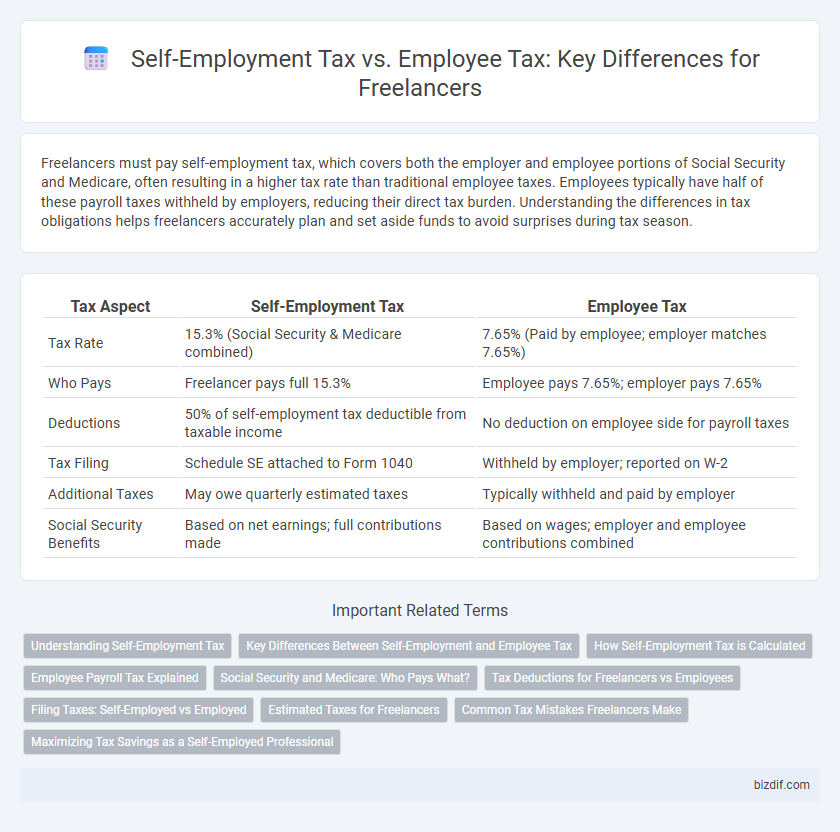

Freelancers must pay self-employment tax, which covers both the employer and employee portions of Social Security and Medicare, often resulting in a higher tax rate than traditional employee taxes. Employees typically have half of these payroll taxes withheld by employers, reducing their direct tax burden. Understanding the differences in tax obligations helps freelancers accurately plan and set aside funds to avoid surprises during tax season.

Table of Comparison

| Tax Aspect | Self-Employment Tax | Employee Tax |

|---|---|---|

| Tax Rate | 15.3% (Social Security & Medicare combined) | 7.65% (Paid by employee; employer matches 7.65%) |

| Who Pays | Freelancer pays full 15.3% | Employee pays 7.65%; employer pays 7.65% |

| Deductions | 50% of self-employment tax deductible from taxable income | No deduction on employee side for payroll taxes |

| Tax Filing | Schedule SE attached to Form 1040 | Withheld by employer; reported on W-2 |

| Additional Taxes | May owe quarterly estimated taxes | Typically withheld and paid by employer |

| Social Security Benefits | Based on net earnings; full contributions made | Based on wages; employer and employee contributions combined |

Understanding Self-Employment Tax

Self-employment tax encompasses both the employer and employee portions of Social Security and Medicare taxes, totaling 15.3%, compared to the typical 7.65% employees pay. Freelancers must calculate and pay self-employment tax on their net earnings annually using Schedule SE alongside Form 1040. Understanding these tax obligations is critical for accurate financial planning and avoiding penalties in freelance income reporting.

Key Differences Between Self-Employment and Employee Tax

Self-employment tax encompasses both Social Security and Medicare taxes paid entirely by the freelancer at a rate of 15.3%, unlike employee tax where the employer covers half. Freelancers must also file quarterly estimated taxes to avoid penalties, contrasting with employees whose taxes are withheld by payroll. Deductible business expenses reduce taxable income for self-employed individuals, a benefit not typically available to employees.

How Self-Employment Tax is Calculated

Self-employment tax is calculated based on 92.35% of net earnings from self-employment, which includes both Social Security and Medicare taxes totaling 15.3%. Unlike employee tax withholding where employers share half the Social Security and Medicare taxes, self-employed individuals pay the full amount themselves. It is essential to report accurate income and expenses on Schedule SE to determine the correct self-employment tax liability for IRS filing.

Employee Payroll Tax Explained

Employee payroll tax consists of Social Security and Medicare contributions automatically withheld from wages, typically amounting to 7.65% for employees, while employers match this contribution. In contrast, self-employed individuals must pay both the employee and employer portions of these taxes, totaling 15.3% under the self-employment tax. Understanding payroll tax obligations helps freelancers accurately estimate tax liabilities and plan for quarterly estimated payments to avoid penalties.

Social Security and Medicare: Who Pays What?

Self-employed individuals pay both the employer and employee portions of Social Security and Medicare taxes through self-employment tax, totaling 15.3%, while employees contribute only 7.65%, with their employers covering the remaining half. The self-employment tax consists of 12.4% for Social Security and 2.9% for Medicare, with an additional 0.9% Medicare surtax for high earners. Employees have these taxes withheld from their paychecks, whereas freelancers must calculate and remit them quarterly via estimated tax payments to avoid penalties.

Tax Deductions for Freelancers vs Employees

Freelancers face self-employment tax, encompassing both Social Security and Medicare contributions, often higher than employee payroll taxes but can deduct business expenses like home office costs and equipment to reduce taxable income. Employees have taxes withheld by employers and benefit from fewer tax deductions, primarily limited to itemized expenses eligible under specific conditions. Maximizing deductions such as health insurance premiums and retirement contributions is crucial for freelancers to offset the higher self-employment tax burden compared to employees.

Filing Taxes: Self-Employed vs Employed

Self-employed individuals must file Schedule C and pay self-employment tax, which covers both Social Security and Medicare contributions, usually totaling 15.3%. Employees, however, have these taxes withheld by their employer through payroll deductions, reducing their tax filing complexity. Understanding these distinctions is crucial for accurately reporting income and calculating tax liabilities during the annual tax filing process.

Estimated Taxes for Freelancers

Freelancers must pay self-employment tax, which covers both Social Security and Medicare taxes, unlike employees whose employers withhold these taxes. To avoid penalties, freelancers are required to file estimated taxes quarterly, based on their projected income, self-employment tax, and income tax liabilities. Properly calculating and submitting estimated taxes ensures compliance with IRS regulations and prevents underpayment issues.

Common Tax Mistakes Freelancers Make

Freelancers often underestimate the impact of self-employment tax, which covers Social Security and Medicare contributions totaling 15.3%, unlike employee tax where employers share half the burden. Many omit estimating quarterly estimated tax payments, leading to penalties and interest from the IRS. Failure to differentiate between deductible business expenses and personal costs frequently results in higher taxable income and increased tax liability.

Maximizing Tax Savings as a Self-Employed Professional

Self-employed professionals face both income tax and self-employment tax, which covers Social Security and Medicare contributions, unlike employees whose taxes are partially paid by employers. Maximizing tax savings involves deducting business expenses such as home office costs, equipment, and professional services to reduce taxable income effectively. Utilizing retirement plans like SEP IRAs or Solo 401(k)s further lowers taxable income while securing financial future benefits.

self-employment tax vs employee tax Infographic

bizdif.com

bizdif.com