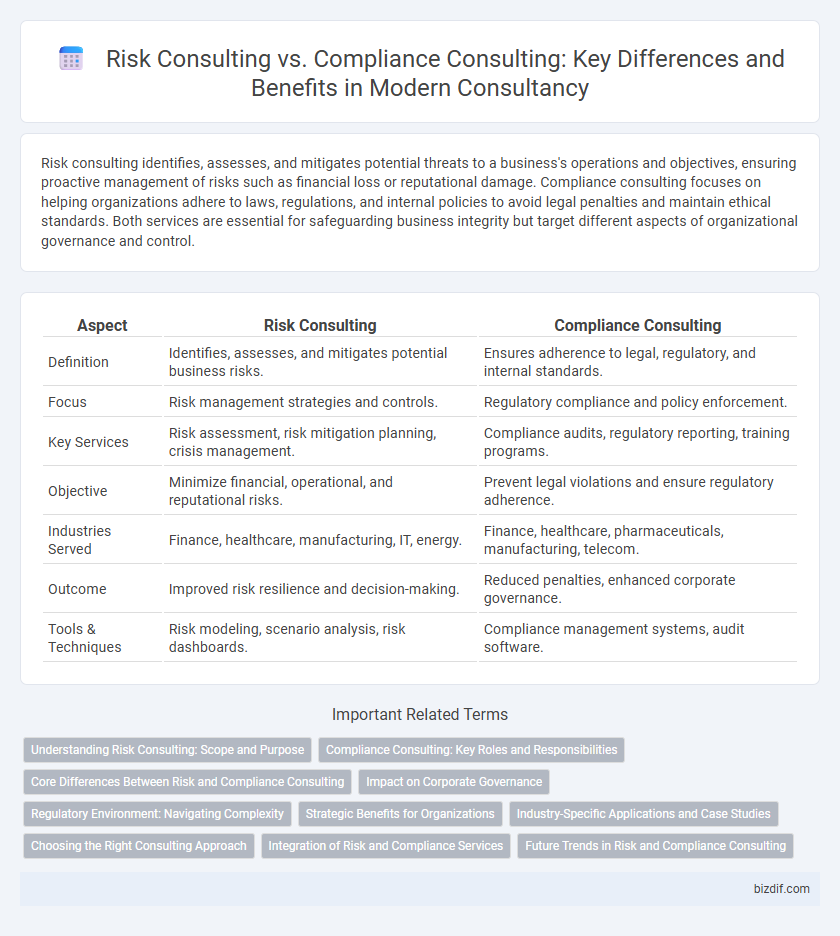

Risk consulting identifies, assesses, and mitigates potential threats to a business's operations and objectives, ensuring proactive management of risks such as financial loss or reputational damage. Compliance consulting focuses on helping organizations adhere to laws, regulations, and internal policies to avoid legal penalties and maintain ethical standards. Both services are essential for safeguarding business integrity but target different aspects of organizational governance and control.

Table of Comparison

| Aspect | Risk Consulting | Compliance Consulting |

|---|---|---|

| Definition | Identifies, assesses, and mitigates potential business risks. | Ensures adherence to legal, regulatory, and internal standards. |

| Focus | Risk management strategies and controls. | Regulatory compliance and policy enforcement. |

| Key Services | Risk assessment, risk mitigation planning, crisis management. | Compliance audits, regulatory reporting, training programs. |

| Objective | Minimize financial, operational, and reputational risks. | Prevent legal violations and ensure regulatory adherence. |

| Industries Served | Finance, healthcare, manufacturing, IT, energy. | Finance, healthcare, pharmaceuticals, manufacturing, telecom. |

| Outcome | Improved risk resilience and decision-making. | Reduced penalties, enhanced corporate governance. |

| Tools & Techniques | Risk modeling, scenario analysis, risk dashboards. | Compliance management systems, audit software. |

Understanding Risk Consulting: Scope and Purpose

Risk consulting involves identifying, assessing, and mitigating potential threats to an organization's assets, operations, and reputation through strategic analysis and tailored risk management frameworks. This discipline focuses on quantifying risks across financial, operational, cybersecurity, and regulatory domains to enhance decision-making and ensure business continuity. In contrast, compliance consulting centers on ensuring adherence to laws, regulations, and internal policies, emphasizing regulatory requirements over broader risk landscapes.

Compliance Consulting: Key Roles and Responsibilities

Compliance consulting involves guiding organizations to adhere to legal regulations, industry standards, and internal policies to mitigate risks and avoid penalties. Key roles include conducting compliance audits, developing policy frameworks, training staff on regulatory requirements, and monitoring ongoing adherence to evolving laws. Consultants ensure that companies implement effective controls, maintain documentation, and prepare for regulatory inspections to uphold ethical and operational standards.

Core Differences Between Risk and Compliance Consulting

Risk consulting centers on identifying, assessing, and mitigating potential threats to an organization's assets, including financial, operational, and strategic risks. Compliance consulting emphasizes ensuring adherence to laws, regulations, industry standards, and internal policies to avoid legal penalties and reputational damage. The core difference lies in risk consulting's forward-looking approach to managing uncertainty, whereas compliance consulting focuses on maintaining conformity with established rules and regulations.

Impact on Corporate Governance

Risk consulting enhances corporate governance by identifying, assessing, and mitigating potential threats that could disrupt business objectives, thereby ensuring more resilient decision-making frameworks. Compliance consulting strengthens governance structures by ensuring adherence to laws, regulations, and internal policies that prevent legal penalties and reputational damage. Together, these services provide a comprehensive approach to safeguarding organizational integrity and sustaining long-term value for stakeholders.

Regulatory Environment: Navigating Complexity

Risk consulting specializes in identifying, assessing, and mitigating potential threats within a regulatory environment to protect organizations from financial and operational losses. Compliance consulting ensures adherence to legal standards and industry regulations, helping companies avoid penalties and maintain ethical business practices. Navigating regulatory complexity requires integrating risk assessment frameworks with compliance protocols to create robust governance and safeguard organizational reputation.

Strategic Benefits for Organizations

Risk consulting enhances an organization's ability to anticipate, assess, and mitigate potential threats, enabling more informed decision-making and safeguarding assets. Compliance consulting ensures adherence to regulatory requirements, minimizing legal penalties and fostering a culture of accountability and ethical standards. Integrating both approaches strategically strengthens organizational resilience and promotes sustainable growth.

Industry-Specific Applications and Case Studies

Risk consulting focuses on identifying and mitigating potential threats tailored to sector-specific challenges, as seen in financial services where credit risk models prevent loan defaults. Compliance consulting ensures adherence to regulatory frameworks unique to each industry, such as healthcare providers implementing HIPAA protocols to protect patient data. Case studies reveal that companies leveraging both consulting types achieve enhanced operational resilience and minimized legal penalties within their respective markets.

Choosing the Right Consulting Approach

Risk consulting prioritizes identifying, assessing, and mitigating potential threats to an organization's assets and operations, offering tailored strategies for uncertainty management and resilience building. Compliance consulting ensures adherence to regulatory requirements and industry standards, minimizing legal penalties and promoting ethical conduct through rigorous policy implementation and audit readiness. Choosing the right consulting approach depends on an organization's immediate needs: risk consulting fits organizations facing dynamic operational risks, while compliance consulting suits those navigating complex regulatory landscapes.

Integration of Risk and Compliance Services

Integrating risk and compliance consulting services enables organizations to create a unified framework that enhances regulatory adherence while proactively identifying potential threats. This combined approach leverages risk assessment methodologies alongside compliance management systems to streamline controls and reduce operational vulnerabilities. Effective integration supports continuous monitoring and real-time reporting, driving more informed decision-making and fostering a resilient business environment.

Future Trends in Risk and Compliance Consulting

Future trends in risk and compliance consulting emphasize the integration of advanced technologies such as artificial intelligence, machine learning, and blockchain to enhance predictive analytics and real-time monitoring. Increased regulatory complexity globally drives demand for automated compliance solutions and adaptive risk management frameworks that improve responsiveness to evolving threats. Firms investing in data-driven insights and cybersecurity resilience will lead the market by enabling proactive rather than reactive consultancy services.

Risk consulting vs Compliance consulting Infographic

bizdif.com

bizdif.com