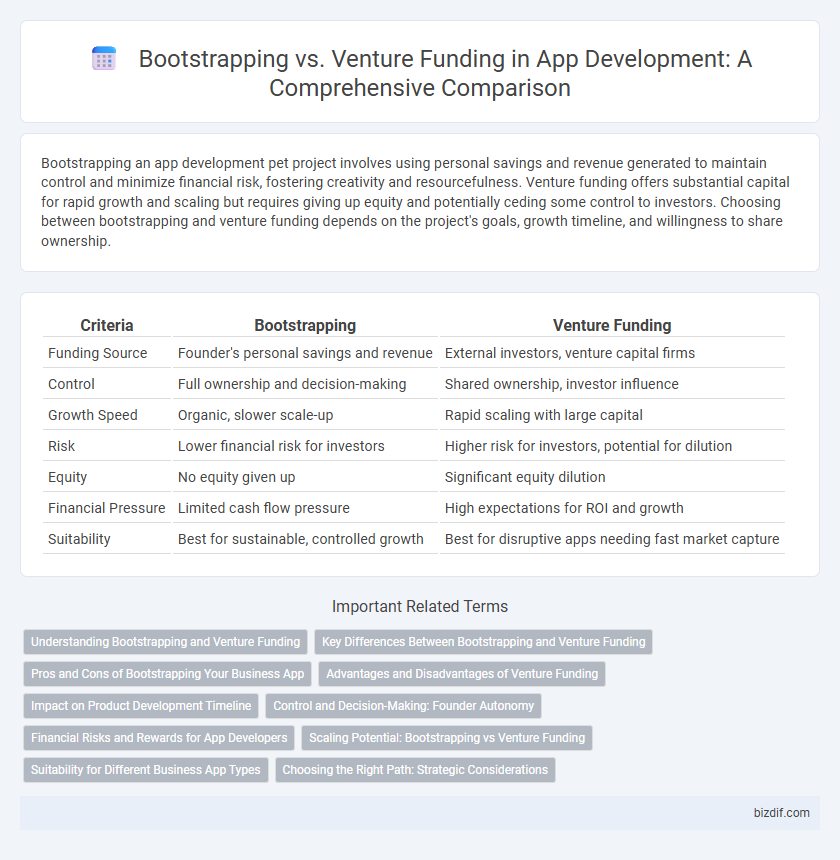

Bootstrapping an app development pet project involves using personal savings and revenue generated to maintain control and minimize financial risk, fostering creativity and resourcefulness. Venture funding offers substantial capital for rapid growth and scaling but requires giving up equity and potentially ceding some control to investors. Choosing between bootstrapping and venture funding depends on the project's goals, growth timeline, and willingness to share ownership.

Table of Comparison

| Criteria | Bootstrapping | Venture Funding |

|---|---|---|

| Funding Source | Founder's personal savings and revenue | External investors, venture capital firms |

| Control | Full ownership and decision-making | Shared ownership, investor influence |

| Growth Speed | Organic, slower scale-up | Rapid scaling with large capital |

| Risk | Lower financial risk for investors | Higher risk for investors, potential for dilution |

| Equity | No equity given up | Significant equity dilution |

| Financial Pressure | Limited cash flow pressure | High expectations for ROI and growth |

| Suitability | Best for sustainable, controlled growth | Best for disruptive apps needing fast market capture |

Understanding Bootstrapping and Venture Funding

Bootstrapping involves developing an app using personal savings and revenue generated from the business, allowing complete control and ownership without external influence. Venture funding provides capital from investors in exchange for equity, enabling accelerated growth and access to expert networks but often requiring dilution of ownership and higher pressure to scale quickly. Understanding the trade-offs between bootstrapping's financial independence and venture funding's resource advantages is critical for aligning with long-term business goals in app development.

Key Differences Between Bootstrapping and Venture Funding

Bootstrapping in app development involves self-funding and relying on personal savings or revenue generated to grow the project, resulting in complete ownership and control but limited financial resources. Venture funding provides external capital through investors, accelerating growth potential and access to extensive networks, but often requires giving up equity and decision-making power. Key differences include funding source, control levels, growth speed, and risk tolerance, which directly impact the app's development strategy and scalability.

Pros and Cons of Bootstrapping Your Business App

Bootstrapping your business app offers complete control and equity retention, reducing reliance on external investors and allowing for organic growth tailored to user feedback. However, limited capital can slow development timelines and restrict marketing reach, potentially delaying scalability and competitive positioning in the app market. This self-funding approach demands rigorous financial discipline and may increase personal risk compared to venture-funded alternatives.

Advantages and Disadvantages of Venture Funding

Venture funding provides app developers with substantial capital to accelerate growth, scale operations, and access valuable mentorship from experienced investors. However, it often requires relinquishing equity and control, leading to potential conflicts in decision-making and pressure for rapid returns. Despite the financial boost, venture funding can impose stringent performance targets and dilute founder ownership, which may impact long-term vision and strategic flexibility.

Impact on Product Development Timeline

Bootstrapping often leads to a slower product development timeline due to limited financial resources, requiring developers to prioritize essential features and iterate gradually. Venture funding accelerates the timeline by providing substantial capital, enabling rapid team expansion, advanced technology adoption, and faster market entry. However, reliance on external funding may introduce pressure to meet aggressive milestones, potentially affecting product quality and innovation focus.

Control and Decision-Making: Founder Autonomy

Bootstrapping empowers founders with full control and decision-making authority, enabling quicker pivots and personalized strategic directions without external investor constraints. Venture funding often involves dilution of founder autonomy due to investor influence, board oversight, and formal approval processes, impacting speed and flexibility. Maintaining founder autonomy is critical for visionary leadership but may limit resources compared to venture-capital-backed growth opportunities.

Financial Risks and Rewards for App Developers

Bootstrapping app development involves using personal savings or revenue to fund growth, minimizing financial risk but potentially limiting scalability due to constrained resources. Venture funding provides substantial capital, enabling rapid expansion and access to mentorship, but it carries the risk of equity dilution and pressure for high returns. App developers must weigh the trade-off between maintaining control with lower financial risk and pursuing aggressive growth with increased financial obligations and investor expectations.

Scaling Potential: Bootstrapping vs Venture Funding

Bootstrapping app development restricts scaling potential due to limited capital, often resulting in slower growth and organic user acquisition. Venture funding accelerates scaling by providing substantial financial resources to expand infrastructure, marketing, and talent acquisition rapidly. Startups leveraging venture capital tend to achieve faster market penetration and competitive advantage compared to self-funded projects.

Suitability for Different Business App Types

Bootstrapping suits early-stage or niche business apps that require minimal initial funding and prioritize control and organic growth. Venture funding is ideal for scalable, high-growth apps such as social networks or SaaS platforms, where significant capital accelerates development and market entry. Choosing between bootstrapping and venture funding depends on the app's market size, growth potential, and founder's risk tolerance.

Choosing the Right Path: Strategic Considerations

Selecting between bootstrapping and venture funding hinges on your startup's growth timeline, control preferences, and market dynamics. Bootstrapping offers complete ownership and slower, sustainable growth, ideal for founders prioritizing autonomy and long-term stability. Venture funding accelerates expansion with external capital but requires equity sharing and alignment with investor expectations, critical for startups targeting rapid scale and competitive markets.

Bootstrapping vs Venture Funding Infographic

bizdif.com

bizdif.com