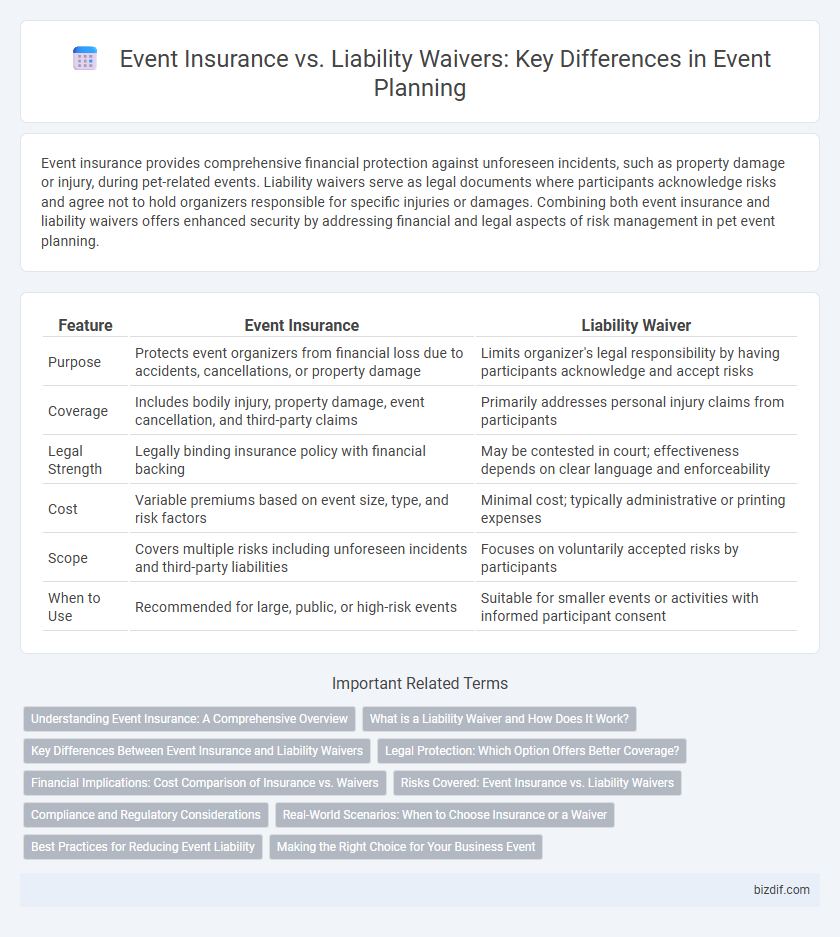

Event insurance provides comprehensive financial protection against unforeseen incidents, such as property damage or injury, during pet-related events. Liability waivers serve as legal documents where participants acknowledge risks and agree not to hold organizers responsible for specific injuries or damages. Combining both event insurance and liability waivers offers enhanced security by addressing financial and legal aspects of risk management in pet event planning.

Table of Comparison

| Feature | Event Insurance | Liability Waiver |

|---|---|---|

| Purpose | Protects event organizers from financial loss due to accidents, cancellations, or property damage | Limits organizer's legal responsibility by having participants acknowledge and accept risks |

| Coverage | Includes bodily injury, property damage, event cancellation, and third-party claims | Primarily addresses personal injury claims from participants |

| Legal Strength | Legally binding insurance policy with financial backing | May be contested in court; effectiveness depends on clear language and enforceability |

| Cost | Variable premiums based on event size, type, and risk factors | Minimal cost; typically administrative or printing expenses |

| Scope | Covers multiple risks including unforeseen incidents and third-party liabilities | Focuses on voluntarily accepted risks by participants |

| When to Use | Recommended for large, public, or high-risk events | Suitable for smaller events or activities with informed participant consent |

Understanding Event Insurance: A Comprehensive Overview

Event insurance provides financial protection against unforeseen incidents such as property damage, bodily injury, or event cancellation, covering costs that liability waivers cannot address. Unlike liability waivers, which primarily serve to limit legal claims by participants, event insurance offers broader coverage validated by policy terms and insurance providers. Comprehensive event insurance policies safeguard organizers from potential financial losses and legal disputes arising during or after an event.

What is a Liability Waiver and How Does It Work?

A liability waiver is a legal document signed by event participants to voluntarily relinquish the right to sue the organizer for potential injuries or damages during the event. It works by clearly outlining the risks involved and securing participant acknowledgment and acceptance of those risks before participation. This protects event planners from certain legal claims but does not cover all liabilities like event insurance does.

Key Differences Between Event Insurance and Liability Waivers

Event insurance provides comprehensive financial protection against property damage, bodily injury, and cancellation risks, while liability waivers are legal documents signed by participants to acknowledge and assume potential risks during the event. Insurance policies cover a broader range of incidents including third-party claims and unforeseen circumstances, whereas waivers primarily limit the organizer's liability by obtaining participant consent. Choosing the right mix depends on the event size, risk profile, and legal requirements to ensure adequate protection and compliance.

Legal Protection: Which Option Offers Better Coverage?

Event insurance provides comprehensive legal protection by covering property damage, bodily injury, and potential financial losses, while liability waivers primarily protect organizers by obtaining participants' acknowledgment of risk without covering third-party claims. Insurance policies are typically broader in scope, offering legal defense and financial compensation in lawsuits, whereas waivers may be contested in court and offer limited enforceability. For robust legal protection, event insurance is generally the preferred option, delivering stronger coverage against unforeseen liabilities.

Financial Implications: Cost Comparison of Insurance vs. Waivers

Event insurance typically involves upfront costs including premiums that vary based on event size, location, and risk factors, often ranging from a few hundred to several thousand dollars. Liability waivers require minimal financial investment but provide limited legal protection, potentially exposing organizers to costly lawsuits and financial losses if claims are successfully made. Comparing these, insurance offers more comprehensive financial security against unforeseen incidents, whereas waivers mainly serve as a preventative tool with significant financial risk if contested in court.

Risks Covered: Event Insurance vs. Liability Waivers

Event insurance provides comprehensive coverage for risks such as property damage, bodily injury, and event cancellation, offering financial protection beyond the scope of liability waivers. Liability waivers primarily protect organizers from participant claims related to personal injury, but do not cover damages to third parties or unforeseen incidents like weather disruptions. Choosing event insurance ensures broader risk mitigation, including legal defense costs and payouts for losses not addressed by liability waivers.

Compliance and Regulatory Considerations

Event insurance provides financial protection against unforeseen incidents and is often required by regulatory bodies to ensure compliance with safety standards. Liability waivers serve as legal agreements that limit an organizer's responsibility but may not fully satisfy regulatory compliance requirements. Event planners should align insurance coverage and waiver policies with local laws and industry regulations to mitigate legal risks effectively.

Real-World Scenarios: When to Choose Insurance or a Waiver

Event insurance offers comprehensive protection against property damage, bodily injury, and cancellation risks, making it essential for large-scale or high-risk events where financial exposure is significant. Liability waivers are most effective for smaller, low-risk events focused on participant agreement to assume responsibility, such as recreational activities or workshops with minimal potential for injury. Selecting between event insurance and a liability waiver depends on factors like event size, risk level, venue requirements, and legal considerations in the jurisdiction.

Best Practices for Reducing Event Liability

Securing comprehensive event insurance provides financial protection against unforeseen damages, cancellations, or injuries, while liability waivers delegate personal responsibility to attendees, reducing organizer exposure to legal claims. Best practices for reducing event liability involve combining both strategies: obtaining tailored insurance policies that cover property, bodily injury, and third-party claims, alongside clear, enforceable waivers signed by participants prior to event entry. Maintaining detailed incident documentation, conducting risk assessments, and implementing proactive safety measures further minimize potential legal and financial risks.

Making the Right Choice for Your Business Event

Choosing between event insurance and a liability waiver depends on the specific risks and scale of your business event. Event insurance offers financial protection against unforeseen incidents such as property damage, cancellations, or bodily injuries, while liability waivers primarily shift legal responsibility to attendees. Assessing the event's location, participant activities, and potential hazards helps determine the most effective risk management strategy.

Event insurance vs Liability waiver Infographic

bizdif.com

bizdif.com