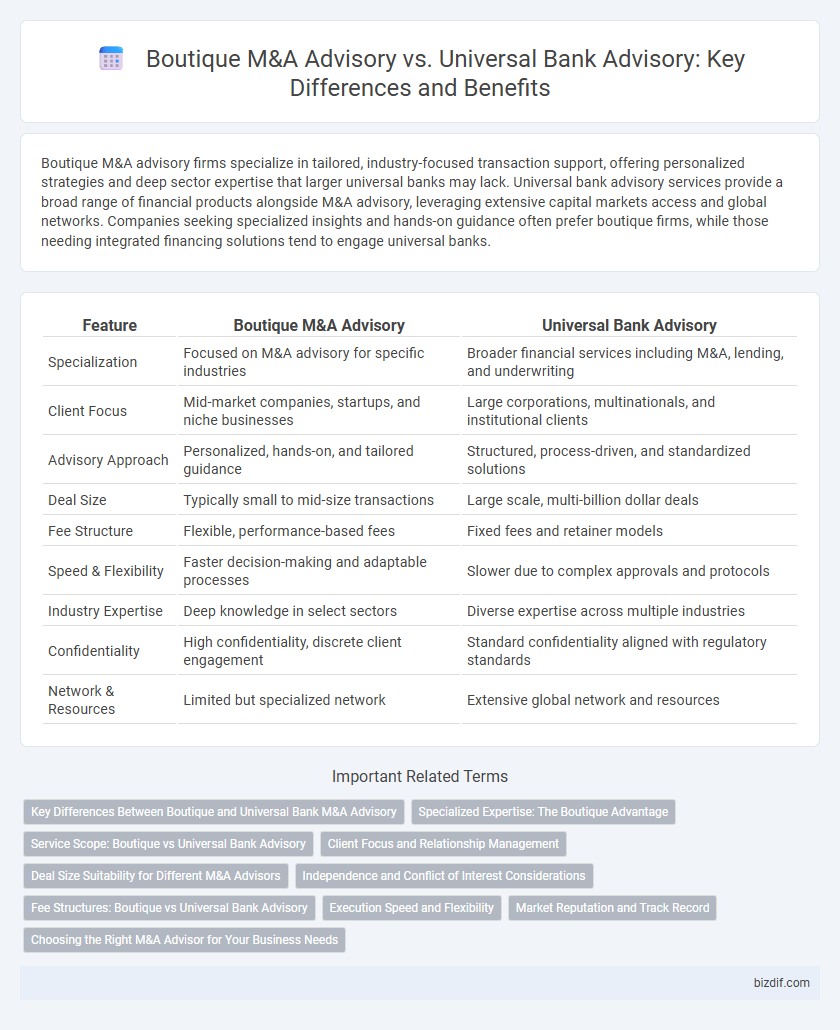

Boutique M&A advisory firms specialize in tailored, industry-focused transaction support, offering personalized strategies and deep sector expertise that larger universal banks may lack. Universal bank advisory services provide a broad range of financial products alongside M&A advisory, leveraging extensive capital markets access and global networks. Companies seeking specialized insights and hands-on guidance often prefer boutique firms, while those needing integrated financing solutions tend to engage universal banks.

Table of Comparison

| Feature | Boutique M&A Advisory | Universal Bank Advisory |

|---|---|---|

| Specialization | Focused on M&A advisory for specific industries | Broader financial services including M&A, lending, and underwriting |

| Client Focus | Mid-market companies, startups, and niche businesses | Large corporations, multinationals, and institutional clients |

| Advisory Approach | Personalized, hands-on, and tailored guidance | Structured, process-driven, and standardized solutions |

| Deal Size | Typically small to mid-size transactions | Large scale, multi-billion dollar deals |

| Fee Structure | Flexible, performance-based fees | Fixed fees and retainer models |

| Speed & Flexibility | Faster decision-making and adaptable processes | Slower due to complex approvals and protocols |

| Industry Expertise | Deep knowledge in select sectors | Diverse expertise across multiple industries |

| Confidentiality | High confidentiality, discrete client engagement | Standard confidentiality aligned with regulatory standards |

| Network & Resources | Limited but specialized network | Extensive global network and resources |

Key Differences Between Boutique and Universal Bank M&A Advisory

Boutique M&A advisory firms specialize in providing personalized, sector-specific expertise and often target mid-market transactions with tailored strategies and direct senior-level attention. Universal bank advisory services operate within large financial institutions offering a broad suite of services, including financing, underwriting, and global reach, primarily focusing on large-scale, complex deals. The key differences lie in the personalized client approach, deal size focus, and range of additional financial services provided by universal banks compared to the niche, specialized advisory focus of boutique firms.

Specialized Expertise: The Boutique Advantage

Boutique M&A advisory firms offer specialized expertise by focusing exclusively on mergers and acquisitions within specific industries, providing tailored strategies that universal banks often cannot match. Their deep sector knowledge and personalized approach enable more precise valuation, negotiation, and deal structuring, resulting in higher success rates and client satisfaction. This specialization allows boutique advisors to navigate complex transactions with agility, leveraging niche networks and industry insights that universal banks typically lack.

Service Scope: Boutique vs Universal Bank Advisory

Boutique M&A advisory firms specialize in tailored, industry-specific mergers and acquisitions services, offering personalized attention and deep sector expertise to mid-market clients. Universal bank advisory services deliver a broad range of financial solutions including M&A advisory, financing, and capital markets access, often targeting large corporations with more standardized offerings. The service scope of boutique advisors is narrower but highly focused, whereas universal banks provide comprehensive, multi-service financial advisory capabilities under one roof.

Client Focus and Relationship Management

Boutique M&A advisory firms excel in delivering highly personalized client focus by tailoring strategic solutions that align closely with individual business goals and sector-specific nuances. Their relationship management emphasizes direct senior-level engagement, fostering deeper trust and more agile decision-making compared to universal bank advisory services. Universal banks tend to prioritize standardized processes and volume-driven mandates, which can limit customization and reduce the depth of client-advisor rapport.

Deal Size Suitability for Different M&A Advisors

Boutique M&A advisory firms specialize in mid-market deals typically ranging from $50 million to $500 million, offering tailored expertise and deeper industry focus compared to universal banks. Universal banks handle larger transactions often exceeding $1 billion, leveraging extensive resources and global reach to manage complex cross-border deals. Choosing between boutique advisory and universal bank advisory depends on deal size, with boutiques providing personalized service for middle-market deals and universal banks suited for high-value, large-scale mergers and acquisitions.

Independence and Conflict of Interest Considerations

Boutique M&A advisory firms maintain higher independence by avoiding lending or risk-bearing activities that can create conflicts of interest common in universal bank advisory services. Their focused expertise ensures unbiased advice tailored to client objectives without the influence of cross-selling banking products or proprietary trading interests. Universal banks often face challenges mitigating conflicts due to integrated commercial banking lines, potentially compromising advisory neutrality and client trust.

Fee Structures: Boutique vs Universal Bank Advisory

Boutique M&A advisory firms typically offer more flexible and performance-based fee structures, aligning their compensation with deal success, which often includes lower retainer fees and higher contingency fees. In contrast, universal bank advisory services usually charge higher upfront fees and fixed retainers, reflecting their larger scale, broader service scope, and brand reputation. Clients seeking cost-efficient and tailored advisory solutions often prefer boutique firms due to their customized fee models and focused industry expertise.

Execution Speed and Flexibility

Boutique M&A advisory firms deliver faster execution speed by leveraging specialized expertise and streamlined decision-making processes, enabling quicker deal closure compared to universal banks. Their flexible approach allows for tailored solutions and personalized client engagement, adapting swiftly to unique transaction needs. Universal banks often face slower execution due to hierarchical structures and standardized protocols, limiting agility in dynamic M&A environments.

Market Reputation and Track Record

Boutique M&A advisory firms consistently demonstrate superior market reputation and focused expertise compared to universal banks, delivering tailored services with a higher success rate in mid-market transactions. These boutiques build strong client relationships through specialized sector knowledge and personalized deal execution, fostering trust and repeat business. Universal banks, while offering broader services, often lack the niche experience and agility that boutique advisors leverage to achieve outstanding deal outcomes.

Choosing the Right M&A Advisor for Your Business Needs

Boutique M&A advisory firms offer specialized expertise and tailored services that align closely with specific industry sectors and smaller, mid-market transactions, providing personalized attention and strategic focus. Universal bank advisory services deliver comprehensive financial solutions backed by extensive resources and global networks, suited for larger or complex deals requiring integrated financing options. Selecting the right M&A advisor depends on your business size, transaction complexity, industry focus, and need for customized advisory versus broad financial capabilities.

Boutique M&A Advisory vs Universal Bank Advisory Infographic

bizdif.com

bizdif.com