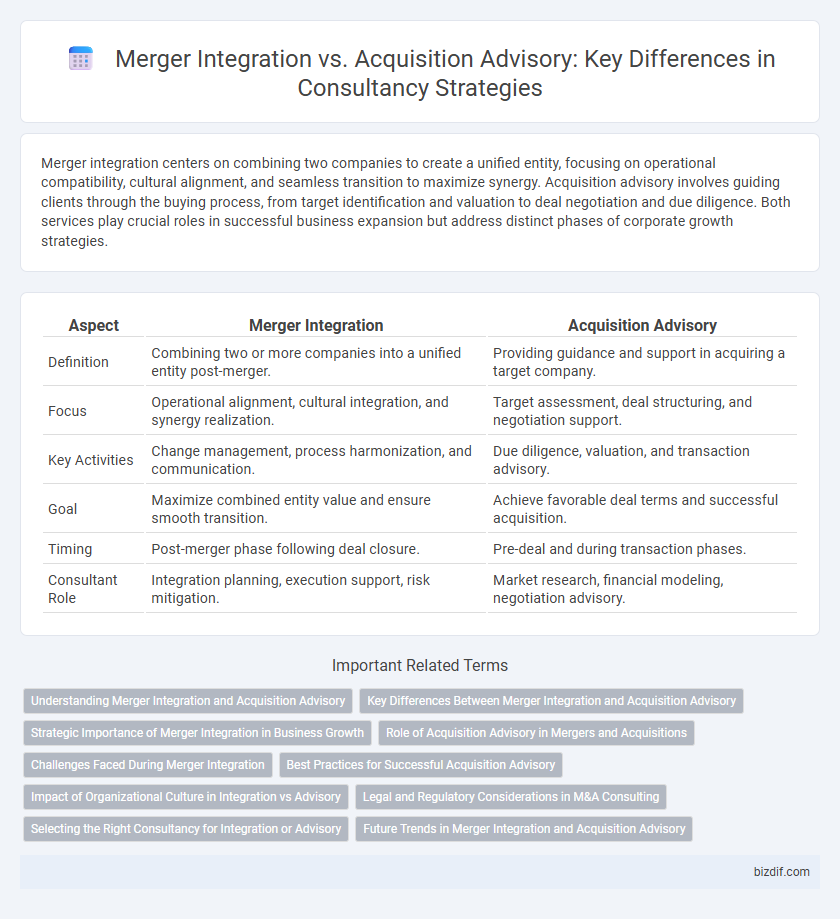

Merger integration centers on combining two companies to create a unified entity, focusing on operational compatibility, cultural alignment, and seamless transition to maximize synergy. Acquisition advisory involves guiding clients through the buying process, from target identification and valuation to deal negotiation and due diligence. Both services play crucial roles in successful business expansion but address distinct phases of corporate growth strategies.

Table of Comparison

| Aspect | Merger Integration | Acquisition Advisory |

|---|---|---|

| Definition | Combining two or more companies into a unified entity post-merger. | Providing guidance and support in acquiring a target company. |

| Focus | Operational alignment, cultural integration, and synergy realization. | Target assessment, deal structuring, and negotiation support. |

| Key Activities | Change management, process harmonization, and communication. | Due diligence, valuation, and transaction advisory. |

| Goal | Maximize combined entity value and ensure smooth transition. | Achieve favorable deal terms and successful acquisition. |

| Timing | Post-merger phase following deal closure. | Pre-deal and during transaction phases. |

| Consultant Role | Integration planning, execution support, risk mitigation. | Market research, financial modeling, negotiation advisory. |

Understanding Merger Integration and Acquisition Advisory

Merger integration focuses on combining two companies' operations, cultures, and systems to achieve synergy and value creation post-transaction. Acquisition advisory involves providing expert guidance throughout the buying process, including target identification, due diligence, valuation, and negotiation. Both services are essential for successful corporate consolidation but emphasize different phases of the transaction lifecycle.

Key Differences Between Merger Integration and Acquisition Advisory

Merger integration focuses on combining two companies post-transaction to achieve operational synergies, cultural alignment, and seamless workflow integration. Acquisition advisory primarily provides strategic guidance during the transaction process, including target identification, valuation, negotiation, and deal structuring. The key difference lies in acquisition advisory's emphasis on pre-deal strategy and execution, while merger integration centers on post-deal organizational consolidation and value realization.

Strategic Importance of Merger Integration in Business Growth

Merger integration is critical in business growth as it ensures seamless unification of operations, cultures, and systems, maximizing synergistic value post-transaction. Acquisition advisory focuses primarily on deal structuring and negotiation, whereas merger integration drives long-term value by aligning objectives, optimizing resource allocation, and sustaining competitive advantage. Effective merger integration reduces operational disruption and accelerates the realization of anticipated financial and strategic benefits.

Role of Acquisition Advisory in Mergers and Acquisitions

Acquisition Advisory plays a crucial role in mergers and acquisitions by providing expert guidance throughout the deal lifecycle, including target identification, valuation, due diligence, and negotiation strategies. This consultancy service ensures alignment of acquisition objectives with corporate goals, mitigates risks, and maximizes transaction value. Unlike Merger Integration, which focuses on post-deal execution and harmonizing operations, Acquisition Advisory concentrates on deal structuring and strategic decision-making prior to transaction closure.

Challenges Faced During Merger Integration

Merger integration often faces significant challenges such as cultural clashes between merging organizations, misalignment of business processes, and integration of complex IT systems. Financial discrepancies and differing management styles can cause operational disruptions and stakeholder uncertainty. Addressing these integration hurdles requires comprehensive planning, clear communication, and experienced consultancy expertise to ensure a smooth transition and value realization.

Best Practices for Successful Acquisition Advisory

Successful acquisition advisory hinges on thorough due diligence, aligning strategic objectives, and transparent stakeholder communication to minimize risks and enhance value creation. Employing a structured integration planning process early in the advisory phase ensures smoother transitions and faster realization of synergies. Leveraging cross-functional expertise and advanced analytics supports informed decision-making and optimizes post-acquisition performance.

Impact of Organizational Culture in Integration vs Advisory

Merger integration requires deep alignment of organizational cultures to ensure smooth transitions, employee retention, and unified operational practices, which directly influence synergy realization and long-term success. Acquisition advisory focuses on assessing cultural compatibility risks during due diligence to inform deal valuation and negotiation strategies, mitigating potential post-transaction disruptions. Effective management of cultural dynamics in merger integration leads to improved collaboration and innovation, while advisory services emphasize cultural fit as a critical factor in acquisition decision-making.

Legal and Regulatory Considerations in M&A Consulting

Merger integration involves aligning operational, cultural, and legal frameworks of two entities post-transaction, requiring comprehensive regulatory compliance to mitigate antitrust risks and ensure smooth consolidation. Acquisition advisory emphasizes due diligence on legal liabilities, contract reviews, and regulatory approvals to identify potential deal breakers and facilitate negotiation strategies. Both services demand expertise in jurisdiction-specific corporate laws, securities regulations, and compliance with international trade standards to secure successful M&A outcomes.

Selecting the Right Consultancy for Integration or Advisory

Selecting the right consultancy for merger integration or acquisition advisory hinges on understanding their expertise in aligning operational, cultural, and strategic objectives during post-merger phases or deal negotiations. A consultancy specialized in merger integration brings proven frameworks to streamline processes and employee transition, while advisory firms provide critical due diligence, valuation insights, and risk assessment expertise. Evaluating case studies, industry experience, and tailored client approaches ensures optimal support either for seamless integration or maximized deal value.

Future Trends in Merger Integration and Acquisition Advisory

Future trends in merger integration and acquisition advisory emphasize the increasing use of advanced analytics and AI-driven tools to streamline due diligence and post-merger integration processes. There is a growing focus on cultural integration and change management to enhance value creation and reduce operational risks. Sustainability considerations and regulatory compliance are becoming critical factors that advisors integrate into strategic planning and execution.

Merger Integration vs Acquisition Advisory Infographic

bizdif.com

bizdif.com