Passive income in freelancing stems from creating scalable products like courses or digital assets that generate revenue with minimal ongoing effort, while active income relies on trading time directly for money through client projects. Building passive income streams requires upfront investment in time and resources but offers long-term financial stability and freedom. Balancing active and passive income can maximize earnings and provide a sustainable freelance career.

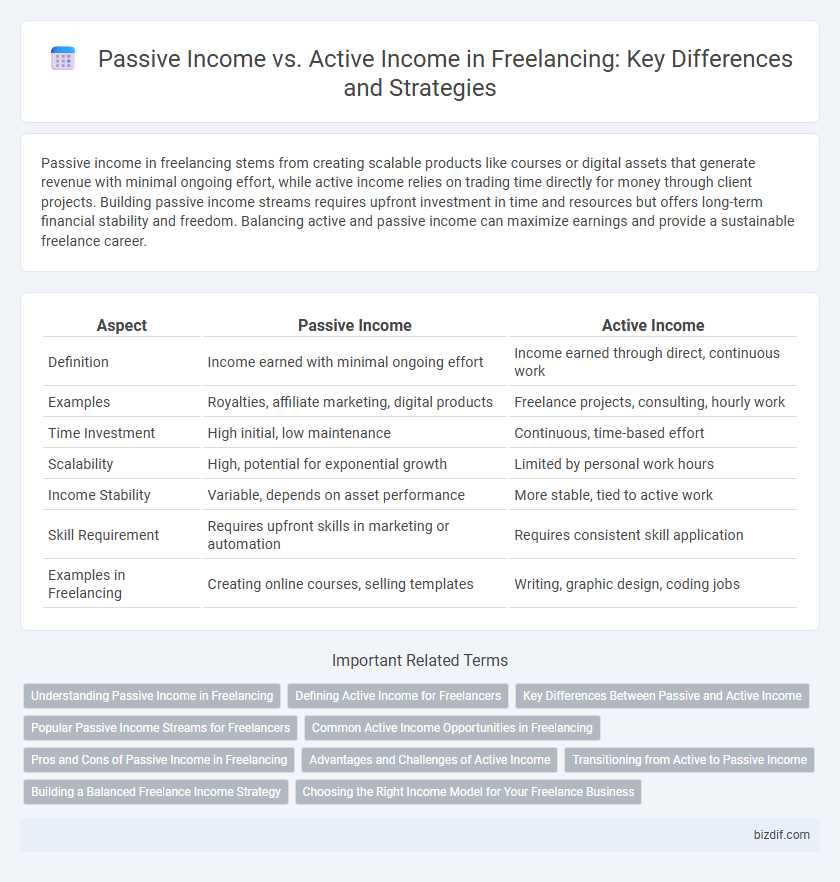

Table of Comparison

| Aspect | Passive Income | Active Income |

|---|---|---|

| Definition | Income earned with minimal ongoing effort | Income earned through direct, continuous work |

| Examples | Royalties, affiliate marketing, digital products | Freelance projects, consulting, hourly work |

| Time Investment | High initial, low maintenance | Continuous, time-based effort |

| Scalability | High, potential for exponential growth | Limited by personal work hours |

| Income Stability | Variable, depends on asset performance | More stable, tied to active work |

| Skill Requirement | Requires upfront skills in marketing or automation | Requires consistent skill application |

| Examples in Freelancing | Creating online courses, selling templates | Writing, graphic design, coding jobs |

Understanding Passive Income in Freelancing

Passive income in freelancing refers to earnings generated with minimal ongoing effort, such as royalties from digital products or affiliate marketing commissions. Unlike active income, which requires continuous work like client projects and hourly billing, passive income leverages upfront investments in time or resources to create scalable revenue streams. Building multiple passive income channels enables freelancers to diversify earnings and achieve financial stability independently from active workload fluctuations.

Defining Active Income for Freelancers

Active income for freelancers refers to earnings directly tied to the time and effort invested in providing services or completing projects. This income requires continuous engagement, such as client consultations, freelance assignments, or contract work, making it dependent on active participation. Unlike passive income, active income stops when the freelancer ceases work, emphasizing the importance of time management and consistent project acquisition.

Key Differences Between Passive and Active Income

Passive income generates earnings with minimal ongoing effort, such as royalties, rental income, or affiliate marketing, enabling freelancers to earn consistently without continuous work. Active income requires direct involvement and time investment, like client projects, consulting, or hourly contracts, where earnings correlate with hours worked. Key differences include scalability, time commitment, and income stability, with passive income offering potential long-term financial growth while active income depends on sustained labor.

Popular Passive Income Streams for Freelancers

Freelancers can diversify their earnings by exploring popular passive income streams such as affiliate marketing, selling digital products, and creating online courses. Platforms like Udemy and Teachable enable freelancers to monetize their expertise long-term without continuous active involvement. Leveraging passive income sources allows freelancers to build financial stability beyond time-for-money active projects.

Common Active Income Opportunities in Freelancing

Freelancers often generate active income through common opportunities such as project-based contracts, hourly consulting, and skill-specific gigs like graphic design, writing, or programming. These income streams require continuous time investment and direct labor, contrasting with passive income sources like digital product sales or affiliate marketing. Understanding the balance between these active engagements and scalable passive options is crucial for sustained financial growth in freelancing careers.

Pros and Cons of Passive Income in Freelancing

Passive income in freelancing offers financial freedom and scalability by generating revenue with minimal ongoing effort, such as royalties from online courses or affiliate marketing. However, it requires significant upfront investment of time and resources to create valuable content or products, and income streams can be unpredictable and slower to build compared to active freelancing work. Freelancers benefit from diversifying income sources but must balance passive income efforts with consistent active client projects to maintain steady cash flow.

Advantages and Challenges of Active Income

Active income in freelancing offers immediate earnings directly tied to hours worked or projects completed, providing financial stability and clear performance incentives. Challenges include limited scalability, dependence on continuous client demand, and the necessity of consistent time investment, which can restrict long-term income growth. Freelancers must balance workload and self-promotion to maximize active income potential while avoiding burnout.

Transitioning from Active to Passive Income

Transitioning from active to passive income in freelancing involves shifting from trading time for money to creating scalable revenue streams such as digital products, online courses, or affiliate marketing. Building passive income requires initial effort in content creation, marketing automation, and audience growth to generate sustainable earnings with minimal ongoing input. Freelancers leveraging platforms like Udemy, Patreon, or their own websites can gradually reduce active hours while increasing financial stability and long-term wealth.

Building a Balanced Freelance Income Strategy

Building a balanced freelance income strategy involves combining active income, earned from client projects and direct work, with passive income streams such as digital product sales, affiliate marketing, or online courses. Diversifying income sources mitigates financial risk and ensures sustainable earnings during market fluctuations. Prioritizing scalable passive income while maintaining quality active engagements enhances long-term freelance financial stability.

Choosing the Right Income Model for Your Freelance Business

Selecting the appropriate income model for your freelance business is crucial for long-term success and financial stability. Passive income streams, such as selling digital products or affiliate marketing, provide steady earnings with minimal ongoing effort, while active income relies on continuous client work and immediate payment. Balancing both models can optimize cash flow, reduce risk, and increase overall profitability in a competitive freelancing market.

Passive income vs Active income Infographic

bizdif.com

bizdif.com