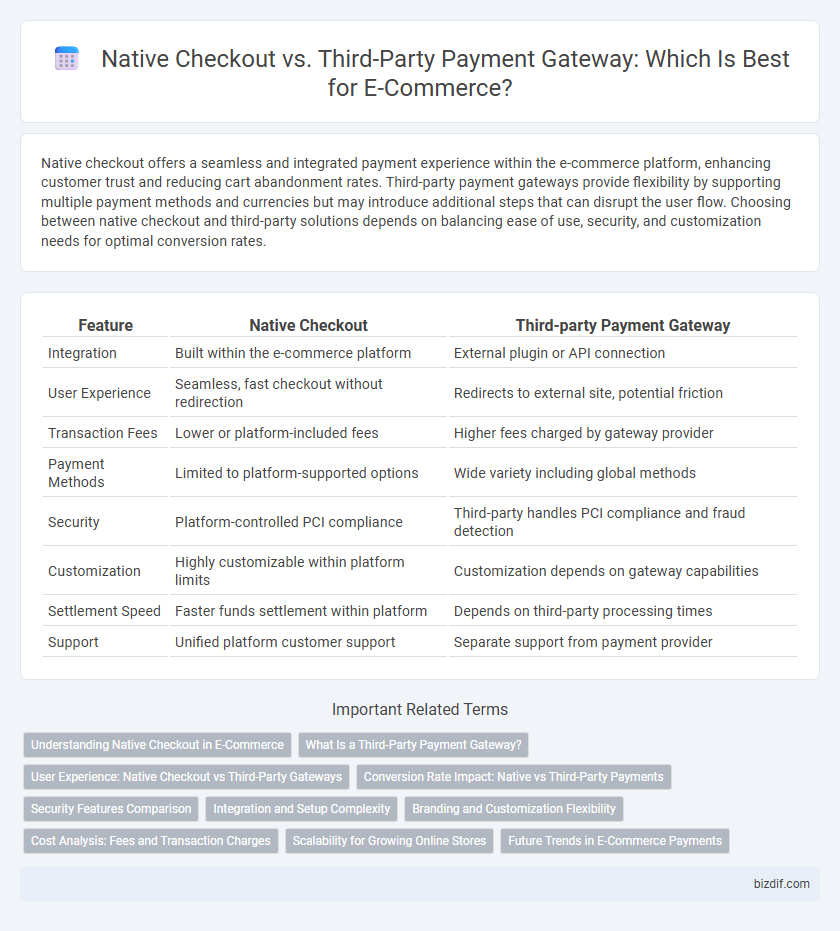

Native checkout offers a seamless and integrated payment experience within the e-commerce platform, enhancing customer trust and reducing cart abandonment rates. Third-party payment gateways provide flexibility by supporting multiple payment methods and currencies but may introduce additional steps that can disrupt the user flow. Choosing between native checkout and third-party solutions depends on balancing ease of use, security, and customization needs for optimal conversion rates.

Table of Comparison

| Feature | Native Checkout | Third-party Payment Gateway |

|---|---|---|

| Integration | Built within the e-commerce platform | External plugin or API connection |

| User Experience | Seamless, fast checkout without redirection | Redirects to external site, potential friction |

| Transaction Fees | Lower or platform-included fees | Higher fees charged by gateway provider |

| Payment Methods | Limited to platform-supported options | Wide variety including global methods |

| Security | Platform-controlled PCI compliance | Third-party handles PCI compliance and fraud detection |

| Customization | Highly customizable within platform limits | Customization depends on gateway capabilities |

| Settlement Speed | Faster funds settlement within platform | Depends on third-party processing times |

| Support | Unified platform customer support | Separate support from payment provider |

Understanding Native Checkout in E-Commerce

Native checkout in e-commerce refers to payment processing integrated directly within the online store, providing a seamless and trusted user experience without redirecting customers to external sites. This method enhances conversion rates by reducing friction during the payment process and maintaining consistent branding throughout the checkout journey. By leveraging native checkout, merchants gain greater control over data security, customer insights, and customization options compared to third-party payment gateways.

What Is a Third-Party Payment Gateway?

A third-party payment gateway is an external service that processes online transactions securely by acting as an intermediary between an e-commerce store and customers' banks. It handles payment authorization, fraud detection, and compliance with PCI DSS standards, enabling merchants to accept various payment methods without managing sensitive data directly. Popular third-party gateways include PayPal, Stripe, and Square, which offer plug-and-play solutions for seamless integration and scalability.

User Experience: Native Checkout vs Third-Party Gateways

Native checkout enhances user experience by enabling seamless payment processing within the e-commerce platform, reducing friction and boosting conversion rates. Third-party payment gateways redirect users to external sites, potentially disrupting the purchasing flow and increasing cart abandonment. Integrating native checkout solutions improves trust and expedites transactions, essential for retaining customers and increasing sales.

Conversion Rate Impact: Native vs Third-Party Payments

Native checkout solutions integrate seamlessly within the e-commerce platform, significantly reducing friction and boosting conversion rates by providing a smoother, faster payment experience. Third-party payment gateways, while offering wide payment options and security, often redirect users off-site, which can cause hesitation and higher cart abandonment. Studies show that e-commerce stores using native checkout can see conversion rate improvements of up to 20% compared to those relying solely on third-party payment gateways.

Security Features Comparison

Native Checkout systems provide enhanced security by storing payment data within the platform, minimizing exposure to external threats with strict PCI compliance and end-to-end encryption. Third-party Payment Gateways offer robust fraud detection tools and tokenization but rely on external servers, increasing potential vulnerability points and dependency on gateway security protocols. E-commerce businesses must weigh native solutions' integrated security controls against third-party providers' specialized protection layers to optimize transaction safety and compliance.

Integration and Setup Complexity

Native checkout systems offer seamless integration directly within the e-commerce platform, reducing setup complexity and enabling faster transaction processing. Third-party payment gateways require additional configuration, API connections, and often involve navigating multiple dashboards, increasing setup time and potential points of failure. Streamlined native checkout integration improves user experience by minimizing checkout interruptions and enhancing overall site performance.

Branding and Customization Flexibility

Native checkout systems provide superior branding opportunities by allowing e-commerce stores to fully customize the user interface, ensuring a seamless and cohesive shopping experience aligned with the brand's identity. Third-party payment gateways often limit customization options, presenting generic checkout pages that can disrupt brand consistency and reduce customer trust. Enhanced flexibility in native checkout enables tailored promotions, personalized messaging, and UI adjustments that strengthen brand loyalty and increase conversion rates.

Cost Analysis: Fees and Transaction Charges

Native checkout systems typically offer lower transaction fees by eliminating intermediaries, reducing overall costs per sale for e-commerce merchants. Third-party payment gateways often charge setup fees, monthly fees, and per-transaction fees that can accumulate, impacting profit margins. Evaluating the fee structure and transaction charges of both options is crucial for optimizing e-commerce cost efficiency and maintaining competitive pricing.

Scalability for Growing Online Stores

Native checkout systems offer seamless integration with e-commerce platforms, enabling faster transaction processing and enhanced user experience as online stores scale. Third-party payment gateways provide flexible payment options and robust security features, supporting diverse markets and high transaction volumes crucial for expanding businesses. Choosing between native checkout and third-party solutions depends on the specific scalability needs, such as customization, geographic reach, and compliance requirements of growing online stores.

Future Trends in E-Commerce Payments

Native checkout solutions offer seamless integration and enhanced user experience by allowing customers to complete purchases without leaving the e-commerce platform, which is driving higher conversion rates. Third-party payment gateways provide flexibility and support multiple payment methods, but emerging trends show a shift towards AI-driven fraud detection, cryptocurrencies, and biometric authentication embedded natively within checkouts. Future e-commerce payment systems will emphasize security, speed, and personalization, leveraging blockchain technology and real-time analytics to optimize transaction processes and customer trust.

Native Checkout vs Third-party Payment Gateway Infographic

bizdif.com

bizdif.com