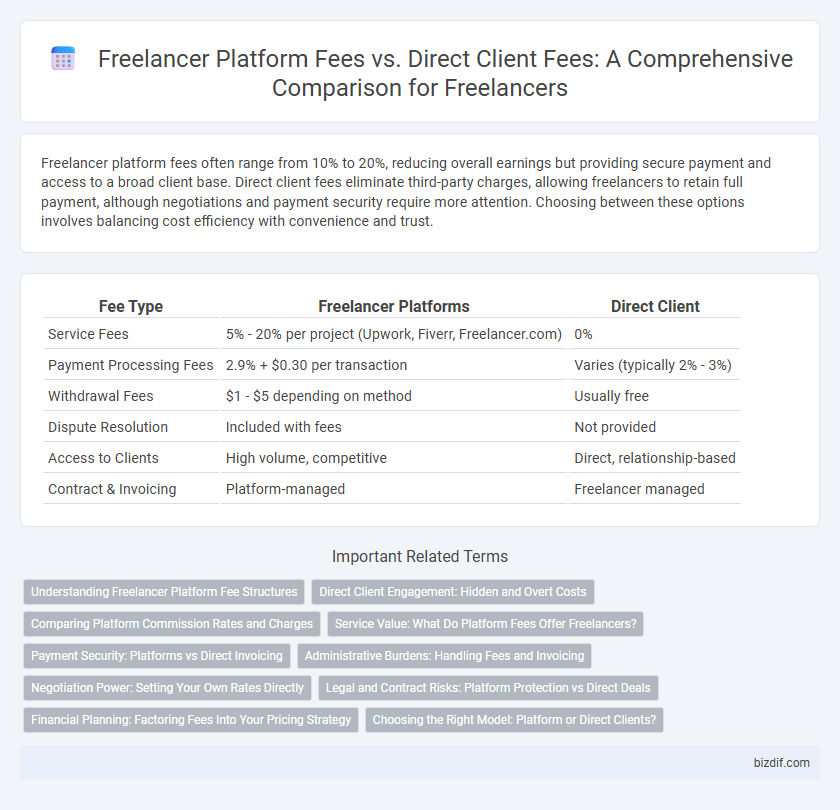

Freelancer platform fees often range from 10% to 20%, reducing overall earnings but providing secure payment and access to a broad client base. Direct client fees eliminate third-party charges, allowing freelancers to retain full payment, although negotiations and payment security require more attention. Choosing between these options involves balancing cost efficiency with convenience and trust.

Table of Comparison

| Fee Type | Freelancer Platforms | Direct Client |

|---|---|---|

| Service Fees | 5% - 20% per project (Upwork, Fiverr, Freelancer.com) | 0% |

| Payment Processing Fees | 2.9% + $0.30 per transaction | Varies (typically 2% - 3%) |

| Withdrawal Fees | $1 - $5 depending on method | Usually free |

| Dispute Resolution | Included with fees | Not provided |

| Access to Clients | High volume, competitive | Direct, relationship-based |

| Contract & Invoicing | Platform-managed | Freelancer managed |

Understanding Freelancer Platform Fee Structures

Freelancer platform fees typically range from 10% to 20% of the project value, depending on the platform and type of service, affecting overall earnings for freelancers. Direct client fees, negotiated independently, allow freelancers to avoid platform commissions but require self-management of contracts and payments, potentially increasing administrative overhead. Understanding the fee structures of platforms like Upwork, Fiverr, and Freelancer.com helps freelancers optimize income by balancing platform security against higher net revenue from direct client engagements.

Direct Client Engagement: Hidden and Overt Costs

Direct client engagement in freelancing often involves hidden and overt costs such as payment processing fees, contract drafting expenses, and time spent on client acquisition without platform mediation. Freelancer platforms typically charge a transparent service fee ranging from 5% to 20%, covering dispute resolution and secure payment systems. While bypassing platforms may save on explicit fees, the indirect costs and risks can reduce overall profitability for freelancers.

Comparing Platform Commission Rates and Charges

Freelancer platforms typically charge commission rates ranging from 5% to 20% per project, significantly impacting net earnings compared to direct client transactions that incur no platform fees. Platforms often apply fixed fees plus variable percentages depending on project size or membership tiers, while direct clients usually involve no intermediary costs. Choosing direct client relationships eliminates platform commissions, maximizing freelancer revenue but requiring increased effort in client acquisition and payment security.

Service Value: What Do Platform Fees Offer Freelancers?

Freelancer platform fees provide essential benefits such as secure payment processing, dispute resolution services, and access to a global client base, enhancing project opportunities and income stability. These fees also cover marketing tools and profile visibility that help freelancers attract high-value clients, which direct client engagements often lack. While direct client fees may be lower, platform fees contribute significantly to long-term service value and professional growth in the freelancing ecosystem.

Payment Security: Platforms vs Direct Invoicing

Freelancer platforms typically charge fees ranging from 5% to 20%, offering robust payment security through escrow services that protect both freelancers and clients by holding funds until project milestones are met. Direct invoicing eliminates platform fees, maximizing freelancer earnings but increases risk as payment relies solely on client trust without escrow or dispute resolution mechanisms. Payment security is a critical consideration, with platforms providing structured protection at a cost, while direct client fees demand stronger contract enforcement and payment follow-up efforts.

Administrative Burdens: Handling Fees and Invoicing

Freelancer platform fees typically range from 5% to 20%, covering payment processing and dispute resolution, but they also handle invoicing and tax documentation, reducing administrative burdens for freelancers. Direct client payments avoid these fees but require freelancers to manage invoicing, payment tracking, and tax compliance independently, increasing time spent on administrative tasks. Efficient accounting software can mitigate some direct payment challenges, but the overall administrative load remains higher without platform support.

Negotiation Power: Setting Your Own Rates Directly

Freelancer platforms typically charge service fees ranging from 5% to 20%, which can significantly reduce overall earnings. Working with direct clients eliminates these platform fees, allowing freelancers to retain full payment and exercise greater negotiation power to set competitive rates. This direct relationship fosters tailored agreements and maximizes profit margins by aligning payment strictly with the freelancer's skill value and project scope.

Legal and Contract Risks: Platform Protection vs Direct Deals

Freelancer platform fees provide a layer of legal protection by enforcing contracts and dispute resolution processes, reducing risks for both parties compared to direct client deals. Direct agreements often lack formal contract enforcement, increasing exposure to payment delays, breaches, and intellectual property disputes. Platforms like Upwork or Fiverr mitigate these risks by offering escrow services and standardized contracts, justifying their fees through enhanced security and risk management.

Financial Planning: Factoring Fees Into Your Pricing Strategy

Freelancers must incorporate platform fees, often ranging from 5% to 20%, into their pricing strategy to ensure profitability when using sites like Upwork or Fiverr. Direct client engagements typically eliminate these fees but require greater marketing and contract management efforts, influencing overall financial planning. Accurately factoring in these costs helps maintain consistent income and supports sustainable business growth.

Choosing the Right Model: Platform or Direct Clients?

Freelancer platform fees typically range from 10% to 20%, impacting overall earnings and project budgets. Direct client relationships eliminate intermediary fees, allowing higher profit margins but requiring additional efforts in contract negotiation, payment security, and client management. Choosing between platform or direct clients depends on balancing fee costs against the benefits of streamlined workflows and client acquisition support provided by freelancing platforms.

Freelancer platform fees vs Direct client fees Infographic

bizdif.com

bizdif.com