Escrow payment provides security by holding funds with a trusted third party until project milestones are met, ensuring both freelancers and clients are protected. Advance payment offers immediate cash flow to freelancers, boosting trust and commitment but carries a higher risk if the client delays or cancels the project. Choosing between escrow and advance payment depends on the project's risk level, client relationship, and the need for financial assurance.

Table of Comparison

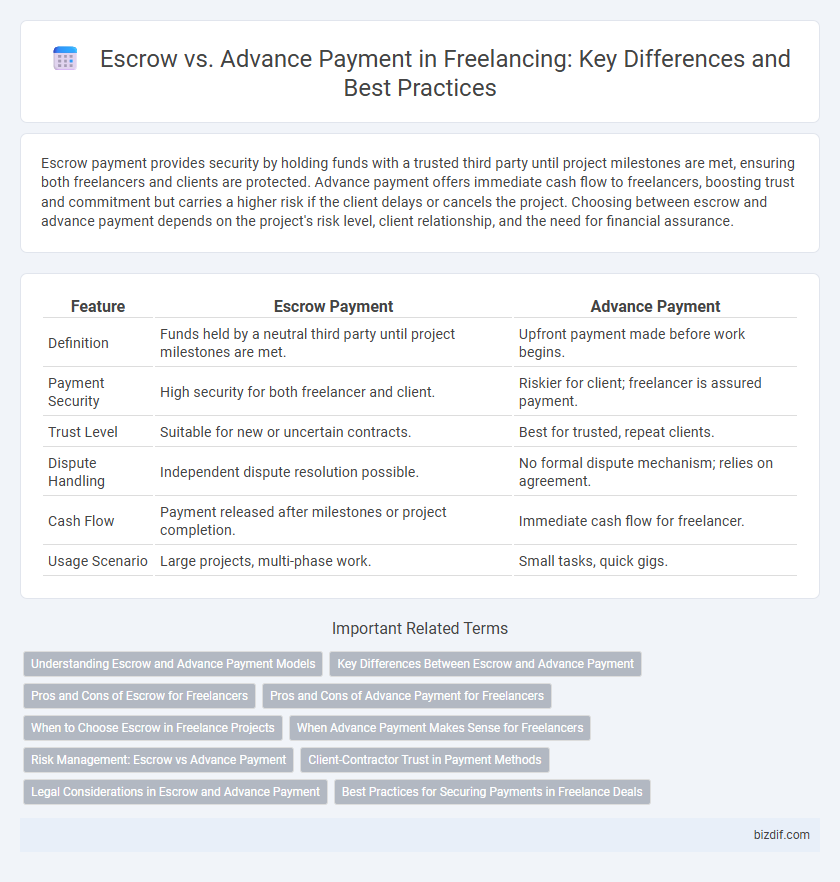

| Feature | Escrow Payment | Advance Payment |

|---|---|---|

| Definition | Funds held by a neutral third party until project milestones are met. | Upfront payment made before work begins. |

| Payment Security | High security for both freelancer and client. | Riskier for client; freelancer is assured payment. |

| Trust Level | Suitable for new or uncertain contracts. | Best for trusted, repeat clients. |

| Dispute Handling | Independent dispute resolution possible. | No formal dispute mechanism; relies on agreement. |

| Cash Flow | Payment released after milestones or project completion. | Immediate cash flow for freelancer. |

| Usage Scenario | Large projects, multi-phase work. | Small tasks, quick gigs. |

Understanding Escrow and Advance Payment Models

Escrow and advance payment models serve distinct roles in freelancing transactions by securing funds and building trust between clients and freelancers. Escrow involves a third-party holding funds until project milestones are met, ensuring protection for both parties through conditional release of payments. Advance payments require a client to pay a portion upfront, providing freelancers with working capital but less financial security compared to escrow arrangements.

Key Differences Between Escrow and Advance Payment

Escrow payments are held by a neutral third party until project milestones are met, ensuring security for both freelancers and clients, while advance payments require clients to pay upfront without intermediary safeguards. Escrow offers dispute resolution mechanisms and reduces risk, whereas advance payments expose freelancers to potential non-completion or client withdrawal risks. The choice between escrow and advance payment impacts trust, cash flow management, and project risk distribution in freelance contracts.

Pros and Cons of Escrow for Freelancers

Escrow payment offers freelancers security by holding funds until project milestones are met, reducing the risk of non-payment and fostering trust between clients and freelancers. However, escrow fees and potential delays in fund release can impact cash flow and project timelines. Freelancers benefit from escrow by ensuring payment assurance but must weigh these advantages against the administrative and financial costs involved.

Pros and Cons of Advance Payment for Freelancers

Advance payments offer freelancers immediate cash flow, reducing financial strain and enabling better resource allocation for project execution. However, accepting advance payments carries risks such as potential client disputes or project cancellations, which may lead to complications in refunding or delivering services. Freelancers must weigh the security of upfront funds against the possibility of payment conflicts to determine if advance payment aligns with their risk tolerance and project scope.

When to Choose Escrow in Freelance Projects

Escrow is ideal for freelance projects requiring security and trust between clients and freelancers, especially for larger, milestone-based contracts where funds are protected until agreed-upon deliverables are met. Choosing escrow reduces the risk of non-payment by holding funds in a neutral account until work completion, making it suitable for new client relationships or complex projects with multiple phases. This method ensures transparency and accountability, fostering confidence and a smoother collaboration throughout the project lifecycle.

When Advance Payment Makes Sense for Freelancers

Advance payment makes sense for freelancers when working with new clients who lack an established trust history, ensuring financial security before committing time and resources. It is especially beneficial for projects involving significant upfront costs or long development cycles, where initial funds cover expenses and reduce the risk of non-payment. Freelancers should clearly define milestones and payment terms to balance client confidence with their own financial protection.

Risk Management: Escrow vs Advance Payment

Escrow payment provides a secure risk management solution by holding funds with a trusted third party until project milestones are met, protecting both freelancers and clients from payment disputes. Advance payment shifts the financial risk primarily to the client, as freelancers receive funds upfront but may not deliver satisfactory work, increasing vulnerability to service quality issues. Utilizing escrow mitigates risks by ensuring funds are only released upon verified completion, fostering trust and accountability in freelance transactions.

Client-Contractor Trust in Payment Methods

Escrow payment systems enhance client-contractor trust by securely holding funds until project milestones are verified, reducing payment disputes and ensuring accountability. Advance payments may strengthen trust through upfront commitment but expose clients to potential risks if the contractor fails to deliver. Selecting escrow services balances protection and confidence, fostering transparent and reliable freelance project transactions.

Legal Considerations in Escrow and Advance Payment

Escrow payments provide a legal safeguard by holding funds with a neutral third party until project milestones are met, reducing the risk of non-payment and disputes in freelancing contracts. Advance payments require clear contractual terms to protect both parties, outlining refund policies and deliverable expectations to avoid potential legal conflicts. Proper documentation and adherence to contract law principles are essential in both escrow and advance payment arrangements to ensure enforceability and protect freelancers' rights.

Best Practices for Securing Payments in Freelance Deals

To secure payments in freelance deals, using an escrow service is a best practice as it holds funds securely until project milestones are met, reducing risk for both parties. Advance payments, typically ranging from 20-50% of the total project cost, provide freelancers with upfront security and demonstrate client commitment. Combining escrow with clear contracts and milestone-based releases enhances trust and ensures timely payment for freelance work.

Escrow vs Advance payment Infographic

bizdif.com

bizdif.com