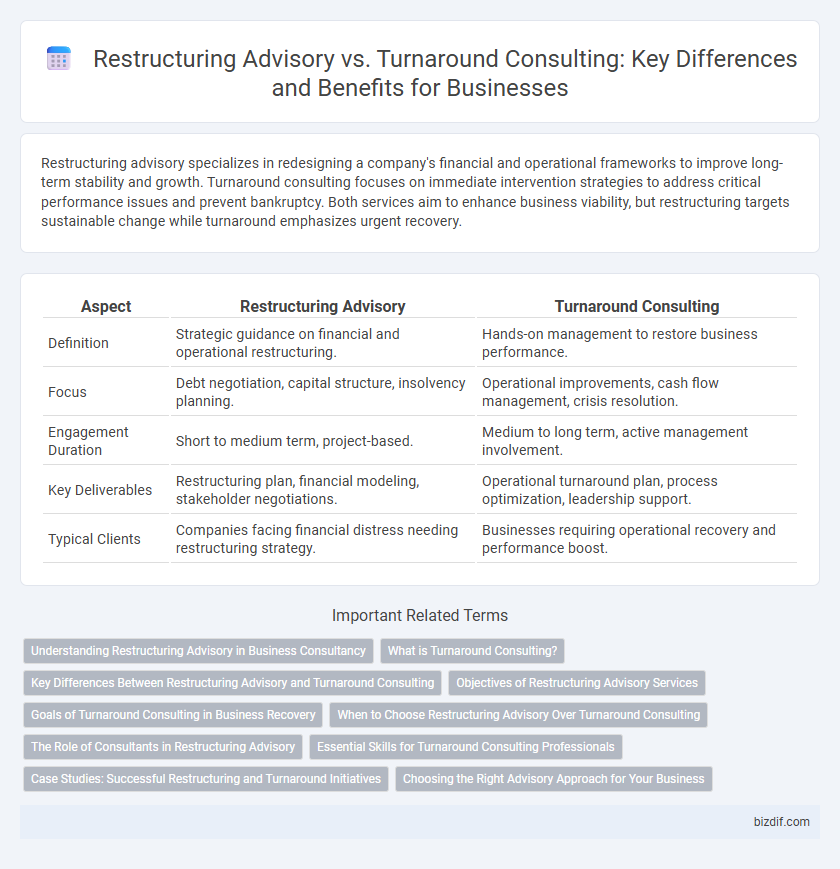

Restructuring advisory specializes in redesigning a company's financial and operational frameworks to improve long-term stability and growth. Turnaround consulting focuses on immediate intervention strategies to address critical performance issues and prevent bankruptcy. Both services aim to enhance business viability, but restructuring targets sustainable change while turnaround emphasizes urgent recovery.

Table of Comparison

| Aspect | Restructuring Advisory | Turnaround Consulting |

|---|---|---|

| Definition | Strategic guidance on financial and operational restructuring. | Hands-on management to restore business performance. |

| Focus | Debt negotiation, capital structure, insolvency planning. | Operational improvements, cash flow management, crisis resolution. |

| Engagement Duration | Short to medium term, project-based. | Medium to long term, active management involvement. |

| Key Deliverables | Restructuring plan, financial modeling, stakeholder negotiations. | Operational turnaround plan, process optimization, leadership support. |

| Typical Clients | Companies facing financial distress needing restructuring strategy. | Businesses requiring operational recovery and performance boost. |

Understanding Restructuring Advisory in Business Consultancy

Restructuring advisory in business consultancy focuses on evaluating and redesigning a company's financial and operational framework to restore stability and improve long-term performance. This service involves strategic debt management, asset optimization, and organizational restructuring tailored to address underlying challenges and stakeholder interests. Unlike turnaround consulting, which centers on immediate operational crisis management, restructuring advisory provides a comprehensive roadmap for sustainable business recovery and growth.

What is Turnaround Consulting?

Turnaround consulting focuses on stabilizing financially distressed companies by implementing immediate corrective actions to restore operational efficiency and profitability. Experts analyze cash flow, restructure debt, optimize management processes, and identify underperforming assets to prevent insolvency. This specialized advisory ensures rapid recovery through strategic decision-making tailored to volatile business conditions.

Key Differences Between Restructuring Advisory and Turnaround Consulting

Restructuring advisory focuses on optimizing a company's financial and operational framework to prevent insolvency, emphasizing strategic debt management and capital structure realignment. Turnaround consulting addresses urgent operational issues causing decline, implementing rapid performance improvements and crisis management to restore viability. The key differences lie in restructuring advisory's preventive, long-term strategic approach versus turnaround consulting's immediate, tactical intervention for recovery.

Objectives of Restructuring Advisory Services

Restructuring Advisory services focus on improving a company's financial stability and operational efficiency by redesigning its capital structure, optimizing cash flow, and negotiating with creditors. These services aim to prevent insolvency and enable sustainable growth through strategic financial planning and stakeholder alignment. Unlike Turnaround Consulting, which emphasizes immediate operational recovery, Restructuring Advisory prioritizes long-term financial health and value preservation.

Goals of Turnaround Consulting in Business Recovery

Turnaround consulting focuses on stabilizing distressed businesses by improving cash flow, operational efficiency, and stakeholder confidence to prevent insolvency. It aims to implement rapid strategic and financial changes that restore profitability and sustain long-term viability. The primary goal is to swiftly reverse business decline through targeted interventions and crisis management.

When to Choose Restructuring Advisory Over Turnaround Consulting

Restructuring advisory is ideal when an organization seeks proactive strategic realignment to optimize operations and improve long-term financial health without imminent risk of failure. Turnaround consulting is more appropriate during acute financial distress requiring immediate crisis management and rapid operational recovery. Companies should choose restructuring advisory when the objective is sustainable transformation rather than urgent survival.

The Role of Consultants in Restructuring Advisory

Consultants in restructuring advisory play a critical role in analyzing financial distress, developing strategic recovery plans, and facilitating negotiations between stakeholders to stabilize and optimize company operations. They provide expertise in debt restructuring, operational improvements, and financial modeling, ensuring the client can regain profitability and avoid insolvency. Their objective is to create sustainable value and guide management through complex transitions with a focus on long-term stability and growth.

Essential Skills for Turnaround Consulting Professionals

Turnaround consulting professionals require expertise in financial analysis, crisis management, and strategic reorganization to stabilize failing businesses and restore profitability. Proficiency in stakeholder communication, risk assessment, and rapid decision-making is critical to navigate volatile environments and implement effective recovery plans. Mastery of operational efficiency improvements and cash flow optimization ensures sustained business revival in turnaround scenarios.

Case Studies: Successful Restructuring and Turnaround Initiatives

Case studies of successful restructuring advisory reveal significant improvements in operational efficiency and financial stability through strategic asset reallocation and debt renegotiation. Turnaround consulting case studies demonstrate rapid performance recovery by implementing crisis management techniques and enhancing cash flow visibility. Both approaches underscore the critical role of tailored solutions and stakeholder alignment in driving sustainable business revival.

Choosing the Right Advisory Approach for Your Business

Restructuring advisory focuses on comprehensive financial and operational changes to improve long-term business viability, while turnaround consulting targets urgent crisis management to stabilize immediate challenges. Evaluating your company's current financial health, cash flow issues, and strategic goals helps determine the most effective approach. Selecting the right advisory ensures targeted solutions, whether through in-depth restructuring plans or rapid turnaround interventions, enhancing sustainable growth and recovery.

Restructuring Advisory vs Turnaround Consulting Infographic

bizdif.com

bizdif.com