Self-employed individuals operate independently, often providing services without forming a formal business entity, while sole proprietors run a business owned and managed by one person, with legal obligations tied directly to the owner. Freelancers typically fall under self-employed status, but those choosing to register their work as a sole proprietorship gain access to benefits such as business banking and simplified tax reporting. Understanding the differences between self-employed and sole proprietor status helps freelancers optimize their financial management and legal protections.

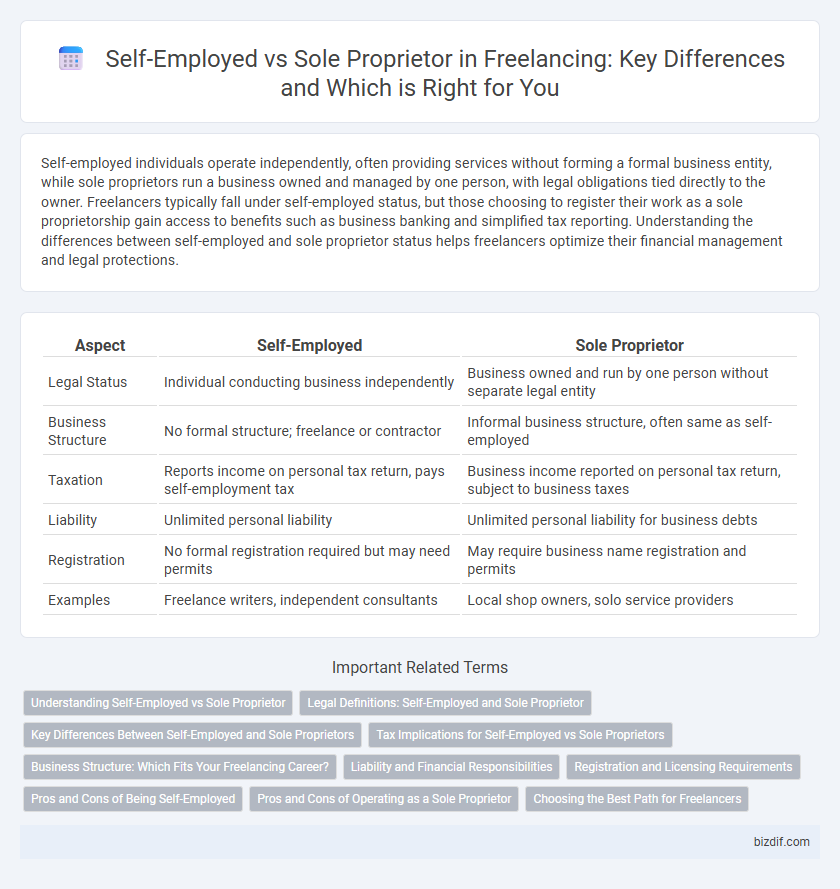

Table of Comparison

| Aspect | Self-Employed | Sole Proprietor |

|---|---|---|

| Legal Status | Individual conducting business independently | Business owned and run by one person without separate legal entity |

| Business Structure | No formal structure; freelance or contractor | Informal business structure, often same as self-employed |

| Taxation | Reports income on personal tax return, pays self-employment tax | Business income reported on personal tax return, subject to business taxes |

| Liability | Unlimited personal liability | Unlimited personal liability for business debts |

| Registration | No formal registration required but may need permits | May require business name registration and permits |

| Examples | Freelance writers, independent consultants | Local shop owners, solo service providers |

Understanding Self-Employed vs Sole Proprietor

Understanding self-employed individuals involves recognizing they operate independently and may run various business types, while sole proprietors specifically own and manage a single unincorporated business. Self-employment encompasses freelancers, consultants, and entrepreneurs who control their work, whereas a sole proprietor assumes full legal responsibility for business debts and liabilities. Tax implications differ as sole proprietors report business income on personal tax returns using Schedule C, while self-employed individuals must pay self-employment taxes covering Social Security and Medicare.

Legal Definitions: Self-Employed and Sole Proprietor

The self-employed refer to individuals who work for themselves without an employer, encompassing various business structures, while a sole proprietor is a specific legal designation for a self-employed individual operating an unincorporated business personally owned and managed. Sole proprietorships lack separate legal status from the owner, meaning personal assets are exposed to business liabilities, unlike certain self-employed classifications like LLCs which offer liability protection. Understanding these definitions is crucial for freelancers to select the appropriate legal structure based on liability, tax implications, and operational control.

Key Differences Between Self-Employed and Sole Proprietors

Self-employed individuals work independently and may operate under various business structures, while sole proprietors specifically run unincorporated businesses owned by one person. Tax reporting for self-employed workers often involves Schedule C or other forms based on their business type, whereas sole proprietors report income and expenses directly on Schedule C of their personal tax returns. Liability differs as sole proprietors have unlimited personal liability for business debts, while self-employed individuals with different business entities might have limited liability protection.

Tax Implications for Self-Employed vs Sole Proprietors

Self-employed individuals report their business income on Schedule C of their personal tax returns, paying both income tax and self-employment tax, which covers Social Security and Medicare. Sole proprietors face a similar tax structure but may benefit from deductions tied specifically to their business expenses to reduce taxable income. Understanding these tax obligations helps freelancers optimize their financial strategies and ensure compliance with IRS requirements.

Business Structure: Which Fits Your Freelancing Career?

Choosing the right business structure is essential for freelancing success, with self-employed and sole proprietor statuses offering distinct advantages. A sole proprietor operates as an unincorporated business owned entirely by one person, providing simplicity in tax filing and full control, while a self-employed individual might operate under various business structures including sole proprietor, LLC, or corporation. Freelancers should evaluate liability protection, tax implications, and long-term growth goals to determine which business structure best fits their freelancing career.

Liability and Financial Responsibilities

Self-employed individuals bear unlimited personal liability for business debts, exposing personal assets to financial risks. Sole proprietors also face unlimited liability, making them personally responsible for all business obligations and potential lawsuits. Both structures require personal accountability for taxes, but sole proprietors must manage business losses directly impacting their personal finances.

Registration and Licensing Requirements

Self-employed individuals generally operate without formal business registration, conducting freelance work under their personal name and Social Security number, which simplifies tax reporting but limits legal protections. Sole proprietors must register their business name with local or state authorities, obtain relevant licenses or permits depending on the industry, and may need an Employer Identification Number (EIN) if they hire employees. Understanding specific state and municipal requirements ensures compliance for sole proprietors, while self-employed freelancers benefit from fewer regulatory hurdles but increased personal liability risks.

Pros and Cons of Being Self-Employed

Being self-employed offers greater control over work schedules and the freedom to choose clients, fostering entrepreneurial growth and flexibility. However, it involves managing all business risks, handling taxes independently, and facing income variability without the safety net of employee benefits. Sole proprietorship simplifies taxes and legal requirements but provides no personal liability protection, making it crucial to weigh business structure choices carefully.

Pros and Cons of Operating as a Sole Proprietor

Operating as a sole proprietor provides freelancers with complete control over business decisions and simplified tax filing under personal income tax, but it exposes them to unlimited personal liability for business debts and legal actions. This structure requires minimal paperwork and lower startup costs, making it ideal for small-scale independent contractors, yet it may limit access to funding and hinder scalability. Freelancers must weigh the ease of management against personal financial risk when choosing the sole proprietorship model.

Choosing the Best Path for Freelancers

Freelancers deciding between self-employed status and sole proprietorship should prioritize understanding legal liabilities, tax obligations, and operational flexibility associated with each structure. Sole proprietorship offers simplicity and direct control but may expose personal assets to business liabilities, while self-employed individuals must manage their own taxes and benefits without the protections of a registered business entity. Evaluating income stability, risk tolerance, and long-term growth plans helps identify the most strategic path for sustainable freelancing success.

Self-employed vs Sole proprietor Infographic

bizdif.com

bizdif.com