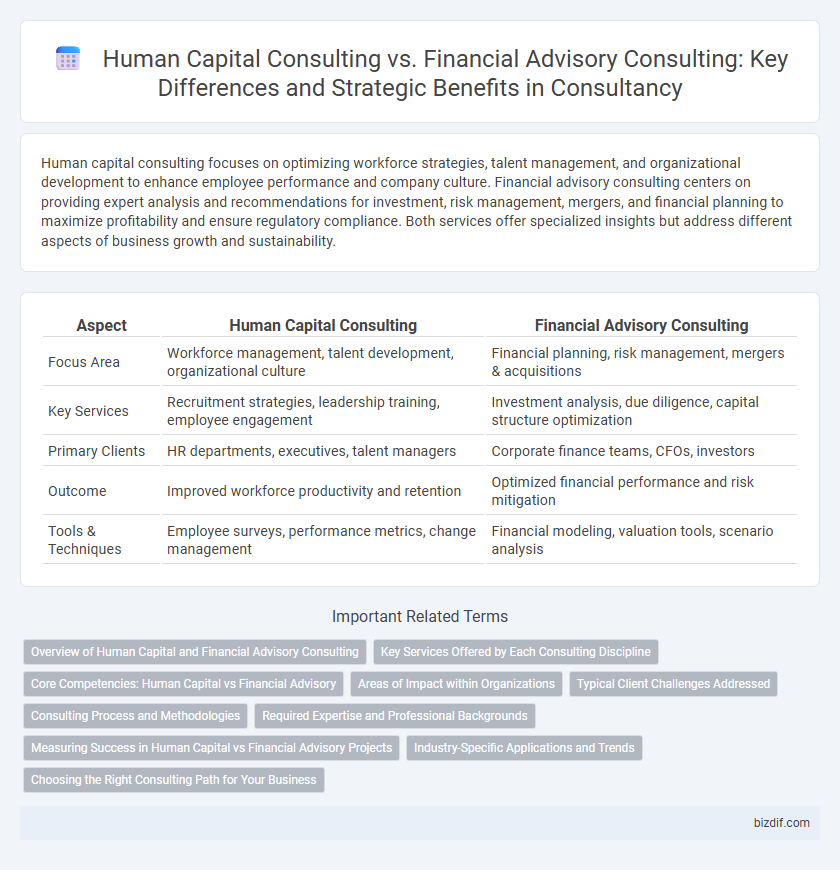

Human capital consulting focuses on optimizing workforce strategies, talent management, and organizational development to enhance employee performance and company culture. Financial advisory consulting centers on providing expert analysis and recommendations for investment, risk management, mergers, and financial planning to maximize profitability and ensure regulatory compliance. Both services offer specialized insights but address different aspects of business growth and sustainability.

Table of Comparison

| Aspect | Human Capital Consulting | Financial Advisory Consulting |

|---|---|---|

| Focus Area | Workforce management, talent development, organizational culture | Financial planning, risk management, mergers & acquisitions |

| Key Services | Recruitment strategies, leadership training, employee engagement | Investment analysis, due diligence, capital structure optimization |

| Primary Clients | HR departments, executives, talent managers | Corporate finance teams, CFOs, investors |

| Outcome | Improved workforce productivity and retention | Optimized financial performance and risk mitigation |

| Tools & Techniques | Employee surveys, performance metrics, change management | Financial modeling, valuation tools, scenario analysis |

Overview of Human Capital and Financial Advisory Consulting

Human capital consulting focuses on optimizing workforce performance, talent management, organizational change, and employee engagement to drive business success. Financial advisory consulting provides expertise in mergers and acquisitions, risk management, financial restructuring, and investment strategies to enhance financial stability and growth. Both practices aim to improve organizational value but differ in their core objectives and specialized areas of expertise.

Key Services Offered by Each Consulting Discipline

Human capital consulting specializes in talent acquisition, employee engagement, leadership development, and organizational change management to enhance workforce productivity and alignment with business goals. Financial advisory consulting focuses on mergers and acquisitions, risk management, capital structuring, financial planning, and regulatory compliance to optimize fiscal performance and strategic investment decisions. Both disciplines deliver critical insights but target distinct organizational needs for operational and financial excellence.

Core Competencies: Human Capital vs Financial Advisory

Human capital consulting specializes in optimizing workforce capabilities, talent acquisition, organizational development, and employee engagement strategies to enhance overall business performance. Financial advisory consulting focuses on capital structure, investment strategies, risk management, and financial planning to improve fiscal health and shareholder value. Both competencies require deep industry expertise, but human capital targets people-related growth while financial advisory emphasizes monetary asset optimization.

Areas of Impact within Organizations

Human capital consulting drives organizational success by optimizing talent management, leadership development, and workforce planning, directly enhancing employee engagement and productivity. Financial advisory consulting impacts organizations through strategic financial planning, risk management, and capital allocation, ensuring sustainable growth and regulatory compliance. Both consulting types play critical roles in shaping organizational resilience, with human capital focusing on people-centered transformation and financial advisory emphasizing fiscal health and operational efficiency.

Typical Client Challenges Addressed

Human capital consulting primarily addresses challenges such as workforce optimization, leadership development, employee engagement, and talent retention, helping organizations align their human resources with strategic goals. Financial advisory consulting focuses on solving issues related to capital structure, investment strategies, risk management, mergers and acquisitions, and regulatory compliance to enhance financial performance and stability. Both consulting types provide tailored solutions that improve organizational efficiency but target distinct areas of business operations and decision-making.

Consulting Process and Methodologies

Human capital consulting emphasizes talent management, organizational development, and workforce analytics through diagnostic assessments, stakeholder interviews, and change management frameworks to align human resources with business strategy. Financial advisory consulting focuses on risk analysis, investment strategies, and regulatory compliance using quantitative modeling, financial due diligence, and performance benchmarking to optimize fiscal outcomes. Both leverage data-driven insights and collaborative workshops but differ in specialized tools and impact areas critical to their respective advisory domains.

Required Expertise and Professional Backgrounds

Human capital consulting requires expertise in organizational behavior, workforce analytics, and talent management, with professionals typically having backgrounds in psychology, human resources, or business administration. Financial advisory consulting demands strong skills in financial analysis, risk management, and investment strategies, often staffed by experts with qualifications in finance, accounting, or economics. Both fields necessitate specialized knowledge but diverge significantly in focus, methodologies, and core competencies.

Measuring Success in Human Capital vs Financial Advisory Projects

Measuring success in human capital consulting projects centers on improving workforce productivity, employee engagement, talent retention rates, and leadership development outcomes. Financial advisory consulting success is quantified through enhanced financial performance indicators such as return on investment (ROI), cost savings, risk mitigation, and compliance adherence. Human capital metrics emphasize qualitative improvements in organizational culture and employee satisfaction, whereas financial advisory focuses on quantitative financial gains and regulatory alignment.

Industry-Specific Applications and Trends

Human capital consulting focuses on optimizing workforce strategies, talent management, and organizational development tailored to industry-specific challenges such as healthcare workforce shortages or technology sector skill gaps. Financial advisory consulting emphasizes capital structure, risk management, and regulatory compliance with specialized applications in industries like banking, energy, and real estate investment. Emerging trends include the integration of AI-driven analytics for predictive workforce planning in human capital consulting and blockchain technology for enhanced transparency in financial advisory services across sectors.

Choosing the Right Consulting Path for Your Business

Human capital consulting focuses on optimizing workforce strategies, talent management, and organizational culture to enhance business performance. Financial advisory consulting provides expert guidance on investment decisions, risk management, and capital structuring to improve financial health and growth prospects. Selecting the right consulting path depends on whether your priority is enhancing employee productivity and engagement or strengthening financial strategy and resource allocation.

Human capital consulting vs Financial advisory consulting Infographic

bizdif.com

bizdif.com