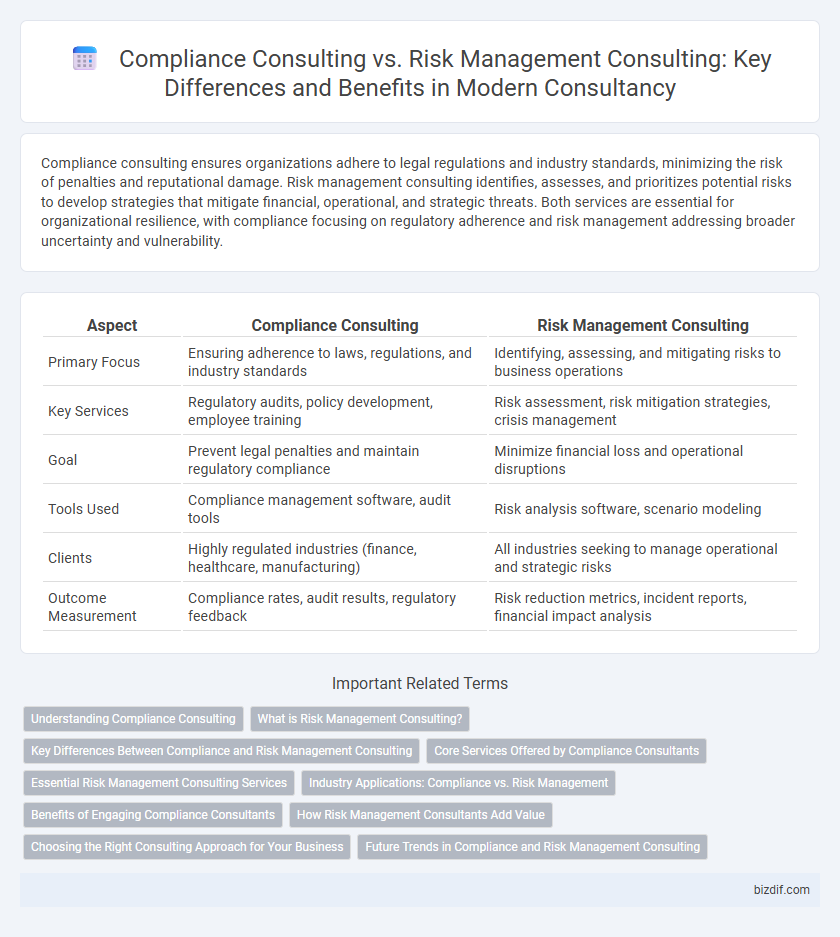

Compliance consulting ensures organizations adhere to legal regulations and industry standards, minimizing the risk of penalties and reputational damage. Risk management consulting identifies, assesses, and prioritizes potential risks to develop strategies that mitigate financial, operational, and strategic threats. Both services are essential for organizational resilience, with compliance focusing on regulatory adherence and risk management addressing broader uncertainty and vulnerability.

Table of Comparison

| Aspect | Compliance Consulting | Risk Management Consulting |

|---|---|---|

| Primary Focus | Ensuring adherence to laws, regulations, and industry standards | Identifying, assessing, and mitigating risks to business operations |

| Key Services | Regulatory audits, policy development, employee training | Risk assessment, risk mitigation strategies, crisis management |

| Goal | Prevent legal penalties and maintain regulatory compliance | Minimize financial loss and operational disruptions |

| Tools Used | Compliance management software, audit tools | Risk analysis software, scenario modeling |

| Clients | Highly regulated industries (finance, healthcare, manufacturing) | All industries seeking to manage operational and strategic risks |

| Outcome Measurement | Compliance rates, audit results, regulatory feedback | Risk reduction metrics, incident reports, financial impact analysis |

Understanding Compliance Consulting

Compliance consulting focuses on ensuring organizations adhere to laws, regulations, and internal policies to avoid legal penalties and reputational damage. Consultants in this field develop frameworks for regulatory compliance, conduct audits, and implement training programs tailored to industry-specific requirements such as GDPR, HIPAA, or SOX. Understanding compliance consulting involves recognizing its role in mitigating legal risks and promoting ethical business practices through proactive adherence to evolving regulatory standards.

What is Risk Management Consulting?

Risk Management Consulting involves identifying, assessing, and prioritizing potential threats to an organization's assets and operations, enabling businesses to develop strategies that minimize the impact of unforeseen events. This type of consulting integrates risk assessment models, regulatory compliance requirements, and industry-specific challenges to create tailored risk mitigation plans. Firms specializing in risk management consulting help clients improve decision-making processes, enhance operational resilience, and ensure long-term sustainability by addressing financial, operational, and reputational risks.

Key Differences Between Compliance and Risk Management Consulting

Compliance consulting centers on ensuring organizations adhere to legal regulations and industry standards, minimizing the risk of penalties and reputational damage. Risk management consulting identifies, assesses, and prioritizes potential threats to business operations, developing strategies to mitigate or transfer risks. While compliance focuses on regulatory conformity, risk management provides a broader framework to safeguard assets and ensure long-term organizational resilience.

Core Services Offered by Compliance Consultants

Compliance consultants specialize in ensuring organizations adhere to regulatory requirements through services such as policy development, internal audits, and regulatory reporting. They focus on creating frameworks that prevent legal infractions and promote ethical business practices. Core offerings include compliance program design, risk assessments specific to regulatory mandates, and employee training on compliance standards.

Essential Risk Management Consulting Services

Essential risk management consulting services focus on identifying, assessing, and prioritizing risks to minimize the impact on business operations and strategic goals. Key services include risk assessment and analysis, regulatory compliance support, crisis management planning, and implementation of risk mitigation strategies tailored to industry-specific challenges. These services differ from compliance consulting by emphasizing proactive risk identification and management beyond mere adherence to laws and regulations.

Industry Applications: Compliance vs. Risk Management

Compliance consulting primarily targets regulated industries such as finance, healthcare, and pharmaceuticals, ensuring adherence to laws like GDPR, HIPAA, and SOX. Risk management consulting serves diverse sectors including manufacturing, energy, and IT, focusing on identifying, assessing, and mitigating operational, strategic, and cyber risks. Both practices enhance organizational resilience but differ in scope: compliance ensures legal conformity while risk management proactively addresses potential threats across the enterprise.

Benefits of Engaging Compliance Consultants

Engaging compliance consultants ensures adherence to evolving regulatory frameworks, reducing the likelihood of costly legal penalties and reputational damage. These experts specialize in implementing robust policies that enhance organizational transparency and operational efficiency. Their proactive guidance supports sustainable growth by mitigating compliance gaps before they escalate into significant risks.

How Risk Management Consultants Add Value

Risk management consultants add value by identifying potential threats and vulnerabilities that could disrupt business operations, enabling proactive mitigation strategies tailored to specific industry risks. Their expertise in assessing risk exposure and implementing robust controls reduces financial losses and enhances regulatory compliance, safeguarding organizational assets. By fostering a culture of risk awareness and resilience, these consultants empower companies to make informed decisions and sustain long-term growth.

Choosing the Right Consulting Approach for Your Business

Compliance consulting ensures your business adheres to laws, regulations, and industry standards, minimizing legal penalties and reputational damage. Risk management consulting focuses on identifying, assessing, and mitigating potential threats to business operations, financial stability, and strategic goals. Selecting the right consulting approach depends on your organization's immediate regulatory challenges or the need to proactively manage uncertainties affecting long-term success.

Future Trends in Compliance and Risk Management Consulting

Future trends in compliance consulting emphasize the integration of artificial intelligence and machine learning for real-time regulatory monitoring and automated reporting. Risk management consulting increasingly leverages predictive analytics and blockchain technology to enhance risk identification and mitigation strategies. Both fields are evolving towards seamless digital transformation to ensure proactive compliance and robust risk resilience in complex regulatory environments.

Compliance Consulting vs Risk Management Consulting Infographic

bizdif.com

bizdif.com