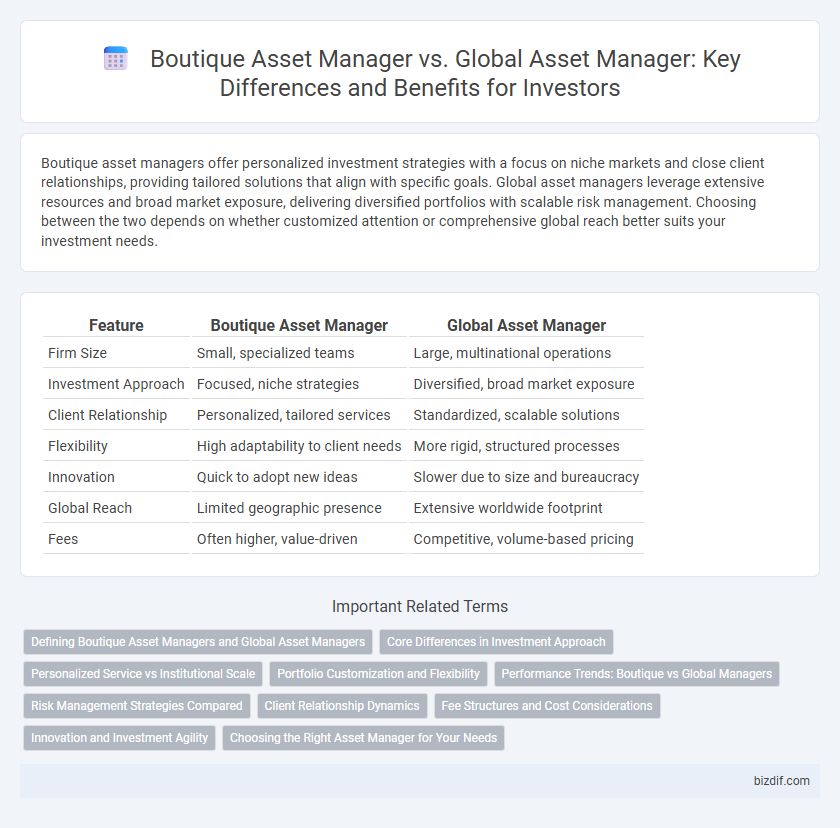

Boutique asset managers offer personalized investment strategies with a focus on niche markets and close client relationships, providing tailored solutions that align with specific goals. Global asset managers leverage extensive resources and broad market exposure, delivering diversified portfolios with scalable risk management. Choosing between the two depends on whether customized attention or comprehensive global reach better suits your investment needs.

Table of Comparison

| Feature | Boutique Asset Manager | Global Asset Manager |

|---|---|---|

| Firm Size | Small, specialized teams | Large, multinational operations |

| Investment Approach | Focused, niche strategies | Diversified, broad market exposure |

| Client Relationship | Personalized, tailored services | Standardized, scalable solutions |

| Flexibility | High adaptability to client needs | More rigid, structured processes |

| Innovation | Quick to adopt new ideas | Slower due to size and bureaucracy |

| Global Reach | Limited geographic presence | Extensive worldwide footprint |

| Fees | Often higher, value-driven | Competitive, volume-based pricing |

Defining Boutique Asset Managers and Global Asset Managers

Boutique Asset Managers specialize in tailored investment strategies with a focus on personalized client relationships, offering niche expertise and agility in decision-making. Global Asset Managers operate on a large scale, managing extensive assets across multiple regions and asset classes, leveraging global research and resources. The distinction lies in boutique firms' emphasis on customization and regional focus versus global managers' broad, diversified investment capabilities.

Core Differences in Investment Approach

Boutique asset managers specialize in personalized investment strategies tailored to specific market niches, often emphasizing active management and deep sector expertise. Global asset managers leverage broad resources and scale, employing diversified portfolios and quantitative models to manage vast assets across multiple geographies. The core difference lies in the boutique's focus on agility and client-centric customization versus the global manager's emphasis on broad market coverage and standardized processes.

Personalized Service vs Institutional Scale

Boutique asset managers excel in delivering personalized service and tailored investment strategies that align closely with individual client goals and risk profiles. Global asset managers benefit from institutional scale, offering extensive resources, broad market access, and diversified product portfolios to accommodate large-scale investments. Clients favor boutique firms for customized attention and agility, while institutional investors often prefer the robustness and global reach of large asset management firms.

Portfolio Customization and Flexibility

Boutique asset managers excel in portfolio customization by tailoring investment strategies to individual client needs, offering greater flexibility than global asset managers who often follow standardized models for broader markets. This personalized approach enables boutique firms to adapt quickly to changing market conditions and incorporate niche investment opportunities, enhancing client satisfaction. In contrast, global asset managers prioritize scalability and consistency, which can limit their ability to provide highly customized portfolio solutions.

Performance Trends: Boutique vs Global Managers

Boutique asset managers consistently demonstrate agile investment strategies that often result in superior risk-adjusted performance compared to global asset managers, especially in niche markets or specialized sectors. Performance trends reveal that boutiques excel in delivering alpha through focused expertise and personalized client service, whereas global managers typically offer broader diversification but may experience diluted returns due to larger asset bases. Data from recent studies indicate that over a 5-year horizon, boutique funds outperform global funds by an average of 1.5% annually, highlighting the efficacy of specialized management approaches in volatile or complex market conditions.

Risk Management Strategies Compared

Boutique asset managers often implement highly specialized risk management strategies tailored to niche markets or unique client goals, leveraging deep expertise and agile decision-making processes. Global asset managers typically employ standardized, large-scale risk frameworks supported by advanced technology and extensive data analytics, aiming for consistent performance across diverse portfolios. Boutique firms prioritize personalized risk controls and flexibility, whereas global managers emphasize scalability and comprehensive risk diversification.

Client Relationship Dynamics

Boutique asset managers typically offer highly personalized client relationship dynamics, emphasizing tailored investment strategies and direct access to senior investment professionals. Global asset managers, by contrast, leverage extensive resources and broad market coverage but may have less frequent, standardized client interactions due to scale. Clients seeking customized service and agility often prefer boutique managers, while those prioritizing comprehensive product offerings and global reach gravitate toward large firms.

Fee Structures and Cost Considerations

Boutique asset managers typically offer more personalized services with fee structures that may include performance-based fees, often resulting in higher costs compared to global asset managers who benefit from economies of scale and usually charge lower fixed fees. Cost considerations for investors include the trade-off between tailored investment strategies offered by boutique firms and the lower expense ratios and broader resources provided by global asset managers. Evaluating total cost efficiency requires analyzing both management fees and additional expenses like fund turnover and administrative costs.

Innovation and Investment Agility

Boutique asset managers excel in innovation by leveraging specialized expertise and nimble decision-making processes, enabling rapid adaptation to market trends and tailored investment strategies. Their smaller scale fosters closer client relationships and the flexibility to explore unique, high-conviction opportunities often overlooked by global asset managers. In contrast, global asset managers prioritize scale and broad market coverage but may face slower innovation cycles due to complex structures and regulatory constraints.

Choosing the Right Asset Manager for Your Needs

Selecting the right asset manager involves evaluating the personalized service and specialized expertise offered by a boutique asset manager versus the extensive resources and global reach of a global asset manager. Boutique asset managers often deliver tailored investment strategies and closer client relationships, ideal for investors seeking customized solutions. In contrast, global asset managers provide diversified portfolios and access to international markets, suitable for clients prioritizing scale and broad market exposure.

Boutique Asset Manager vs Global Asset Manager Infographic

bizdif.com

bizdif.com