Dropshipping pet products often requires no upfront investment, allowing entrepreneurs to start without purchasing inventory or managing storage costs. In contrast, traditional pet product businesses demand significant initial capital to stock merchandise, increasing financial risk. This no upfront investment model enables faster market entry and flexibility in testing different pet product niches.

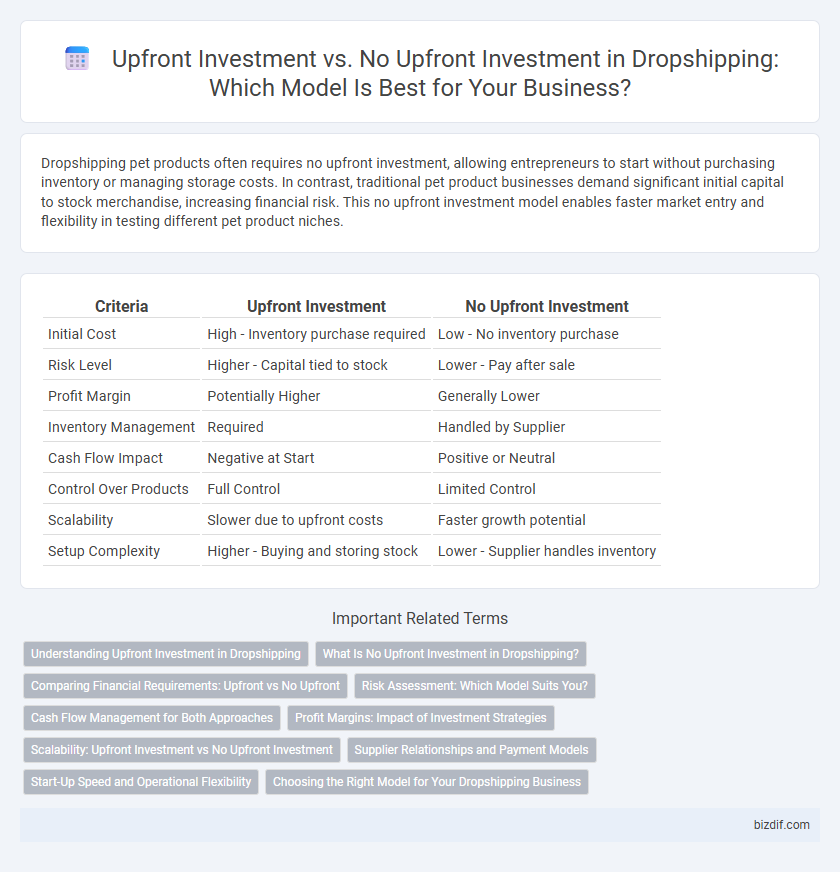

Table of Comparison

| Criteria | Upfront Investment | No Upfront Investment |

|---|---|---|

| Initial Cost | High - Inventory purchase required | Low - No inventory purchase |

| Risk Level | Higher - Capital tied to stock | Lower - Pay after sale |

| Profit Margin | Potentially Higher | Generally Lower |

| Inventory Management | Required | Handled by Supplier |

| Cash Flow Impact | Negative at Start | Positive or Neutral |

| Control Over Products | Full Control | Limited Control |

| Scalability | Slower due to upfront costs | Faster growth potential |

| Setup Complexity | Higher - Buying and storing stock | Lower - Supplier handles inventory |

Understanding Upfront Investment in Dropshipping

Understanding upfront investment in dropshipping involves recognizing costs such as website setup, marketing, and inventory samples, which are usually required to establish a competitive online store. Unlike traditional retail models, dropshipping reduces the need for large capital as inventory is not purchased in bulk, but initial payments for domain hosting, advertising, and supplier fees can impact cash flow. Entrepreneurs should evaluate these upfront costs carefully to optimize budget allocation and improve profit margins in their dropshipping business model.

What Is No Upfront Investment in Dropshipping?

No upfront investment in dropshipping means sellers do not pay for inventory before making sales, reducing financial risk and allowing entrepreneurs to start with minimal capital. This model relies on suppliers who hold the stock and ship products directly to customers, eliminating costs related to warehousing and bulk purchasing. By avoiding inventory expenses, dropshippers can test multiple products and scale their business without significant monetary commitment.

Comparing Financial Requirements: Upfront vs No Upfront

Dropshipping requires no upfront investment in inventory, significantly lowering initial financial risk compared to traditional retail models that demand bulk purchasing and storage costs. With no upfront investment, entrepreneurs avoid expenses such as warehousing, shipping logistics, and inventory management, allowing for greater cash flow flexibility. However, businesses with upfront investment benefit from higher profit margins and more control over product quality and delivery times, balancing financial commitment with potential returns.

Risk Assessment: Which Model Suits You?

Dropshipping requires minimal upfront investment, reducing financial risk by eliminating inventory purchase costs, making it ideal for entrepreneurs testing market demand without heavy capital commitment. Conversely, traditional inventory models demand significant upfront investment, increasing risk but potentially offering higher profit margins through bulk purchasing and control over stock. Assess your risk tolerance, cash flow capacity, and business goals to determine whether the lower-risk dropshipping model or the capital-intensive inventory approach best aligns with your entrepreneurial strategy.

Cash Flow Management for Both Approaches

Dropshipping with no upfront investment allows for better cash flow management by eliminating the need to purchase inventory before making sales, reducing financial risk and improving liquidity. In contrast, upfront investment requires purchasing stock in advance, tying up capital and potentially causing cash flow constraints if sales are slower than anticipated. Effective cash flow management is crucial for both approaches to ensure operational sustainability and optimize profit margins in dropshipping businesses.

Profit Margins: Impact of Investment Strategies

Profit margins in dropshipping are significantly influenced by upfront investment strategies. Businesses with upfront investment often access premium product sourcing and branding, leading to higher profit margins despite initial costs. In contrast, no upfront investment models reduce financial risk but typically result in thinner profit margins due to reliance on standard suppliers and limited control over pricing.

Scalability: Upfront Investment vs No Upfront Investment

Dropshipping with no upfront investment offers greater scalability by reducing financial risk and enabling rapid expansion without the burden of inventory costs. In contrast, businesses that require upfront investment in stock face limitations on growth due to tied-up capital and potential inventory obsolescence. Scalability in no upfront investment models is enhanced through flexible supplier relationships and the ability to test products with minimal financial exposure.

Supplier Relationships and Payment Models

Dropshipping with no upfront investment allows entrepreneurs to minimize financial risks by paying suppliers only after a sale is made, fostering a pay-per-order payment model that strengthens trust and long-term collaborations with suppliers. In contrast, dropshipping requiring upfront investment demands bulk purchasing or inventory deposits, which can enhance supplier relationships through guaranteed orders but increases financial exposure. Payment models in no upfront investment setups rely heavily on trust and transparent order processing, while upfront investment often secures priority handling and better pricing from suppliers.

Start-Up Speed and Operational Flexibility

Dropshipping offers rapid start-up speed by eliminating the need for inventory purchase, enabling entrepreneurs to launch their stores quickly with minimal upfront investment. This model enhances operational flexibility as sellers can easily test diverse product niches and scale or pivot without being tied to stocked goods. In contrast, businesses with upfront investment face slower launches due to inventory procurement and risk reduced flexibility from capital tied in stored products.

Choosing the Right Model for Your Dropshipping Business

Choosing the right dropshipping model depends heavily on your upfront investment capacity and risk tolerance. Models requiring upfront investment, such as purchasing initial inventory or investing in advanced marketing tools, can lead to higher control over product quality and potentially better profit margins. Conversely, no upfront investment models minimize financial risk and enable quick market entry but often result in lower control and increased reliance on supplier reliability.

Upfront Investment vs No Upfront Investment Infographic

bizdif.com

bizdif.com