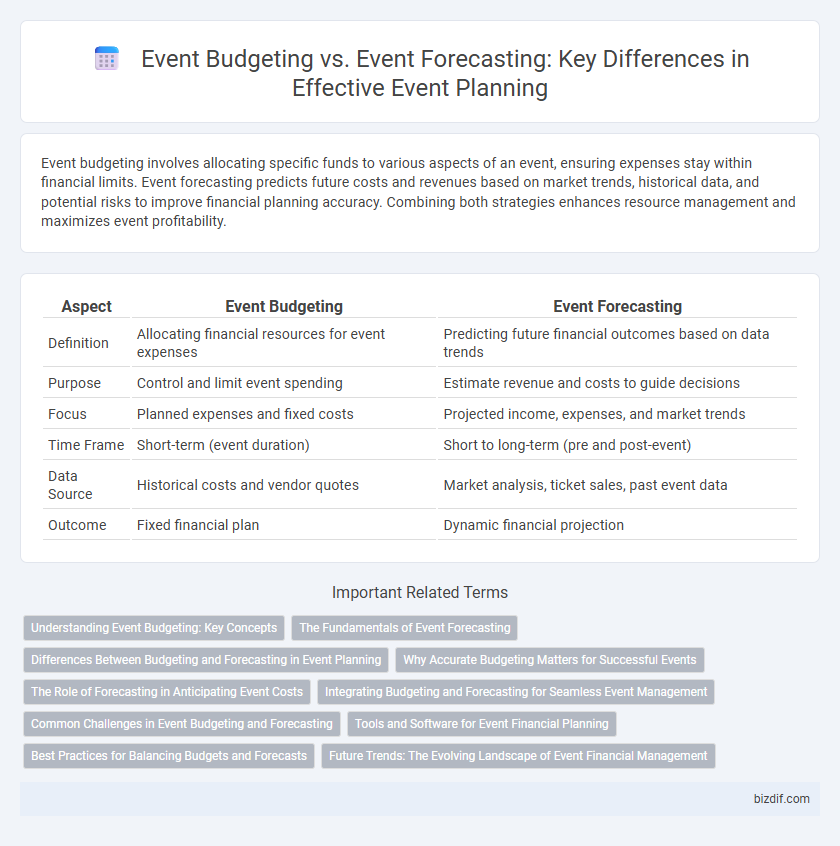

Event budgeting involves allocating specific funds to various aspects of an event, ensuring expenses stay within financial limits. Event forecasting predicts future costs and revenues based on market trends, historical data, and potential risks to improve financial planning accuracy. Combining both strategies enhances resource management and maximizes event profitability.

Table of Comparison

| Aspect | Event Budgeting | Event Forecasting |

|---|---|---|

| Definition | Allocating financial resources for event expenses | Predicting future financial outcomes based on data trends |

| Purpose | Control and limit event spending | Estimate revenue and costs to guide decisions |

| Focus | Planned expenses and fixed costs | Projected income, expenses, and market trends |

| Time Frame | Short-term (event duration) | Short to long-term (pre and post-event) |

| Data Source | Historical costs and vendor quotes | Market analysis, ticket sales, past event data |

| Outcome | Fixed financial plan | Dynamic financial projection |

Understanding Event Budgeting: Key Concepts

Event budgeting involves allocating specific financial resources to various components such as venue, catering, and entertainment, ensuring expenses align with the overall budget limits. Key concepts include fixed and variable costs, contingency funds, and tracking expenditures to prevent overspending. Accurate budgeting is essential for maintaining financial control and achieving event goals.

The Fundamentals of Event Forecasting

Event forecasting in event planning involves analyzing historical data, market trends, and attendee behavior to predict future event outcomes and financial performance accurately. Unlike event budgeting, which sets spending limits based on available funds, forecasting provides dynamic insights that adjust as new information emerges, ensuring more agile decision-making. Mastering the fundamentals of event forecasting enables planners to optimize resource allocation, anticipate risks, and maximize event ROI effectively.

Differences Between Budgeting and Forecasting in Event Planning

Event budgeting in event planning involves setting a fixed financial plan that allocates resources for specific categories like venue, catering, and marketing, establishing spending limits before the event begins. Event forecasting predicts future financial outcomes by analyzing current trends, past event data, and market conditions to adjust expectations and make informed decisions throughout the planning process. While budgeting is a static plan focused on cost control, forecasting is dynamic, allowing planners to anticipate changes and optimize resource allocation for successful event execution.

Why Accurate Budgeting Matters for Successful Events

Accurate event budgeting is crucial for successful events because it allocates resources efficiently, preventing overspending and ensuring all essential elements are funded. Unlike event forecasting, which predicts potential costs and revenues, budgeting sets concrete financial limits that guide decision-making throughout the planning process. Effective budgeting enhances financial control, reduces risks, and supports achieving the event's strategic goals within the available budget.

The Role of Forecasting in Anticipating Event Costs

Event forecasting plays a crucial role in anticipating event costs by analyzing historical data, market trends, and potential variables to provide accurate financial projections. Unlike event budgeting, which allocates funds based on set limits, forecasting enables planners to predict expenses dynamically, adapt strategies, and minimize financial risks. Effective forecasting improves cost management, ensuring resource optimization and maximizing event profitability.

Integrating Budgeting and Forecasting for Seamless Event Management

Integrating event budgeting and forecasting enables precise allocation of financial resources and anticipates potential cost variations, ensuring seamless event management. Budgeting establishes fixed spending limits while forecasting predicts future financial outcomes based on real-time data and market trends within the event industry. Utilizing software tools that combine both processes improves accuracy, supports strategic decision-making, and enhances overall event profitability.

Common Challenges in Event Budgeting and Forecasting

Event budgeting and forecasting often face common challenges such as accurately estimating costs and predicting revenue streams, which can be impacted by fluctuating vendor prices and uncertain attendee numbers. Limited historical data and unexpected expenses further complicate the ability to create precise financial plans for events. Effective use of data analytics and flexible budget adjustments are essential strategies to address these uncertainties in event financial management.

Tools and Software for Event Financial Planning

Event budgeting relies on tools like Microsoft Excel and specialized software such as Eventbrite Budget Planner to allocate and track expenses in real-time, ensuring precise cost management. Event forecasting utilizes predictive analytics platforms like Forecast and Social Table to analyze historical data and market trends, enabling accurate revenue projections and risk assessment. Integrating budgeting and forecasting software enhances financial planning efficiency by providing comprehensive dashboards and automated reporting features tailored for event management professionals.

Best Practices for Balancing Budgets and Forecasts

Effective event budgeting involves allocating resources based on detailed cost estimates and historical data, while event forecasting predicts future financial outcomes using market trends and attendee behavior analysis. Best practices for balancing budgets and forecasts include continuously updating expense tracking, integrating real-time data analytics, and adjusting financial plans to reflect changes in vendor pricing or attendee registration rates. Leveraging software tools for budget control and demand forecasting ensures accurate financial management and maximizes event ROI.

Future Trends: The Evolving Landscape of Event Financial Management

Event budgeting ensures precise allocation of resources based on historical data and fixed costs, while event forecasting incorporates predictive analytics and real-time market trends to anticipate future expenses and revenue streams. The evolving landscape of event financial management is increasingly driven by AI-powered tools and big data integration, enabling more dynamic and accurate financial projections. As virtual and hybrid events become mainstream, adaptive budgeting strategies that incorporate fluctuating technology costs and audience engagement metrics are essential for maximizing ROI.

Event budgeting vs Event forecasting Infographic

bizdif.com

bizdif.com