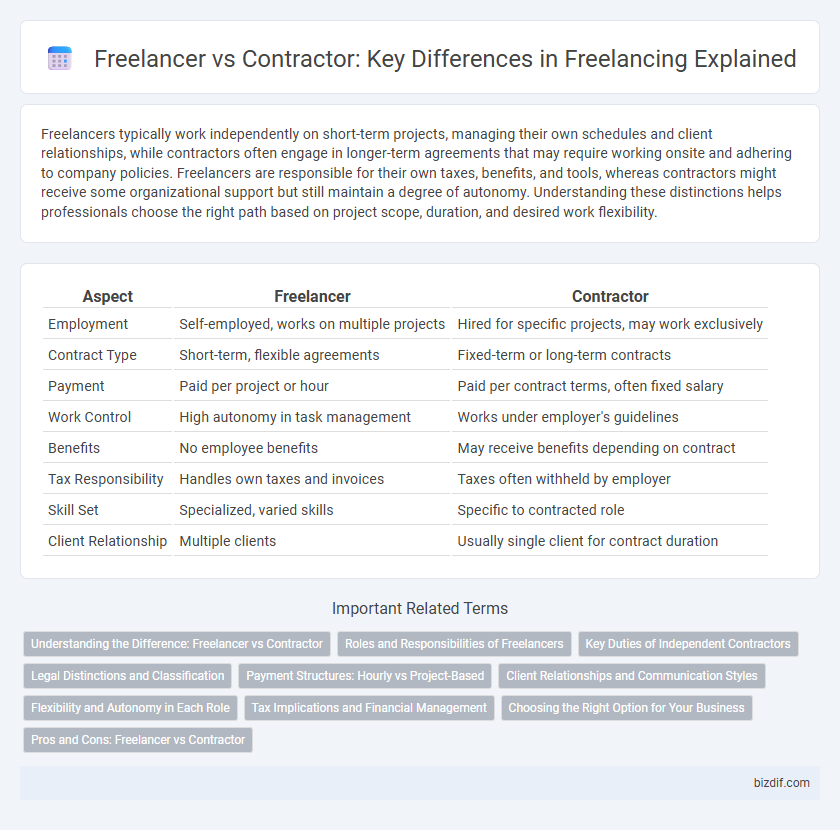

Freelancers typically work independently on short-term projects, managing their own schedules and client relationships, while contractors often engage in longer-term agreements that may require working onsite and adhering to company policies. Freelancers are responsible for their own taxes, benefits, and tools, whereas contractors might receive some organizational support but still maintain a degree of autonomy. Understanding these distinctions helps professionals choose the right path based on project scope, duration, and desired work flexibility.

Table of Comparison

| Aspect | Freelancer | Contractor |

|---|---|---|

| Employment | Self-employed, works on multiple projects | Hired for specific projects, may work exclusively |

| Contract Type | Short-term, flexible agreements | Fixed-term or long-term contracts |

| Payment | Paid per project or hour | Paid per contract terms, often fixed salary |

| Work Control | High autonomy in task management | Works under employer's guidelines |

| Benefits | No employee benefits | May receive benefits depending on contract |

| Tax Responsibility | Handles own taxes and invoices | Taxes often withheld by employer |

| Skill Set | Specialized, varied skills | Specific to contracted role |

| Client Relationship | Multiple clients | Usually single client for contract duration |

Understanding the Difference: Freelancer vs Contractor

Freelancers typically work on multiple short-term projects for various clients, offering specialized skills without long-term commitment, whereas contractors usually engage in longer-term agreements with a single client, often integrating more deeply into the client's business processes. Freelancers maintain more control over their work schedule and project selection, while contractors may be subject to more structured hours and specific deliverables outlined by the hiring company. Understanding these distinctions helps businesses and workers align expectations regarding responsibilities, payment terms, and legal obligations in freelance versus contract work arrangements.

Roles and Responsibilities of Freelancers

Freelancers independently manage multiple clients and projects, delivering specialized services such as graphic design, content writing, or web development without long-term commitment to any single company. Their responsibilities include negotiating contracts, setting deadlines, handling invoicing, and ensuring high-quality deliverables that meet client specifications. Unlike contractors who often work under defined terms for a single client, freelancers maintain autonomy in project selection and workflow management.

Key Duties of Independent Contractors

Independent contractors manage project scopes, deliverables, and timelines autonomously while ensuring compliance with contractual agreements. They often provide specialized services such as consulting, design, or IT solutions, collaborating directly with clients to meet specific business needs. Unlike freelancers, contractors typically engage in longer-term projects requiring formal invoicing, tax responsibilities, and adherence to regulatory standards.

Legal Distinctions and Classification

Freelancers are typically classified as independent contractors who provide services to multiple clients without long-term commitments, while contractors may have more formalized agreements and can sometimes be treated as employees under labor laws. Legal distinctions hinge on factors such as degree of control, exclusivity, and provision of tools, which determine tax obligations, liability, and benefits eligibility. Misclassification risks include penalties and back taxes, making accurate classification crucial for compliance with regulations like the IRS guidelines and labor standards.

Payment Structures: Hourly vs Project-Based

Freelancers often prefer hourly payment structures that provide flexibility and compensation based on actual time worked, while contractors typically agree on project-based payments that offer fixed costs and clear deliverables. Hourly rates benefit freelancers managing multiple short-term tasks, whereas project-based fees suit contractors handling defined, long-term assignments. Choosing between hourly and project-based payment depends on the scope, duration, and nature of the freelancing engagement.

Client Relationships and Communication Styles

Freelancers typically maintain a more flexible and informal client relationship, often managing multiple clients simultaneously with direct and frequent communication. Contractors usually engage in longer-term projects with formal agreements, emphasizing structured communication and defined reporting lines. Clear expectations and communication frequency significantly impact the success of both freelancer and contractor collaborations.

Flexibility and Autonomy in Each Role

Freelancers enjoy greater flexibility in choosing projects, setting their own schedules, and working from any location, which fosters high autonomy in managing their workload. Contractors often have set hours and project scopes defined by the hiring organization, limiting flexibility but providing more structured engagement and consistent income. The degree of autonomy for contractors typically depends on the terms of the contract, with some roles offering independence while others require strict adherence to company policies.

Tax Implications and Financial Management

Freelancers are typically classified as self-employed individuals responsible for paying self-employment taxes, including Social Security and Medicare, directly to the IRS, which requires quarterly estimated tax payments and careful expense tracking for deductions. Contractors, often operating through a business entity like an LLC or corporation, may benefit from different tax treatment, including potential payroll tax advantages and the ability to deduct business expenses at the entity level, impacting their overall tax liability and financial strategy. Effective financial management for both involves maintaining detailed records of income and expenses, understanding relevant tax obligations, and planning for taxes to optimize cash flow and ensure compliance.

Choosing the Right Option for Your Business

Freelancers offer flexible, project-based expertise ideal for specialized tasks or short-term needs, while contractors typically provide more structured, long-term services with defined responsibilities. Selecting between a freelancer and a contractor depends on your business requirements, budget constraints, and desired level of control over the work process. Evaluating factors such as project scope, timeline, and compliance with labor laws ensures the right choice for efficient resource management and operational success.

Pros and Cons: Freelancer vs Contractor

Freelancers offer flexibility in project selection and often have lower costs due to minimal overhead, but they may face inconsistent income and limited benefits. Contractors typically provide specialized skills with more stable, longer-term engagements and access to company resources, yet they might encounter stricter work scopes and less autonomy. Evaluating project needs and desired work arrangements helps determine whether a freelancer's adaptability or a contractor's structure aligns better with business goals.

Freelancer vs Contractor Infographic

bizdif.com

bizdif.com