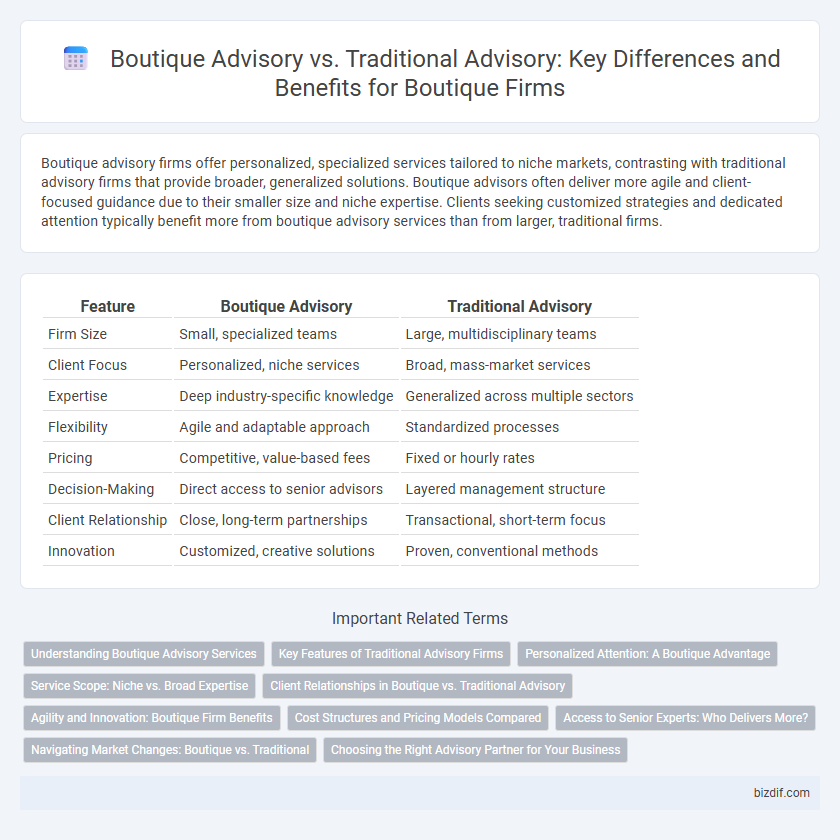

Boutique advisory firms offer personalized, specialized services tailored to niche markets, contrasting with traditional advisory firms that provide broader, generalized solutions. Boutique advisors often deliver more agile and client-focused guidance due to their smaller size and niche expertise. Clients seeking customized strategies and dedicated attention typically benefit more from boutique advisory services than from larger, traditional firms.

Table of Comparison

| Feature | Boutique Advisory | Traditional Advisory |

|---|---|---|

| Firm Size | Small, specialized teams | Large, multidisciplinary teams |

| Client Focus | Personalized, niche services | Broad, mass-market services |

| Expertise | Deep industry-specific knowledge | Generalized across multiple sectors |

| Flexibility | Agile and adaptable approach | Standardized processes |

| Pricing | Competitive, value-based fees | Fixed or hourly rates |

| Decision-Making | Direct access to senior advisors | Layered management structure |

| Client Relationship | Close, long-term partnerships | Transactional, short-term focus |

| Innovation | Customized, creative solutions | Proven, conventional methods |

Understanding Boutique Advisory Services

Boutique advisory services specialize in personalized, niche market expertise, offering tailored strategies that align closely with client-specific goals. Unlike traditional advisory firms, which often provide standardized solutions across broad sectors, boutiques emphasize deep industry knowledge and bespoke advice. This focused approach enables boutique advisors to deliver highly customized support, driving superior value and client satisfaction.

Key Features of Traditional Advisory Firms

Traditional advisory firms typically offer a broad range of standardized financial services, leveraging extensive industry experience and established client networks. They emphasize hierarchical structures, comprehensive regulatory compliance, and large-scale resources to support complex transactions. These firms prioritize long-term client relationships through personalized portfolio management and structured advice based on historical market data and institutional research.

Personalized Attention: A Boutique Advantage

Boutique advisory firms excel in delivering personalized attention by offering tailored strategies that traditional advisory services often lack due to their larger client bases. These firms maintain smaller client-to-advisor ratios, enabling deeper understanding of individual financial goals and more responsive support. Personalized attention enhances client satisfaction and drives more effective, customized financial outcomes.

Service Scope: Niche vs. Broad Expertise

Boutique advisory firms specialize in niche markets, offering highly tailored services that leverage deep industry expertise and personalized client engagement. Traditional advisory firms provide broader expertise across multiple sectors, delivering comprehensive solutions but often with less customization. The focused service scope of boutique advisories enables agile and specialized strategies, while traditional firms prioritize scalability and diverse capabilities.

Client Relationships in Boutique vs. Traditional Advisory

Boutique advisory firms emphasize personalized client relationships through tailored strategies and in-depth understanding of individual needs, fostering higher trust and long-term collaboration compared to traditional advisory firms. Traditional advisory firms often rely on standardized processes and larger client portfolios, which can limit direct engagement and responsiveness. This personalized approach in boutique advisory leads to more customized and agile solutions, enhancing client satisfaction and loyalty.

Agility and Innovation: Boutique Firm Benefits

Boutique advisory firms offer superior agility by providing highly tailored solutions that quickly adapt to evolving market trends, unlike traditional advisory firms burdened by rigid structures. Their focused expertise drives innovation, leveraging cutting-edge technologies and personalized strategies that enhance client outcomes. This flexibility and forward-thinking approach position boutique advisories as ideal partners for businesses seeking dynamic and creative problem-solving.

Cost Structures and Pricing Models Compared

Boutique advisory firms often feature leaner cost structures, enabling more flexible and competitive pricing models compared to traditional advisory firms that typically incur higher overhead costs due to larger teams and extensive infrastructure. Boutique advisors frequently adopt value-based or performance-driven pricing, aligning fees more closely with client outcomes, whereas traditional firms generally rely on fixed hourly rates or retainer fees. This lean cost structure and adaptive pricing approach position boutique advisory firms as cost-effective, tailored solutions for clients seeking personalized and transparent financial guidance.

Access to Senior Experts: Who Delivers More?

Boutique advisory firms offer clients direct access to senior experts who bring specialized industry knowledge and personalized attention, often resulting in more tailored strategic solutions. Traditional advisory firms tend to delegate responsibilities to junior staff, making senior expert involvement less consistent and diluted. Clients seeking high-level insights and customized guidance typically benefit more from the boutique advisory model due to the concentrated expertise and hands-on approach of seasoned professionals.

Navigating Market Changes: Boutique vs. Traditional

Boutique advisory firms specialize in personalized strategies and agile decision-making, enabling quicker adaptation to volatile market changes compared to traditional advisory firms, which often rely on rigid structures and standardized processes. Their deep industry expertise allows boutiques to provide tailored solutions that address specific client challenges amidst economic shifts. Traditional advisory firms may offer broader resources, but boutiques excel in delivering niche insights and innovative approaches for dynamic market navigation.

Choosing the Right Advisory Partner for Your Business

Boutique advisory firms offer specialized expertise and personalized service tailored to niche markets, contrasting with traditional advisory firms that provide broader, standardized solutions. Choosing the right advisory partner involves evaluating industry-specific knowledge, client engagement level, and agility in addressing unique business challenges. Businesses benefit from boutique advisors' focused insights and customized strategies, which often lead to more effective decision-making and competitive advantage.

Boutique Advisory vs Traditional Advisory Infographic

bizdif.com

bizdif.com