Escrow payment in freelancing secures funds by holding them with a trusted third party until project milestones are met, ensuring protection for both clients and freelancers. Direct payment involves clients paying freelancers immediately without intermediary safeguards, which can speed up transactions but carries higher risk of disputes over work satisfaction. Choosing between escrow and direct payment depends on the project size, trust level, and desired security in the transaction process.

Table of Comparison

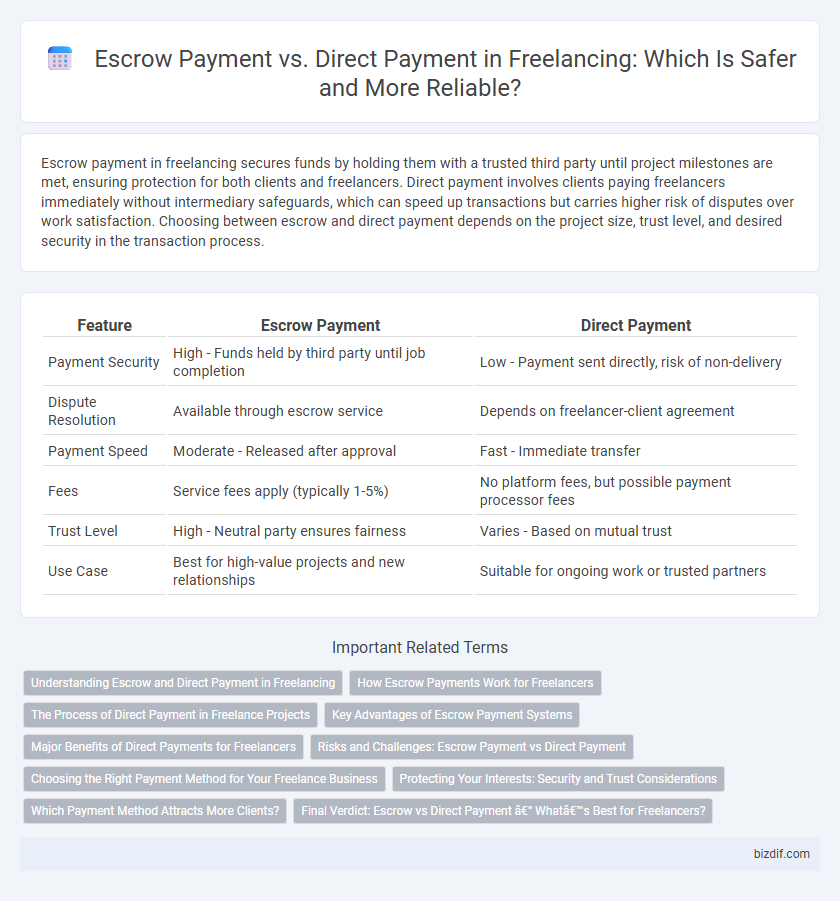

| Feature | Escrow Payment | Direct Payment |

|---|---|---|

| Payment Security | High - Funds held by third party until job completion | Low - Payment sent directly, risk of non-delivery |

| Dispute Resolution | Available through escrow service | Depends on freelancer-client agreement |

| Payment Speed | Moderate - Released after approval | Fast - Immediate transfer |

| Fees | Service fees apply (typically 1-5%) | No platform fees, but possible payment processor fees |

| Trust Level | High - Neutral party ensures fairness | Varies - Based on mutual trust |

| Use Case | Best for high-value projects and new relationships | Suitable for ongoing work or trusted partners |

Understanding Escrow and Direct Payment in Freelancing

Escrow payment in freelancing secures funds by holding them with a trusted third party until project milestones are met, reducing payment risks for both clients and freelancers. Direct payment involves the client paying the freelancer immediately upon task completion, offering faster transactions but less financial protection. Choosing between escrow and direct payment depends on project complexity, trust level, and the desire for transaction security.

How Escrow Payments Work for Freelancers

Escrow payments enhance security in freelancing by holding funds with a trusted third party until project milestones are met or the work is approved by the client. Freelancers gain confidence knowing the payment is secured before starting the job, reducing the risk of non-payment or disputes. This method fosters trust and ensures timely payouts once contractual obligations are fulfilled.

The Process of Direct Payment in Freelance Projects

Direct payment in freelance projects involves a straightforward transaction where the client transfers funds directly to the freelancer upon completion of agreed milestones or the entire project. This process minimizes delays as there is no intermediary holding the funds, but it requires a high level of trust between both parties to ensure timely payment and project delivery. Freelancers often rely on contracts and invoicing tools to secure payments and maintain clear financial records during the direct payment process.

Key Advantages of Escrow Payment Systems

Escrow payment systems offer enhanced security by holding funds in a neutral account until project milestones are met, reducing risks for both freelancers and clients. They promote trust and transparency through clear payment terms and dispute resolution mechanisms that protect both parties from potential fraud. Escrow services also streamline payment processes by automating fund releases upon verified completion, ensuring timely compensation and project progress.

Major Benefits of Direct Payments for Freelancers

Direct payments empower freelancers with immediate access to their earnings, eliminating delays often associated with escrow processing. This method enhances cash flow management and reduces dependency on third-party platforms, allowing freelancers greater control over their financial transactions. Furthermore, direct payments minimize transaction fees and reduce administrative overhead, maximizing net income for independent professionals.

Risks and Challenges: Escrow Payment vs Direct Payment

Escrow payment systems mitigate risks by holding funds securely until project milestones are verified, reducing the chance of non-payment or fraud for freelancers. Direct payments expose freelancers and clients to higher risks such as delayed payments, disputes, or loss of funds due to lack of intermediary oversight. Choosing escrow reduces payment uncertainty, enhances trust, and provides dispute resolution mechanisms, while direct payments require greater reliance on mutual trust and may result in payment delays or legal complications.

Choosing the Right Payment Method for Your Freelance Business

Escrow payment offers secure transaction protection by holding funds until project milestones are met, reducing the risk of non-payment and ensuring client trust. Direct payment provides faster access to funds but requires strong client relationships and reliable communication to avoid disputes. Evaluating project scope, client reliability, and payment security needs will help freelancers select the best payment method for their business growth.

Protecting Your Interests: Security and Trust Considerations

Escrow payment systems provide a secure method for freelancers and clients by holding funds in a neutral account until project milestones are approved, reducing the risk of non-payment or incomplete work. Direct payments offer faster transactions but lack the built-in protections of escrow, increasing the potential for disputes or delayed payments. Choosing escrow enhances trust and ensures financial security, safeguarding both parties' interests throughout the freelancing process.

Which Payment Method Attracts More Clients?

Escrow payment attracts more clients by providing a secure transaction environment that holds funds until project milestones are met, reducing the risk of payment disputes. Direct payment may offer faster access to funds but lacks the built-in protection that reassures clients about service delivery and quality assurance. Freelancers using escrow platforms like Upwork or Freelancer often experience higher client trust and increased job invitations due to this added payment security.

Final Verdict: Escrow vs Direct Payment – What’s Best for Freelancers?

Escrow payment systems provide freelancers with a secure transaction environment by holding funds until project completion, reducing the risk of non-payment. Direct payments offer faster access to funds but expose freelancers to potential payment delays or disputes. For freelancers prioritizing financial security and trust, escrow payments are generally the best choice, while direct payments suit those with established client relationships and faster cash flow needs.

Escrow Payment vs Direct Payment Infographic

bizdif.com

bizdif.com