Invoice submission involves the freelancer sending a detailed billing statement to the client for completed work, specifying payment terms and deadlines. Escrow release entails the client or an authorized party releasing funds held in escrow to the freelancer only after satisfactory completion of agreed milestones or deliverables. Understanding the distinction between invoice submission and escrow release ensures timely payments and safeguards both parties in freelancing contracts.

Table of Comparison

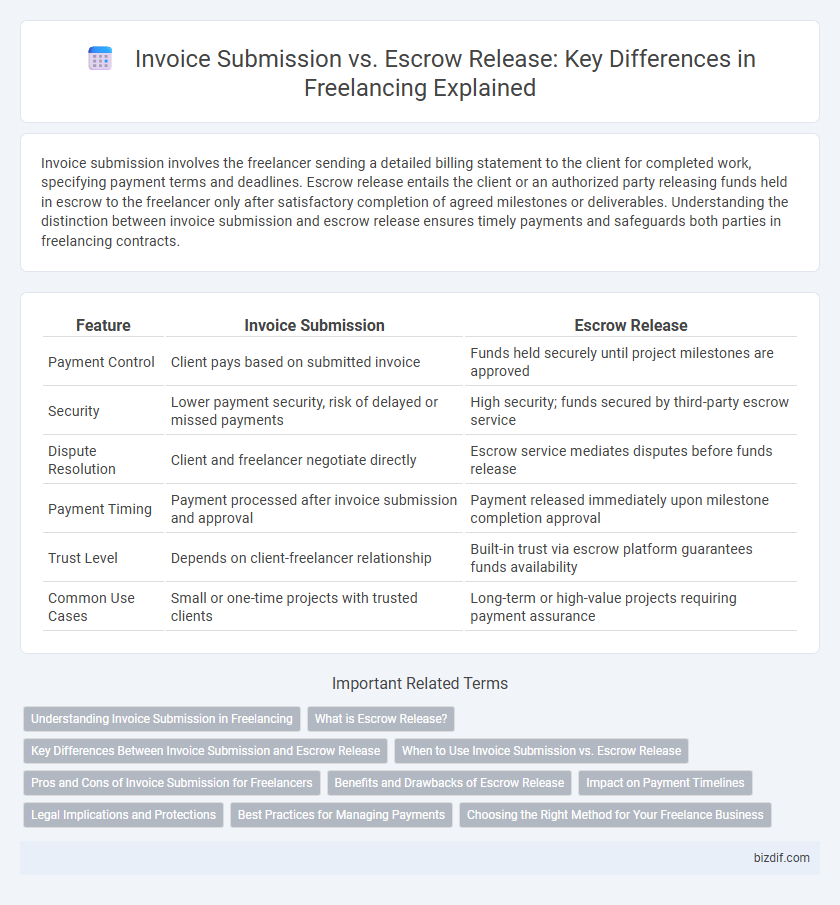

| Feature | Invoice Submission | Escrow Release |

|---|---|---|

| Payment Control | Client pays based on submitted invoice | Funds held securely until project milestones are approved |

| Security | Lower payment security, risk of delayed or missed payments | High security; funds secured by third-party escrow service |

| Dispute Resolution | Client and freelancer negotiate directly | Escrow service mediates disputes before funds release |

| Payment Timing | Payment processed after invoice submission and approval | Payment released immediately upon milestone completion approval |

| Trust Level | Depends on client-freelancer relationship | Built-in trust via escrow platform guarantees funds availability |

| Common Use Cases | Small or one-time projects with trusted clients | Long-term or high-value projects requiring payment assurance |

Understanding Invoice Submission in Freelancing

Invoice submission in freelancing involves the contractor sending a detailed billing statement to the client, specifying the completed work and payment due. This process establishes a formal request for payment and helps maintain clear financial documentation between the freelancer and client. Unlike escrow release, which depends on mutual agreement or project milestones, invoice submission directly initiates the payment cycle based on completed deliverables.

What is Escrow Release?

Escrow release is the process where funds held by a neutral third party in an escrow account are transferred to the freelancer after project milestones or contract terms are met. This method guarantees payment security by ensuring clients deposit funds upfront, which are only released upon satisfactory delivery of work. Escrow release protects both freelancers and clients, minimizing payment disputes and enhancing trust in freelance transactions.

Key Differences Between Invoice Submission and Escrow Release

Invoice submission involves the freelancer sending a detailed billing statement to the client specifying the completed work and payment amount, whereas escrow release refers to the client authorizing the payment held in a third-party escrow account to be transferred to the freelancer. An invoice acts as a payment request and record of services rendered, while escrow release provides secured payment protection, ensuring funds are available before work completion or approval. The key difference lies in the timing and security of the funds: invoices depend on client payment terms, while escrow release guarantees payment by holding funds in advance.

When to Use Invoice Submission vs. Escrow Release

Invoice submission is ideal when freelancers and clients agree on milestone-based payments or deliverables that require formal billing documentation before funds are transferred. Escrow release is preferred in fixed-price projects, where payment is secured upfront and funds are released only after the agreed work is completed and approved, ensuring protection for both parties. Choosing invoice submission versus escrow release depends on the project type, payment terms, and trust level between freelancer and client.

Pros and Cons of Invoice Submission for Freelancers

Invoice submission offers freelancers straightforward payment processing and clear documentation for tax and accounting purposes, enhancing financial transparency. However, relying solely on invoice submission can lead to delayed payments and increased risk of non-payment without client escrow protection. This method requires freelancers to invest time in follow-ups and may result in cash flow instability compared to escrow release systems.

Benefits and Drawbacks of Escrow Release

Escrow release in freelancing secures payment by holding funds in a neutral account until project milestones or final delivery are approved, reducing payment disputes and increasing trust between clients and freelancers. The main benefit is safeguarded transactions that ensure freelancers receive timely compensation while clients maintain control over funds until work satisfaction. However, escrow release may lead to delayed payments if clients hesitate to approve releases, potentially impacting the freelancer's cash flow and project continuity.

Impact on Payment Timelines

Invoice submission often results in variable payment timelines depending on client processing speeds, which can delay cash flow for freelancers. Escrow release guarantees faster and more reliable payments as funds are secured upfront, minimizing waiting periods. Prioritizing escrow mechanisms enhances financial stability by providing predictable payment schedules in freelancing projects.

Legal Implications and Protections

Invoice submission establishes a formal request for payment, creating a legally binding record of the work completed and the agreed-upon amount, which is crucial for enforcing payment in disputes. Escrow release offers enhanced protection by holding funds securely until both parties fulfill contractual obligations, reducing the risk of non-payment and providing a clear mechanism for dispute resolution. Understanding these differences helps freelancers safeguard their earnings and ensures compliance with contractual and legal standards.

Best Practices for Managing Payments

Invoice submission requires clear documentation of services rendered and timely delivery to ensure accurate payment processing. Escrow release protects both freelancers and clients by holding funds securely until project milestones are verified and approved. Maintaining transparent communication and setting explicit payment terms are crucial for preventing disputes and ensuring smooth financial transactions in freelance work.

Choosing the Right Method for Your Freelance Business

Selecting the appropriate payment method between invoice submission and escrow release significantly impacts cash flow management and client trust in freelancing. Invoice submission suits freelancers with established clients who value routine billing, while escrow release provides security by holding funds upfront, ideal for new or high-risk projects. Understanding project scope, client reliability, and payment terms helps freelancers optimize income stability and minimize payment disputes.

Invoice Submission vs Escrow Release Infographic

bizdif.com

bizdif.com