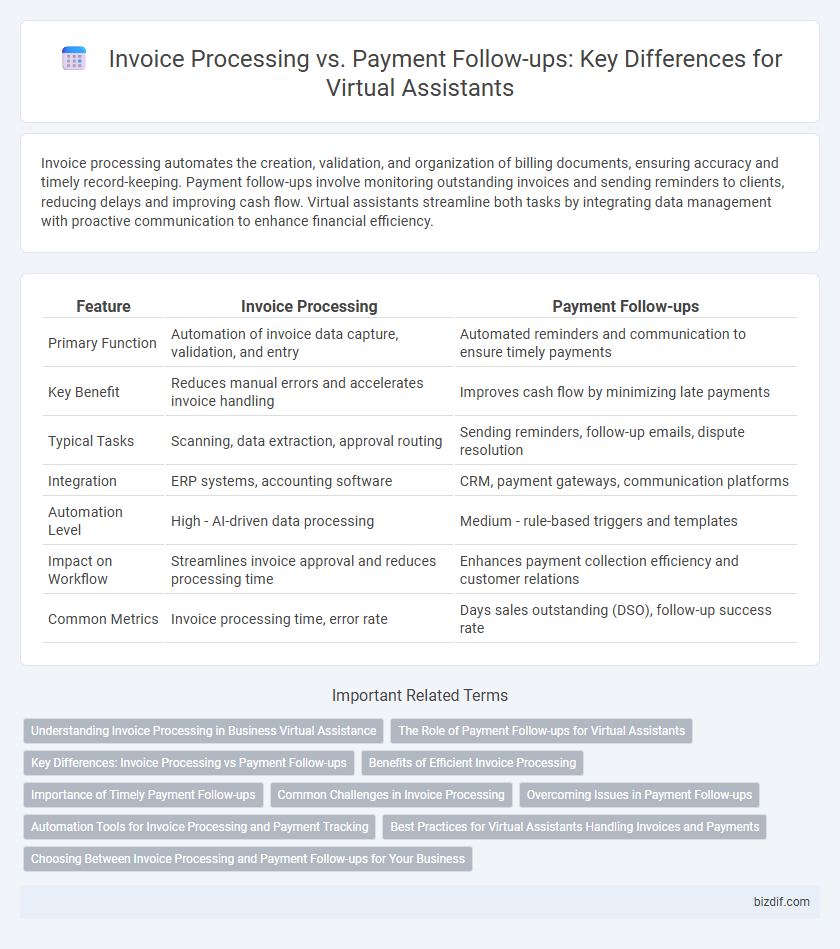

Invoice processing automates the creation, validation, and organization of billing documents, ensuring accuracy and timely record-keeping. Payment follow-ups involve monitoring outstanding invoices and sending reminders to clients, reducing delays and improving cash flow. Virtual assistants streamline both tasks by integrating data management with proactive communication to enhance financial efficiency.

Table of Comparison

| Feature | Invoice Processing | Payment Follow-ups |

|---|---|---|

| Primary Function | Automation of invoice data capture, validation, and entry | Automated reminders and communication to ensure timely payments |

| Key Benefit | Reduces manual errors and accelerates invoice handling | Improves cash flow by minimizing late payments |

| Typical Tasks | Scanning, data extraction, approval routing | Sending reminders, follow-up emails, dispute resolution |

| Integration | ERP systems, accounting software | CRM, payment gateways, communication platforms |

| Automation Level | High - AI-driven data processing | Medium - rule-based triggers and templates |

| Impact on Workflow | Streamlines invoice approval and reduces processing time | Enhances payment collection efficiency and customer relations |

| Common Metrics | Invoice processing time, error rate | Days sales outstanding (DSO), follow-up success rate |

Understanding Invoice Processing in Business Virtual Assistance

Invoice processing in business virtual assistance involves accurately capturing, verifying, and entering invoice details into accounting systems to streamline financial workflows and enhance cash flow management. Virtual assistants ensure timely approval routing and discrepancy resolution, reducing errors and late payments. Efficient invoice processing supports better vendor relationships and improves overall financial reporting accuracy.

The Role of Payment Follow-ups for Virtual Assistants

Payment follow-ups play a crucial role in virtual assistants' workflow by ensuring timely settlements and maintaining healthy cash flow for businesses. Unlike invoice processing, which focuses on generating and managing invoices, payment follow-ups involve communicating with clients to resolve overdue payments and address discrepancies. Efficient follow-up strategies reduce days sales outstanding (DSO) and enhance financial stability, making them essential for comprehensive accounts receivable management.

Key Differences: Invoice Processing vs Payment Follow-ups

Invoice processing involves the systematic capture, verification, and validation of billing details to ensure accuracy and compliance before recording the transaction in financial systems. Payment follow-ups focus on tracking outstanding invoices, sending reminders, and resolving payment delays to maintain healthy cash flow and reduce accounts receivable aging. The key difference lies in invoice processing managing data entry and approval workflows, while payment follow-ups prioritize customer communication and collections management.

Benefits of Efficient Invoice Processing

Efficient invoice processing using virtual assistants reduces manual errors and accelerates approval cycles, ensuring timely payments and improved cash flow management. Automation of invoice workflows enhances accuracy and compliance, minimizing the risk of late fees and supplier disputes. Streamlined invoice handling frees up resources for strategic tasks, boosting overall operational productivity and financial transparency.

Importance of Timely Payment Follow-ups

Timely payment follow-ups are crucial for maintaining healthy cash flow and minimizing outstanding invoices in invoice processing. Virtual assistants automate reminders and communication, reducing delays and improving collection rates. Efficient follow-ups prevent payment bottlenecks and enhance overall financial management.

Common Challenges in Invoice Processing

Invoice processing frequently faces challenges such as data entry errors, delayed approvals, and mismatched invoice details that hinder timely payments. Automated virtual assistants help reduce manual errors and streamline workflow by extracting and validating invoice information accurately. Persistent delays in invoice verification and communication gaps with vendors remain significant obstacles impacting overall financial efficiency.

Overcoming Issues in Payment Follow-ups

Invoice processing involves accurately capturing and validating billing details to ensure seamless record-keeping, while payment follow-ups focus on timely reminders and communication to address outstanding dues. Overcoming issues in payment follow-ups requires automated alert systems, clear customer communication protocols, and integration with customer relationship management (CRM) tools. Leveraging virtual assistants for real-time tracking and personalized follow-up messages significantly reduces payment delays and enhances cash flow management.

Automation Tools for Invoice Processing and Payment Tracking

Automation tools for invoice processing streamline data extraction, validation, and approval workflows, significantly reducing manual errors and processing time. Payment tracking systems integrate with accounting software to provide real-time updates on payment status, enabling timely follow-ups and improved cash flow management. Combining these technologies enhances overall operational efficiency and financial accuracy in businesses.

Best Practices for Virtual Assistants Handling Invoices and Payments

Virtual assistants streamline invoice processing by accurately capturing data, verifying details, and ensuring timely submission to optimize cash flow management. Best practices include organizing invoices with standardized templates, using automation tools for reminders, and maintaining clear communication with clients to prevent payment delays. Proactive payment follow-ups combined with detailed record-keeping enhance reconciliation and improve overall financial accuracy for businesses.

Choosing Between Invoice Processing and Payment Follow-ups for Your Business

Invoice processing streamlines the management of incoming bills by automating data entry, validation, and approval workflows, reducing errors and accelerating payment cycles. Payment follow-ups focus on tracking outstanding invoices and sending reminders to clients, improving cash flow and minimizing late payments through consistent communication. Selecting between these depends on your business needs: prioritize invoice processing to enhance operational efficiency or payment follow-ups to strengthen receivables management and customer relationships.

Invoice Processing vs Payment Follow-ups Infographic

bizdif.com

bizdif.com