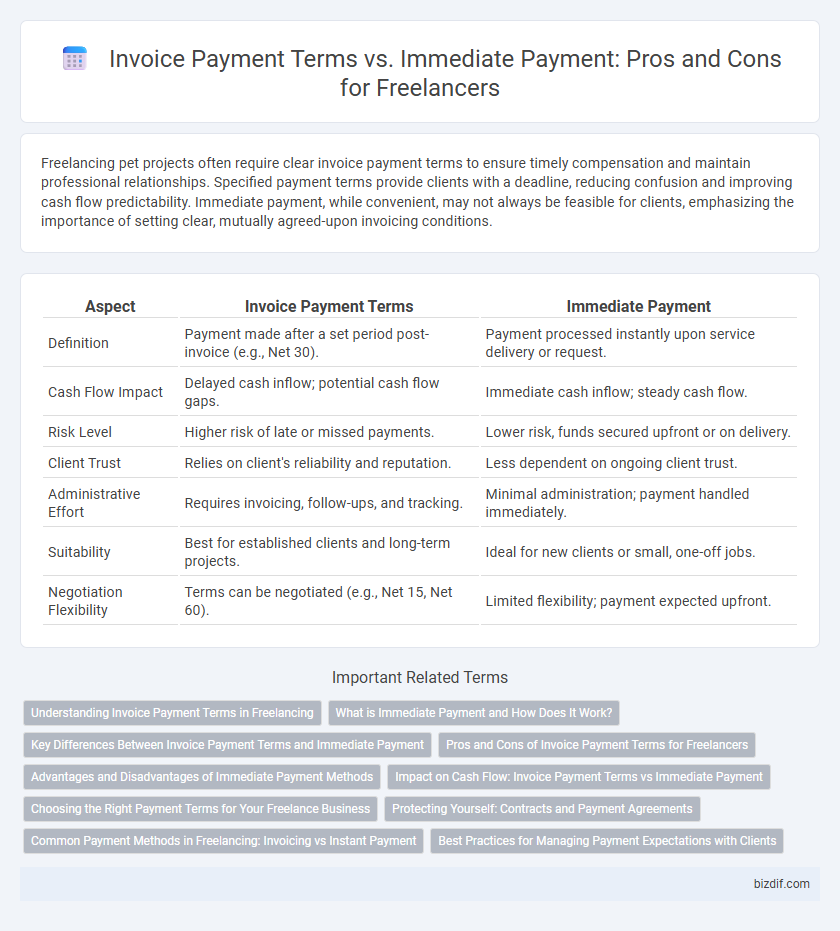

Freelancing pet projects often require clear invoice payment terms to ensure timely compensation and maintain professional relationships. Specified payment terms provide clients with a deadline, reducing confusion and improving cash flow predictability. Immediate payment, while convenient, may not always be feasible for clients, emphasizing the importance of setting clear, mutually agreed-upon invoicing conditions.

Table of Comparison

| Aspect | Invoice Payment Terms | Immediate Payment |

|---|---|---|

| Definition | Payment made after a set period post-invoice (e.g., Net 30). | Payment processed instantly upon service delivery or request. |

| Cash Flow Impact | Delayed cash inflow; potential cash flow gaps. | Immediate cash inflow; steady cash flow. |

| Risk Level | Higher risk of late or missed payments. | Lower risk, funds secured upfront or on delivery. |

| Client Trust | Relies on client's reliability and reputation. | Less dependent on ongoing client trust. |

| Administrative Effort | Requires invoicing, follow-ups, and tracking. | Minimal administration; payment handled immediately. |

| Suitability | Best for established clients and long-term projects. | Ideal for new clients or small, one-off jobs. |

| Negotiation Flexibility | Terms can be negotiated (e.g., Net 15, Net 60). | Limited flexibility; payment expected upfront. |

Understanding Invoice Payment Terms in Freelancing

Invoice payment terms in freelancing clarify the timeframe within which clients must settle outstanding payments, typically ranging from net 15 to net 60 days. Clear and agreed-upon invoice payment terms help freelancers manage cash flow, avoid payment delays, and reduce the risk of disputes. Understanding these terms enables freelancers to set expectations with clients, ensuring timely compensation while maintaining professional relationships.

What is Immediate Payment and How Does It Work?

Immediate payment in freelancing refers to the client paying the freelancer at the moment the invoice is issued or upon project completion without delay. This payment method eliminates waiting periods associated with traditional invoice payment terms like net 30 or net 60, ensuring quicker cash flow for freelancers. Immediate payment works through digital payment platforms or direct bank transfers that facilitate instant transaction processing.

Key Differences Between Invoice Payment Terms and Immediate Payment

Invoice payment terms specify a predetermined period, often 30, 60, or 90 days, within which clients must settle their outstanding balances, allowing freelancers to manage cash flow and project timelines effectively. Immediate payment requires clients to pay as soon as the service is delivered, ensuring instant revenue but potentially limiting flexibility for client budgeting. Understanding these differences helps freelancers tailor their invoicing strategies to balance prompt income with client relationship management.

Pros and Cons of Invoice Payment Terms for Freelancers

Invoice payment terms allow freelancers to manage cash flow effectively by setting clear deadlines for client payments, which can aid in financial planning and reduce disputes. However, these terms may lead to delayed income and require diligent follow-up to ensure timely payment, potentially causing cash flow challenges. Clear contract agreements and automated invoicing tools can help mitigate risks associated with postponed payments while maintaining professional client relationships.

Advantages and Disadvantages of Immediate Payment Methods

Immediate payment methods in freelancing ensure cash flow stability and reduce the risk of delayed or defaulted payments, providing freelancers with quick access to funds. However, they may limit flexibility for clients who prefer invoiced payment terms, potentially affecting client relationships and reducing opportunities for negotiation on payment deadlines. The choice of immediate payment versus invoiced terms impacts financial planning, client satisfaction, and operational workflow efficiency.

Impact on Cash Flow: Invoice Payment Terms vs Immediate Payment

Invoice payment terms such as net 30 or net 60 can delay revenue recognition and create cash flow gaps, impacting a freelancer's ability to manage operational expenses and invest in growth. Immediate payment ensures faster access to funds, enhancing liquidity and reducing reliance on credit or loans. Optimizing payment terms based on client reliability improves predictability and financial stability for freelancers.

Choosing the Right Payment Terms for Your Freelance Business

Selecting appropriate invoice payment terms is crucial for maintaining steady cash flow and client relationships in freelancing. Standard terms like Net 30 offer clients a reasonable window for payment while immediate payment ensures faster revenue but may limit client flexibility. Balancing your cash flow needs with client preferences supports sustainable freelance business growth and reduces payment disputes.

Protecting Yourself: Contracts and Payment Agreements

Clearly defined invoice payment terms in contracts establish expectations and protect freelancers from delayed or missed payments by specifying due dates, penalties, and payment methods. Immediate payment clauses reduce financial risk by ensuring faster cash flow, but require explicit agreement to avoid disputes. Utilizing detailed payment agreements within contracts safeguards freelancers' rights and fosters professional accountability.

Common Payment Methods in Freelancing: Invoicing vs Instant Payment

Freelancers commonly use invoicing and immediate payment as primary methods for receiving compensation, with invoicing allowing detailed billing and payment tracking over agreed periods, typically net 15 to 30 days. Immediate payment methods such as PayPal, Venmo, or direct bank transfers facilitate quicker cash flow but may lack the formal documentation offered by invoices. Choosing between these methods depends on project scope, client preferences, and the freelancer's cash flow needs, balancing professionalism and payment speed.

Best Practices for Managing Payment Expectations with Clients

Clearly defining invoice payment terms, such as net 15 or net 30, establishes mutual expectations and reduces disputes. Freelancers should communicate payment policies upfront, include detailed invoices, and set reminders to encourage timely payments. Implementing consistent follow-ups and offering multiple payment methods enhances client convenience and improves cash flow.

Invoice Payment Terms vs Immediate Payment Infographic

bizdif.com

bizdif.com