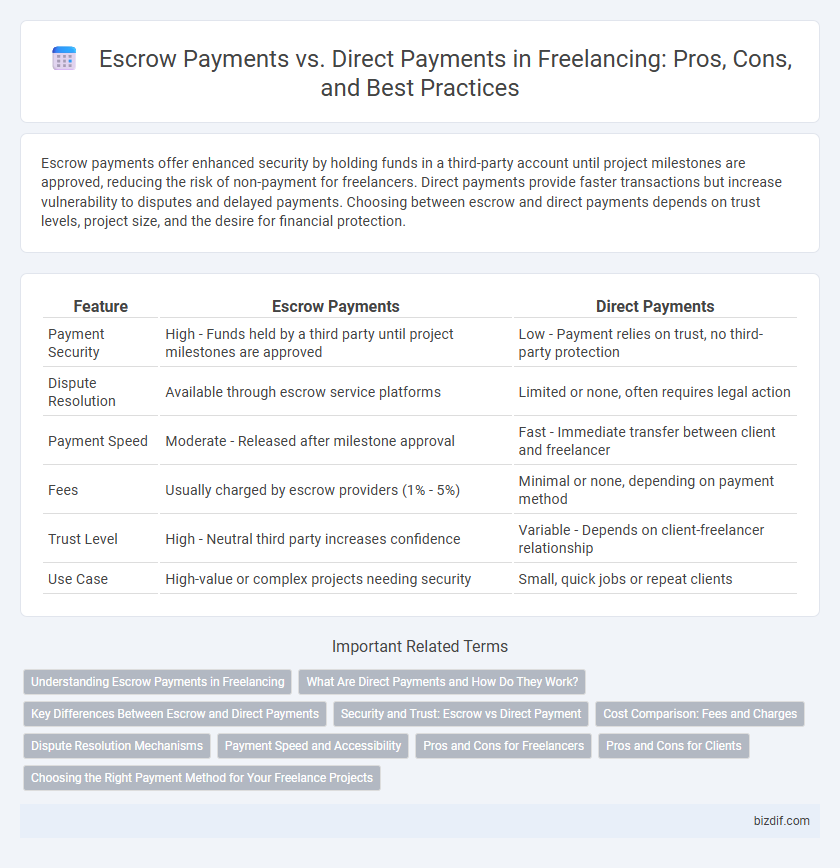

Escrow payments offer enhanced security by holding funds in a third-party account until project milestones are approved, reducing the risk of non-payment for freelancers. Direct payments provide faster transactions but increase vulnerability to disputes and delayed payments. Choosing between escrow and direct payments depends on trust levels, project size, and the desire for financial protection.

Table of Comparison

| Feature | Escrow Payments | Direct Payments |

|---|---|---|

| Payment Security | High - Funds held by a third party until project milestones are approved | Low - Payment relies on trust, no third-party protection |

| Dispute Resolution | Available through escrow service platforms | Limited or none, often requires legal action |

| Payment Speed | Moderate - Released after milestone approval | Fast - Immediate transfer between client and freelancer |

| Fees | Usually charged by escrow providers (1% - 5%) | Minimal or none, depending on payment method |

| Trust Level | High - Neutral third party increases confidence | Variable - Depends on client-freelancer relationship |

| Use Case | High-value or complex projects needing security | Small, quick jobs or repeat clients |

Understanding Escrow Payments in Freelancing

Escrow payments in freelancing provide a secure transaction method where funds are held by a third party until project milestones are met or deliverables approved, reducing risks for both clients and freelancers. This system ensures that freelancers receive payment for completed work while clients maintain control over releasing funds only when satisfied. Understanding escrow payments enhances trust and transparency, making it a preferred choice for managing freelance project finances.

What Are Direct Payments and How Do They Work?

Direct payments in freelancing refer to the transfer of funds from clients to freelancers without intermediary platforms, ensuring faster access to earnings. These transactions typically involve bank transfers, PayPal, or digital wallets, allowing freelancers to receive payments immediately upon project completion. While direct payments offer greater control over funds, they lack the buyer-seller protection and dispute resolution features that escrow services provide.

Key Differences Between Escrow and Direct Payments

Escrow payments involve a third-party holding funds securely until the agreed-upon work is completed and approved, ensuring protection for both freelancers and clients. Direct payments transfer money immediately from client to freelancer, offering faster access to funds but less security for dispute resolution. The key differences center on payment security, risk management, and timing of fund release, with escrow mitigating risk through neutral escrow agents and direct payments providing simplicity and speed.

Security and Trust: Escrow vs Direct Payment

Escrow payments enhance security and trust by holding funds with a neutral third party until project milestones are met, reducing the risk of non-payment or incomplete work. Direct payments, while faster, expose both freelancers and clients to risks such as disputes over payment or deliverables without a guaranteed resolution mechanism. This trust factor makes escrow systems preferred in freelance platforms to protect all parties involved.

Cost Comparison: Fees and Charges

Escrow payments typically involve service fees ranging from 1% to 5%, providing a secure transaction environment for both freelancers and clients. Direct payments often incur lower fees, mainly transaction charges from payment platforms such as PayPal or bank transfers, averaging around 2% to 3%. Choosing between escrow and direct payments requires balancing security with cost efficiency based on project value and trust level.

Dispute Resolution Mechanisms

Escrow payments offer a structured dispute resolution mechanism by holding funds securely until both parties confirm project milestones, reducing risks of non-payment or unsatisfactory work. Direct payments often lack formal mediation processes, placing the burden of resolving conflicts entirely on the freelancer and client, which can lead to prolonged disagreements or loss of funds. Utilizing escrow services enhances trust and provides neutral arbitration, making it a preferred choice for managing financial disputes in freelancing.

Payment Speed and Accessibility

Escrow payments offer secure transaction processing by holding funds until project milestones are verified, which can slightly slow payment speed but boosts trust and reduces disputes. Direct payments enable faster fund transfers between clients and freelancers, enhancing immediate accessibility but increasing risk without formal safeguards. Choosing between escrow and direct payments depends on balancing the need for quick access to funds against secure, verified payment methods.

Pros and Cons for Freelancers

Escrow payments offer freelancers enhanced security by holding funds in a third-party account until project milestones are met, reducing the risk of non-payment. However, escrow services often charge fees, potentially decreasing net earnings and delaying access to funds. Direct payments provide faster access to money and lower fees but expose freelancers to higher risks of late or missed payments without guaranteed protection.

Pros and Cons for Clients

Escrow payments provide clients with enhanced security by holding funds until project milestones are approved, reducing the risk of incomplete or unsatisfactory work. However, escrow services often involve additional fees and can slow down payment timelines compared to direct payments. Direct payments offer faster transactions and lower costs but increase the risk of non-delivery or subpar results, requiring clients to carefully vet freelancers before committing funds.

Choosing the Right Payment Method for Your Freelance Projects

Escrow payments provide a secure transaction method, holding funds until project milestones or completion, reducing risk for both freelancers and clients. Direct payments offer faster access to funds but require strong trust and clear agreements to avoid disputes. Selecting the right payment method depends on project size, client reliability, and the need for financial security in freelance contracts.

Escrow Payments vs Direct Payments Infographic

bizdif.com

bizdif.com