Escrow services provide a secure payment method by holding funds until the agreed work is delivered and approved, ensuring trust between freelancers and clients. Invoices are formal requests for payment after completing work, which may carry payment risks if the client delays or refuses to pay. Choosing escrow over invoices minimizes financial disputes and guarantees timely compensation in freelance pet projects.

Table of Comparison

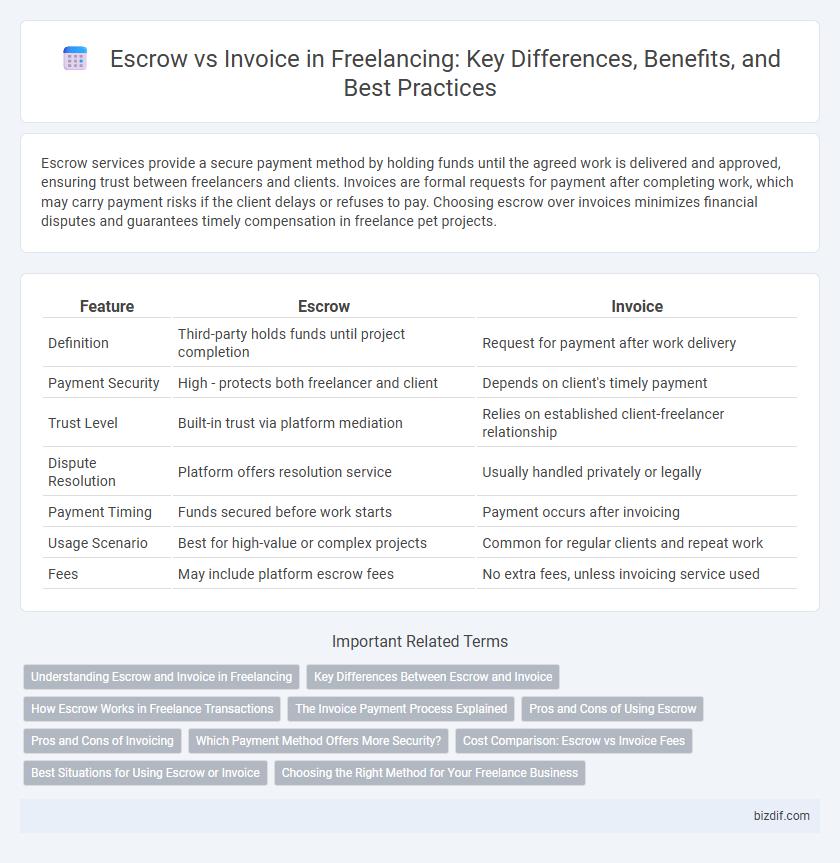

| Feature | Escrow | Invoice |

|---|---|---|

| Definition | Third-party holds funds until project completion | Request for payment after work delivery |

| Payment Security | High - protects both freelancer and client | Depends on client's timely payment |

| Trust Level | Built-in trust via platform mediation | Relies on established client-freelancer relationship |

| Dispute Resolution | Platform offers resolution service | Usually handled privately or legally |

| Payment Timing | Funds secured before work starts | Payment occurs after invoicing |

| Usage Scenario | Best for high-value or complex projects | Common for regular clients and repeat work |

| Fees | May include platform escrow fees | No extra fees, unless invoicing service used |

Understanding Escrow and Invoice in Freelancing

Escrow in freelancing secures funds by holding client payments in a third-party account until project milestones are met, ensuring trust and payment protection for both parties. Invoices serve as formal payment requests from freelancers, detailing services provided, payment terms, and due dates to maintain clear financial communication. Choosing between escrow and invoices depends on project complexity, client-freelancer trust levels, and payment security preferences.

Key Differences Between Escrow and Invoice

Escrow involves a third-party holding funds securely until project milestones are met, ensuring payment protection for freelancers, whereas an invoice is a direct request for payment issued by the freelancer to the client after completing services. Escrow systems reduce payment risks and build trust in freelance contracts, while invoices rely on client honesty and timely payment processing. Key differences include payment security, dispute resolution mechanisms, and the timing of fund release, impacting cash flow and project management in freelancing.

How Escrow Works in Freelance Transactions

Escrow in freelance transactions acts as a secure intermediary account where the client deposits funds before the project begins, ensuring payment protection for both parties. The freelancer proceeds with the work knowing the funds are reserved, and upon satisfactory project completion and client approval, the escrow service releases the payment. This method minimizes risk of non-payment and disputes by providing transparent transaction management throughout the freelancing process.

The Invoice Payment Process Explained

In freelancing, the invoice payment process involves the freelancer sending a detailed invoice after completing the work, specifying the payment amount, due date, and payment methods. Clients review the invoice and process payment through agreed channels, often using platforms or bank transfers, ensuring transparency and record-keeping. Unlike escrow, which secures funds before work begins, the invoice system relies on post-completion payment, requiring trust and clear communication between freelancer and client.

Pros and Cons of Using Escrow

Using escrow in freelancing ensures secure payments by holding funds until the agreed work is completed, reducing the risk of non-payment and building trust between client and freelancer. However, escrow services often involve fees and can delay access to funds compared to direct invoicing. While escrow enhances financial safety, it may slow down cash flow and increase transaction costs, especially for smaller projects.

Pros and Cons of Invoicing

Invoicing offers freelancers straightforward payment requests with clear documentation, simplifying tax reporting and cash flow management, but lacks built-in payment security, increasing the risk of delayed or non-payment from clients. While invoices foster professional relationships through transparent billing, disputes may arise without a neutral party to mediate, unlike escrow services that hold funds securely before work completion. Freelancers must weigh the ease and familiarity of invoicing against potential financial risks and consider contracts or payment terms to mitigate late payments.

Which Payment Method Offers More Security?

Escrow services provide enhanced security by holding funds in a neutral account until both freelancer and client fulfill agreed-upon terms, minimizing risk of nonpayment or incomplete work. Invoices depend on client goodwill and timely payment, offering less protection against disputes or delayed transactions. Therefore, escrow is generally regarded as the more secure payment method in freelancing agreements.

Cost Comparison: Escrow vs Invoice Fees

Escrow services typically charge a fee ranging from 1% to 5% of the transaction amount, providing secure payment protection for both freelancers and clients, whereas invoice processing fees vary widely, often including flat fees or percentages from 0.5% to 3% depending on the payment platform used. Escrow fees can be higher due to the added security and dispute resolution mechanisms, making it a costlier option compared to straightforward invoicing solutions that might have lower base fees but less protection. Freelancers must weigh the trade-offs between escrow's higher fees for guaranteed payment security against invoicing's potentially lower fees with increased risk of delayed or disputed payments.

Best Situations for Using Escrow or Invoice

Escrow is best suited for high-value freelance projects requiring secure payment protection, ensuring funds are held by a trusted third party until project milestones are met. Invoices work well for ongoing, trusted client relationships where services are billed regularly and prompt payments are expected without the need for third-party intervention. Freelancers handling complex deliverables or first-time clients benefit from escrow to mitigate risks, while established collaborations often rely on invoicing for streamlined financial transactions.

Choosing the Right Method for Your Freelance Business

Choosing between escrow and invoicing depends on project scope, client trust level, and payment security needs. Escrow services offer secured funds held by a third party, ensuring payment upon completion, ideal for high-value or complex projects. Invoicing provides flexibility and quicker payment cycles but requires robust client trust and clear payment terms to minimize disputes.

Escrow vs Invoice Infographic

bizdif.com

bizdif.com