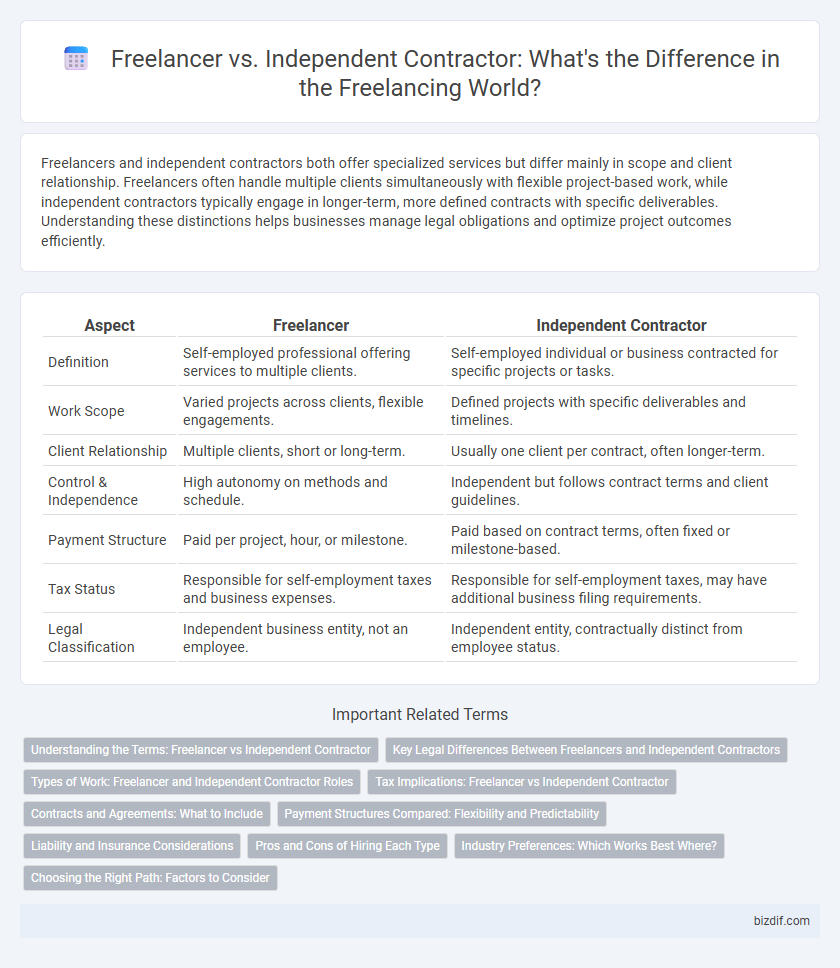

Freelancers and independent contractors both offer specialized services but differ mainly in scope and client relationship. Freelancers often handle multiple clients simultaneously with flexible project-based work, while independent contractors typically engage in longer-term, more defined contracts with specific deliverables. Understanding these distinctions helps businesses manage legal obligations and optimize project outcomes efficiently.

Table of Comparison

| Aspect | Freelancer | Independent Contractor |

|---|---|---|

| Definition | Self-employed professional offering services to multiple clients. | Self-employed individual or business contracted for specific projects or tasks. |

| Work Scope | Varied projects across clients, flexible engagements. | Defined projects with specific deliverables and timelines. |

| Client Relationship | Multiple clients, short or long-term. | Usually one client per contract, often longer-term. |

| Control & Independence | High autonomy on methods and schedule. | Independent but follows contract terms and client guidelines. |

| Payment Structure | Paid per project, hour, or milestone. | Paid based on contract terms, often fixed or milestone-based. |

| Tax Status | Responsible for self-employment taxes and business expenses. | Responsible for self-employment taxes, may have additional business filing requirements. |

| Legal Classification | Independent business entity, not an employee. | Independent entity, contractually distinct from employee status. |

Understanding the Terms: Freelancer vs Independent Contractor

Freelancers are self-employed individuals offering services to multiple clients without long-term commitments, often working project-based or on a short-term contract. Independent contractors operate under a formal agreement with a client, which defines the scope, deliverables, and payment terms, and they may have more structured responsibilities. Both roles require managing taxes and business expenses independently, but independent contractors often engage in more exclusive or longer-term work arrangements compared to freelancers.

Key Legal Differences Between Freelancers and Independent Contractors

Freelancers and independent contractors differ primarily in their legal classifications under tax and labor laws, impacting liability, taxation, and contract obligations. Freelancers often operate under short-term, task-specific agreements with multiple clients, whereas independent contractors typically engage in longer-term, project-based contracts with more control over work processes. Key legal distinctions include the withholding of taxes, eligibility for employee benefits, and the level of autonomy in delivering services, making accurate classification essential to avoid misclassification risks and ensure compliance.

Types of Work: Freelancer and Independent Contractor Roles

Freelancers typically engage in short-term projects or specific tasks such as graphic design, writing, and web development, offering flexibility across multiple clients. Independent contractors generally take on longer-term assignments that require specialized skills, including consulting, construction, or IT services, often under a formal contract. Both roles differ in commitment levels and project scopes, impacting the nature and duration of work performed.

Tax Implications: Freelancer vs Independent Contractor

Freelancers are typically classified as independent contractors for tax purposes, meaning they must report income on Schedule C and pay self-employment taxes covering Social Security and Medicare. Independent contractors are responsible for estimated quarterly tax payments to avoid penalties and may deduct business expenses to reduce taxable income. Both must maintain accurate records to comply with IRS regulations and maximize tax benefits.

Contracts and Agreements: What to Include

Freelancers and independent contractors must include clear contract terms specifying project scope, deliverables, deadlines, and payment schedules to ensure mutual understanding and legal protection. Confidentiality clauses, intellectual property ownership, and termination conditions are essential components to safeguard both parties' interests. Including dispute resolution mechanisms, such as mediation or arbitration, helps prevent potential conflicts and facilitates smoother project completion.

Payment Structures Compared: Flexibility and Predictability

Freelancers often enjoy flexible payment structures such as milestone payments, hourly rates, or project-based fees, allowing adaptability to varying workload and client needs. Independent contractors typically operate under more predictable payment schedules, such as fixed contracts or retainer agreements, providing steady income streams aligned with specific deliverables or time periods. Understanding these distinctions helps professionals choose the right engagement model to balance financial stability and cash flow flexibility in freelancing careers.

Liability and Insurance Considerations

Freelancers and independent contractors differ significantly in liability and insurance considerations; freelancers often operate under personal liability, necessitating professional liability insurance to protect against client claims. Independent contractors may require broader general liability insurance due to larger project scopes and subcontractor involvement, reducing personal financial risk. Understanding these insurance nuances ensures adequate protection and compliance with contractual obligations in freelancing engagements.

Pros and Cons of Hiring Each Type

Hiring a freelancer offers flexibility and access to specialized skills without long-term commitments but may involve less control over work schedules and availability. Independent contractors provide more consistent engagement and often greater reliability due to contractual obligations, though they usually require more rigorous vetting and formal agreements. Balancing cost, project scope, and control needs is crucial when deciding between a freelancer and an independent contractor for your business.

Industry Preferences: Which Works Best Where?

Freelancers dominate creative industries like graphic design, writing, and marketing due to project-based work flexibility, while independent contractors are preferred in sectors like construction, IT, and consulting for longer-term assignments requiring specialized skills. Companies in tech and finance often favor independent contractors to ensure compliance with regulatory standards and structured contractual obligations. Freelancers suit startups and small businesses needing rapid, scalable talent without long-term commitments.

Choosing the Right Path: Factors to Consider

Choosing between a freelancer and an independent contractor depends on factors such as project scope, client expectations, and legal classification. Freelancers often work on multiple short-term projects with varied clients, while independent contractors typically engage in longer-term, contract-specific assignments with defined deliverables. Consider tax implications, contract terms, and the level of control over work to determine the most suitable professional status for your freelancing career.

Freelancer vs Independent Contractor Infographic

bizdif.com

bizdif.com