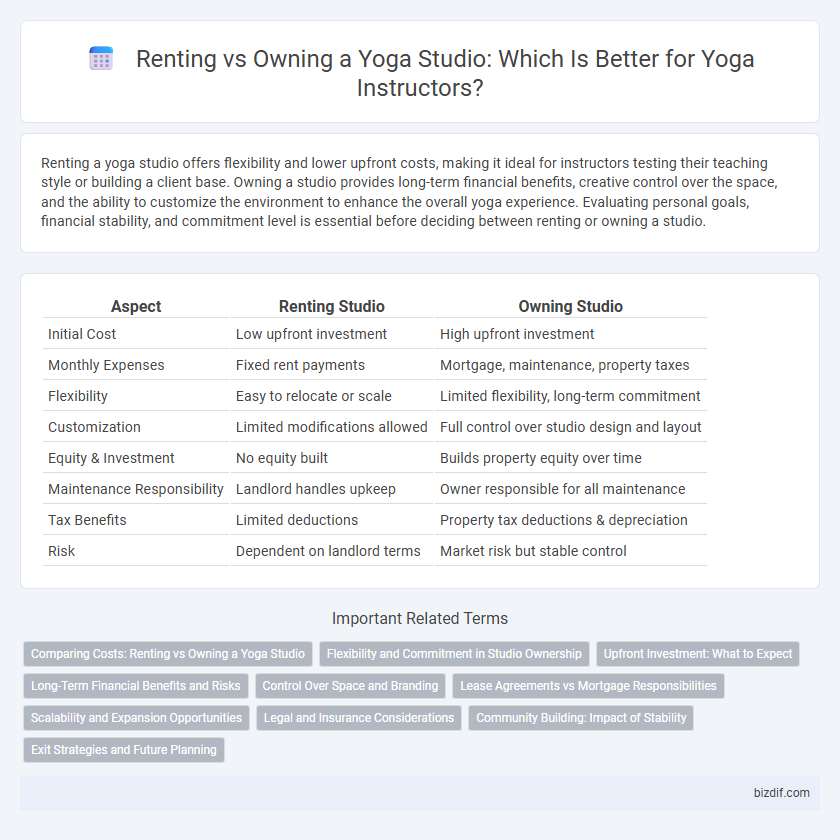

Renting a yoga studio offers flexibility and lower upfront costs, making it ideal for instructors testing their teaching style or building a client base. Owning a studio provides long-term financial benefits, creative control over the space, and the ability to customize the environment to enhance the overall yoga experience. Evaluating personal goals, financial stability, and commitment level is essential before deciding between renting or owning a studio.

Table of Comparison

| Aspect | Renting Studio | Owning Studio |

|---|---|---|

| Initial Cost | Low upfront investment | High upfront investment |

| Monthly Expenses | Fixed rent payments | Mortgage, maintenance, property taxes |

| Flexibility | Easy to relocate or scale | Limited flexibility, long-term commitment |

| Customization | Limited modifications allowed | Full control over studio design and layout |

| Equity & Investment | No equity built | Builds property equity over time |

| Maintenance Responsibility | Landlord handles upkeep | Owner responsible for all maintenance |

| Tax Benefits | Limited deductions | Property tax deductions & depreciation |

| Risk | Dependent on landlord terms | Market risk but stable control |

Comparing Costs: Renting vs Owning a Yoga Studio

Renting a yoga studio typically involves lower upfront costs, allowing instructors to avoid large initial investments and maintenance expenses, but monthly rental fees can accumulate over time. Owning a studio requires significant capital for purchase, renovations, and utilities, yet it offers long-term financial benefits like property appreciation and tax deductions. Careful analysis of monthly rent payments versus mortgage and ownership expenses helps determine the most cost-effective option for sustainable yoga business growth.

Flexibility and Commitment in Studio Ownership

Renting a yoga studio offers unparalleled flexibility, allowing instructors to adapt schedules and locations based on demand without long-term financial obligations. Owning a studio requires a significant commitment, including mortgage, maintenance, and operational responsibilities, which can limit spontaneity but provide stability and control over the space. Choosing between renting and owning impacts the ability to scale the business and respond swiftly to market changes in the yoga industry.

Upfront Investment: What to Expect

Renting a yoga studio requires a lower upfront investment, typically covering the first month's rent, security deposit, and basic setup costs. Owning a studio demands a significantly larger initial capital outlay for purchasing or leasing commercial property, renovations, permits, and essential equipment. Understanding these financial commitments helps instructors choose the best path based on budget, long-term goals, and risk tolerance.

Long-Term Financial Benefits and Risks

Owning a yoga studio offers long-term financial benefits such as equity growth, tax advantages, and control over operational costs, which can lead to higher profitability over time compared to renting. Renting a studio reduces upfront capital investment and provides flexibility but involves ongoing lease expenses and potential rent increases that may erode profit margins. Evaluating market trends, location stability, and personal financial goals is crucial to balancing the financial risks and benefits in the yoga instruction business.

Control Over Space and Branding

Owning a yoga studio provides complete control over the physical environment, allowing customization of lighting, sound, and decor to create a unique brand experience that resonates with clients. Renting space limits this control, as landlords may impose restrictions on modifications, reducing the ability to fully express the studio's identity. Strong control over the studio space enhances brand consistency and client loyalty, crucial for long-term business growth in the competitive yoga market.

Lease Agreements vs Mortgage Responsibilities

Leasing a yoga studio typically involves shorter-term lease agreements with lower upfront costs, offering flexibility and less financial risk compared to owning. Mortgage responsibilities for owned studios include long-term financial commitments, property taxes, maintenance, and potential equity growth. Understanding lease terms versus mortgage obligations is crucial for yoga instructors to align their business goals with financial capacity.

Scalability and Expansion Opportunities

Renting a yoga studio offers flexibility and lower upfront costs but limits scalability due to lease constraints and lack of control over space modifications. Owning a studio enables long-term expansion with the potential to customize facilities, add multiple rooms, and create branded experiences that attract a larger client base. Investment in ownership supports building equity and scaling the business through diversified class offerings and additional wellness services.

Legal and Insurance Considerations

Renting a yoga studio requires thorough review of lease agreements to understand liability clauses and compliance with local zoning laws, ensuring legal protection. Owning a studio offers greater control but demands comprehensive insurance coverage, including property, general liability, and professional liability insurance, to mitigate risks associated with injuries and property damage. Both options necessitate verifying that policies meet industry standards and state regulations to safeguard instructors and clients.

Community Building: Impact of Stability

Owning a yoga studio fosters a strong sense of community by providing stability and a consistent location for regular practitioners, which enhances long-term relationships and trust. Renting a studio may limit this stability, as changing locations can disrupt class schedules and reduce members' commitment to the practice. Stable ownership also allows for personalized space design, reflecting community values and improving overall student experience.

Exit Strategies and Future Planning

Owning a yoga studio allows for greater control over exit strategies, such as selling the property or transferring ownership to a family member, which can lead to long-term financial security and business continuity. Renting a studio offers more flexibility with less upfront investment but may complicate future planning due to lease restrictions and potential relocation costs. Strategic planning for both options should consider market conditions, asset valuation, and the owner's long-term goals to ensure a smooth transition or exit.

Renting studio vs Owning studio Infographic

bizdif.com

bizdif.com