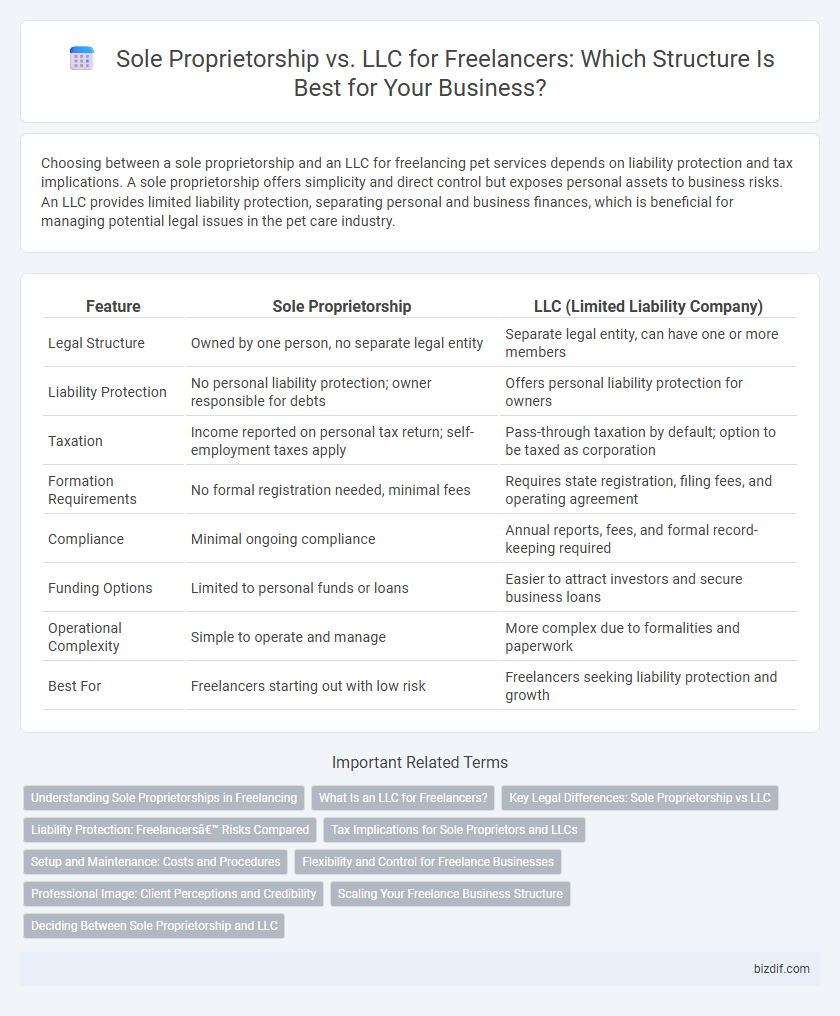

Choosing between a sole proprietorship and an LLC for freelancing pet services depends on liability protection and tax implications. A sole proprietorship offers simplicity and direct control but exposes personal assets to business risks. An LLC provides limited liability protection, separating personal and business finances, which is beneficial for managing potential legal issues in the pet care industry.

Table of Comparison

| Feature | Sole Proprietorship | LLC (Limited Liability Company) |

|---|---|---|

| Legal Structure | Owned by one person, no separate legal entity | Separate legal entity, can have one or more members |

| Liability Protection | No personal liability protection; owner responsible for debts | Offers personal liability protection for owners |

| Taxation | Income reported on personal tax return; self-employment taxes apply | Pass-through taxation by default; option to be taxed as corporation |

| Formation Requirements | No formal registration needed, minimal fees | Requires state registration, filing fees, and operating agreement |

| Compliance | Minimal ongoing compliance | Annual reports, fees, and formal record-keeping required |

| Funding Options | Limited to personal funds or loans | Easier to attract investors and secure business loans |

| Operational Complexity | Simple to operate and manage | More complex due to formalities and paperwork |

| Best For | Freelancers starting out with low risk | Freelancers seeking liability protection and growth |

Understanding Sole Proprietorships in Freelancing

Sole proprietorships in freelancing offer a simple business structure where the individual and the business are legally the same, making tax filing straightforward with income reported on the freelancer's personal tax return. This structure provides complete control over business decisions but exposes the freelancer to unlimited personal liability for debts and legal actions. Understanding the implications of sole proprietorships helps freelancers assess risks and benefits before considering alternatives like forming an LLC.

What Is an LLC for Freelancers?

An LLC (Limited Liability Company) for freelancers is a business structure that provides personal liability protection while allowing flexible management and pass-through taxation. Unlike a sole proprietorship, an LLC separates personal assets from business debts and legal obligations, reducing personal financial risk. Freelancers benefit from an LLC by gaining credibility, potential tax advantages, and limited liability without the complexity of a corporation.

Key Legal Differences: Sole Proprietorship vs LLC

Sole proprietorships offer simple setup with unlimited personal liability, meaning the owner is personally responsible for all business debts and legal actions. LLCs provide limited liability protection, separating personal assets from business liabilities, and often feature flexible tax options such as pass-through taxation or corporate taxation. Legal formalities for LLCs include registration with the state, operating agreements, and compliance requirements, unlike the minimal formalities required for sole proprietorships.

Liability Protection: Freelancers’ Risks Compared

Sole proprietorships offer no personal liability protection, which means freelancers are personally responsible for business debts and legal claims, exposing their personal assets to risk. In contrast, forming an LLC (Limited Liability Company) provides freelancers with liability protection by separating personal and business assets, reducing personal financial exposure. This risk mitigation is crucial for freelancers operating in industries with higher potential for legal disputes or significant financial liabilities.

Tax Implications for Sole Proprietors and LLCs

Sole proprietors report business income and expenses on their personal tax return using Schedule C, subjecting all profits to self-employment tax. LLCs can choose to be taxed as a sole proprietorship, partnership, or corporation, offering flexibility to minimize tax liability, including potential savings on self-employment taxes if electing S-corporation status. Understanding these tax differences is critical for freelancers to optimize deductions, payroll taxes, and overall tax burden.

Setup and Maintenance: Costs and Procedures

Setting up a sole proprietorship for freelancers typically involves minimal costs and simple registration processes, often requiring just a business license or local permits. In contrast, forming an LLC incurs higher initial fees, including state filing costs ranging from $50 to $500, along with more complex paperwork like operating agreements. Maintenance for sole proprietorships is minimal, with fewer regulatory requirements, while LLCs necessitate annual reports, franchise taxes, and ongoing compliance, increasing both time commitments and expenses.

Flexibility and Control for Freelance Businesses

Sole proprietorships offer freelancers maximum flexibility and complete control over business decisions, allowing swift adaptability to client needs without requiring formal approval processes. LLCs provide more structured management, which can limit day-to-day decision-making freedom but adds protection by separating personal and business liabilities. Freelancers prioritizing operational simplicity and direct oversight often prefer sole proprietorships, while those seeking liability protection with moderate control trade-offs opt for LLCs.

Professional Image: Client Perceptions and Credibility

Sole proprietorships often appear less formal, which may impact client trust and the perceived stability of a freelancer's business. Forming an LLC enhances professional credibility by signaling legal protection and a commitment to business structure, fostering stronger client confidence. Many clients prefer working with LLCs for added assurance of accountability and long-term reliability.

Scaling Your Freelance Business Structure

Choosing between a sole proprietorship and an LLC significantly impacts scaling your freelance business structure due to liability protection and tax advantages. An LLC separates personal assets from business liabilities, offering increased credibility and flexibility to attract clients and investors, essential for growth. Sole proprietorships have simpler setup and lower costs but risk personal asset exposure, limiting scalability in competitive markets.

Deciding Between Sole Proprietorship and LLC

Choosing between a sole proprietorship and an LLC depends on factors like liability protection, tax implications, and administrative requirements. A sole proprietorship offers simplicity and direct control but exposes personal assets to business liabilities, while an LLC provides limited liability protection and potential tax flexibility with added regulatory obligations. Freelancers should evaluate their risk tolerance, growth plans, and financial goals to determine the best structure for their business.

Sole Proprietorship vs LLC Infographic

bizdif.com

bizdif.com