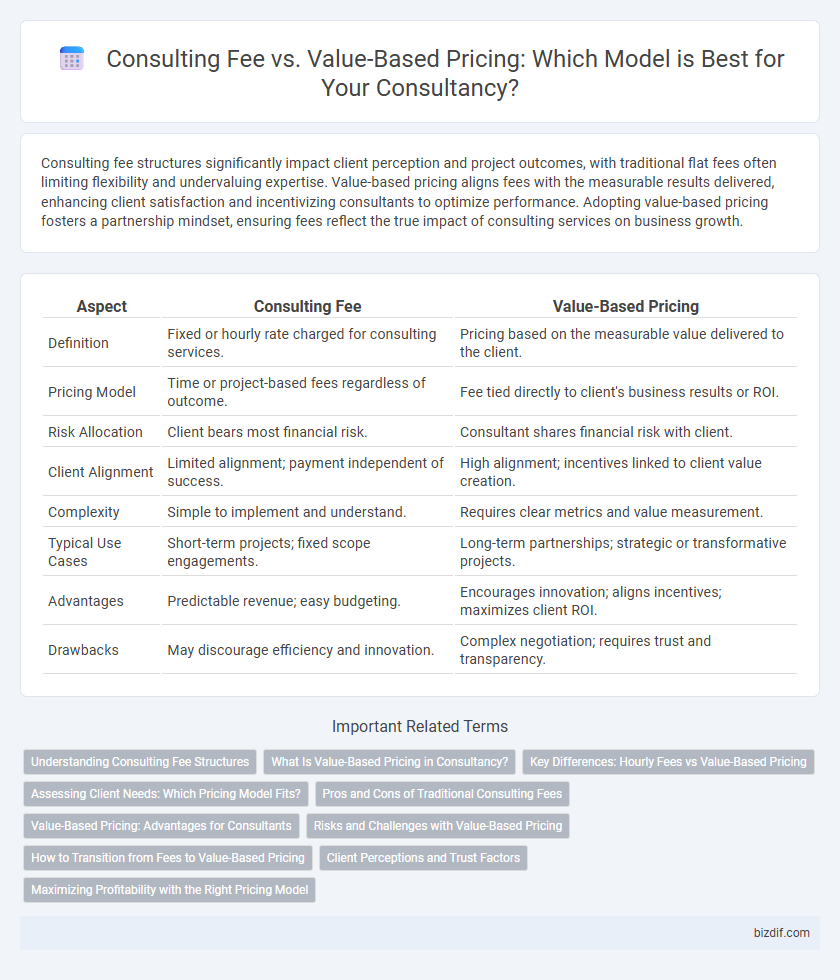

Consulting fee structures significantly impact client perception and project outcomes, with traditional flat fees often limiting flexibility and undervaluing expertise. Value-based pricing aligns fees with the measurable results delivered, enhancing client satisfaction and incentivizing consultants to optimize performance. Adopting value-based pricing fosters a partnership mindset, ensuring fees reflect the true impact of consulting services on business growth.

Table of Comparison

| Aspect | Consulting Fee | Value-Based Pricing |

|---|---|---|

| Definition | Fixed or hourly rate charged for consulting services. | Pricing based on the measurable value delivered to the client. |

| Pricing Model | Time or project-based fees regardless of outcome. | Fee tied directly to client's business results or ROI. |

| Risk Allocation | Client bears most financial risk. | Consultant shares financial risk with client. |

| Client Alignment | Limited alignment; payment independent of success. | High alignment; incentives linked to client value creation. |

| Complexity | Simple to implement and understand. | Requires clear metrics and value measurement. |

| Typical Use Cases | Short-term projects; fixed scope engagements. | Long-term partnerships; strategic or transformative projects. |

| Advantages | Predictable revenue; easy budgeting. | Encourages innovation; aligns incentives; maximizes client ROI. |

| Drawbacks | May discourage efficiency and innovation. | Complex negotiation; requires trust and transparency. |

Understanding Consulting Fee Structures

Consulting fee structures typically fall into two categories: hourly or project-based fees and value-based pricing. Hourly or project fees are straightforward, charging clients for time or deliverables, while value-based pricing aligns fees with the measurable business outcomes or benefits delivered to the client. Understanding these models helps consultants match pricing strategies to client expectations, project complexity, and perceived value, optimizing revenue and client satisfaction.

What Is Value-Based Pricing in Consultancy?

Value-based pricing in consultancy is a strategic approach where fees are determined by the measurable value delivered to the client rather than traditional hourly rates or fixed fees. This model aligns the consultant's compensation with the client's business outcomes, ensuring that the pricing reflects the impact of solutions on revenue growth, cost savings, or efficiency improvements. By focusing on the client's perception of value, consultants can enhance profitability while fostering stronger client partnerships.

Key Differences: Hourly Fees vs Value-Based Pricing

Consulting fees are traditionally calculated based on hourly rates, which charge clients for the time spent on tasks regardless of outcomes, emphasizing transparency and predictability. Value-based pricing, however, aligns fees with the tangible results and business value delivered, incentivizing consultants to focus on impactful solutions rather than hours worked. This key difference shifts the client-consultant relationship towards performance-driven engagements, often enhancing client satisfaction and long-term partnerships.

Assessing Client Needs: Which Pricing Model Fits?

Assessing client needs is crucial in determining whether consulting fee or value-based pricing fits best, as fee structures should align with project complexity and desired outcomes. Consulting fees offer predictable costs suitable for clearly defined tasks and fixed deliverables, while value-based pricing aligns fees with the measurable impact and benefits delivered to the client. Selecting the right pricing model depends on the client's budget flexibility, risk tolerance, and the consultant's ability to quantify value.

Pros and Cons of Traditional Consulting Fees

Traditional consulting fees, often based on hourly or daily rates, provide clear and predictable billing structures that simplify budgeting for clients but may encourage inefficiency and limit value alignment between consultant and client. This pricing model can lead to challenges in measuring outcomes, as fees are not directly tied to the impact or results delivered, potentially reducing incentive for consultants to maximize client value. Despite these drawbacks, traditional fees remain popular due to their transparency and straightforward administration, especially in projects with uncertain scopes or evolving requirements.

Value-Based Pricing: Advantages for Consultants

Value-based pricing allows consultants to align fees directly with the tangible outcomes and business impact delivered to clients, enhancing perceived value and client satisfaction. This pricing strategy promotes stronger client relationships by focusing on results rather than hours worked, fostering trust and long-term partnerships. Consultants benefit from increased profit margins and motivation to deliver exceptional solutions that exceed client expectations.

Risks and Challenges with Value-Based Pricing

Value-based pricing in consultancy presents risks such as inaccurate value estimation leading to underpricing or client dissatisfaction. Challenges include difficulty in quantifying intangible benefits and aligning price with perceived value across diverse client expectations. Consultants must manage potential disputes over value assessment and ensure transparent communication to mitigate financial unpredictability.

How to Transition from Fees to Value-Based Pricing

Transitioning from consulting fees to value-based pricing requires a thorough understanding of client outcomes and delivering measurable results that justify the price. Consultants should implement clear value metrics and communicate the tangible benefits their services will provide, aligning fees with the client's business impact rather than time spent. Building trust through case studies and pilot projects facilitates this shift, enabling a smoother adoption of value-driven agreements.

Client Perceptions and Trust Factors

Consulting fee structures significantly influence client perceptions and trust, with value-based pricing often fostering stronger client confidence by aligning costs with tangible business outcomes. Clients tend to perceive value-based pricing as a transparent model that demonstrates consultants' commitment to delivering measurable results, enhancing long-term trust. Fixed fees may create skepticism about service adaptability, whereas value-based pricing highlights mutual investment in success and partnership integrity.

Maximizing Profitability with the Right Pricing Model

Consulting fee structures directly impact profitability, with traditional hourly or project-based fees often limiting revenue potential. Value-based pricing aligns fees with the measurable outcomes and benefits delivered to clients, enabling consultants to capture greater value from their expertise. Maximizing profitability requires selecting a pricing model that reflects the client's perceived value, incentivizes efficiency, and differentiates the consulting service in competitive markets.

Consulting Fee vs Value-Based Pricing Infographic

bizdif.com

bizdif.com