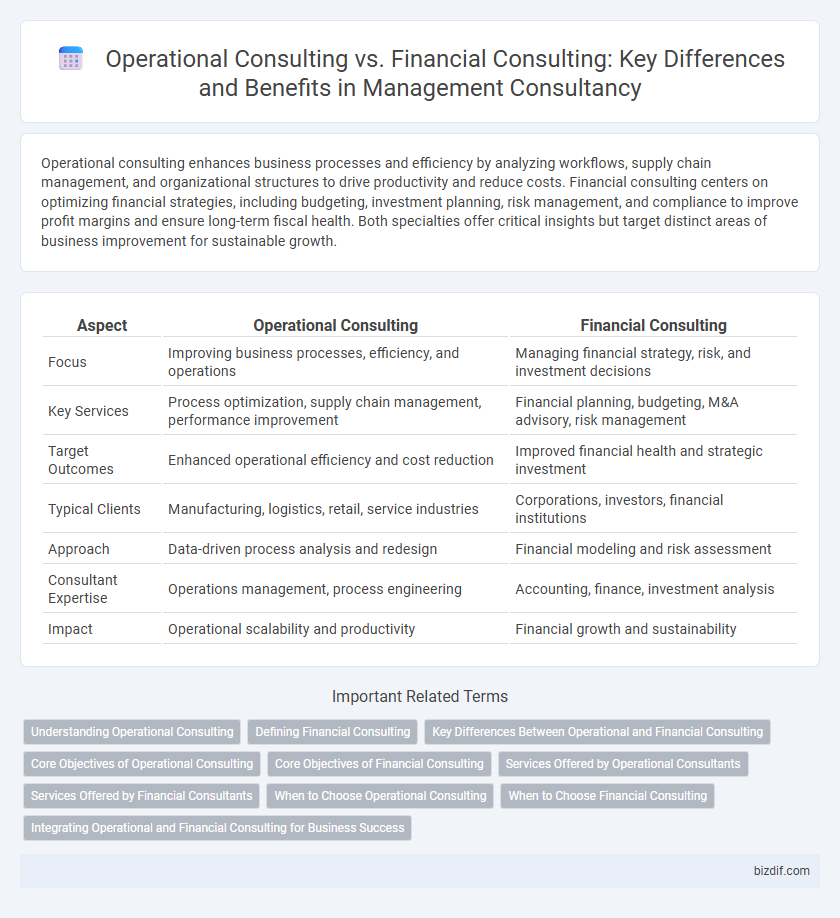

Operational consulting enhances business processes and efficiency by analyzing workflows, supply chain management, and organizational structures to drive productivity and reduce costs. Financial consulting centers on optimizing financial strategies, including budgeting, investment planning, risk management, and compliance to improve profit margins and ensure long-term fiscal health. Both specialties offer critical insights but target distinct areas of business improvement for sustainable growth.

Table of Comparison

| Aspect | Operational Consulting | Financial Consulting |

|---|---|---|

| Focus | Improving business processes, efficiency, and operations | Managing financial strategy, risk, and investment decisions |

| Key Services | Process optimization, supply chain management, performance improvement | Financial planning, budgeting, M&A advisory, risk management |

| Target Outcomes | Enhanced operational efficiency and cost reduction | Improved financial health and strategic investment |

| Typical Clients | Manufacturing, logistics, retail, service industries | Corporations, investors, financial institutions |

| Approach | Data-driven process analysis and redesign | Financial modeling and risk assessment |

| Consultant Expertise | Operations management, process engineering | Accounting, finance, investment analysis |

| Impact | Operational scalability and productivity | Financial growth and sustainability |

Understanding Operational Consulting

Operational consulting focuses on improving a company's internal processes, supply chain management, and workforce productivity to enhance overall efficiency. It involves analyzing workflow, identifying bottlenecks, and implementing sustainable strategies tailored to specific industry needs. This approach contrasts with financial consulting, which primarily emphasizes financial planning, investment strategies, and risk management.

Defining Financial Consulting

Financial consulting involves analyzing a company's financial health, optimizing budgeting, forecasting, and managing investments to maximize profitability and ensure regulatory compliance. It encompasses services like risk assessment, financial planning, tax strategy, and capital structure evaluation tailored to improve financial performance. Unlike operational consulting, which focuses on improving internal processes and efficiency, financial consulting centers exclusively on strategic financial decision-making and resource allocation.

Key Differences Between Operational and Financial Consulting

Operational consulting focuses on optimizing business processes, supply chain management, and organizational efficiency, whereas financial consulting centers on financial planning, investment analysis, and risk management. Operational consultants analyze workflow, production, and logistics to improve productivity, while financial consultants evaluate balance sheets, cash flow, and capital allocation strategies. Key differences lie in their distinct objectives: operational consulting aims to enhance operational performance, and financial consulting seeks to maximize financial health and profitability.

Core Objectives of Operational Consulting

Operational consulting focuses on improving business processes, enhancing efficiency, and optimizing resources to drive sustainable performance improvements and cost reductions. This type of consulting aims to streamline supply chains, improve production workflows, and implement best practices in operations management. By addressing operational challenges, consultants help organizations increase productivity and achieve measurable gains in operational excellence.

Core Objectives of Financial Consulting

Financial consulting centers on optimizing a company's financial health by enhancing cash flow, reducing costs, and improving investment strategies to maximize profitability. It involves comprehensive financial analysis, risk management, and strategic planning to support sustainable growth and regulatory compliance. Unlike operational consulting, which focuses on process efficiency and organizational workflows, financial consulting prioritizes fiscal stability and capital allocation to drive business value.

Services Offered by Operational Consultants

Operational consultants specialize in enhancing business processes, improving supply chain management, and optimizing production efficiency to drive operational excellence. They offer services such as workflow analysis, performance benchmarking, and implementation of lean methodologies tailored to streamline day-to-day operations. Their expertise spans project management, quality control, and risk mitigation, enabling organizations to reduce costs and increase productivity.

Services Offered by Financial Consultants

Financial consultants specialize in services such as investment management, risk assessment, tax planning, retirement strategy, and financial reporting analysis. They provide tailored advice to optimize cash flow, enhance portfolio performance, and ensure regulatory compliance for individuals and organizations. Their expertise supports effective capital allocation, budgeting, and strategic financial decision-making to drive sustainable growth.

When to Choose Operational Consulting

Operational consulting is ideal when organizations need to improve internal processes, enhance supply chain efficiency, or optimize workforce productivity to achieve better overall performance. Companies experiencing challenges with production bottlenecks, quality control issues, or IT system integration should consider operational consulting for targeted process improvements. This consulting type focuses on enhancing operational effectiveness to drive cost reduction and increase customer satisfaction.

When to Choose Financial Consulting

Financial consulting is essential when businesses need expert guidance on budgeting, investment strategies, or cash flow management to enhance profitability. It is ideal for companies facing financial restructuring, mergers, acquisitions, or seeking capital raising opportunities. Organizations aiming to optimize tax planning, compliance, and risk management should prioritize financial consulting over operational consulting.

Integrating Operational and Financial Consulting for Business Success

Integrating operational and financial consulting enhances business success by aligning process improvements with financial strategies to maximize efficiency and profitability. Operational consulting focuses on optimizing workflows, supply chains, and organizational structures, while financial consulting provides insights into budgeting, forecasting, and capital allocation. Combining these approaches ensures data-driven decision-making that drives sustainable growth and competitive advantage.

Operational Consulting vs Financial Consulting Infographic

bizdif.com

bizdif.com