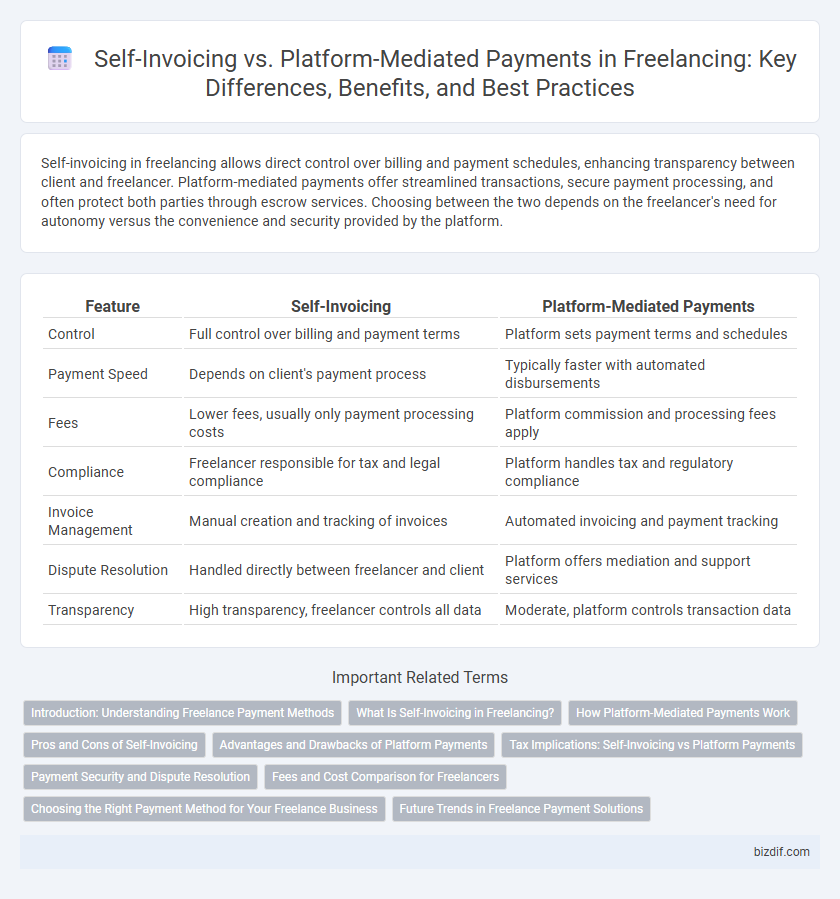

Self-invoicing in freelancing allows direct control over billing and payment schedules, enhancing transparency between client and freelancer. Platform-mediated payments offer streamlined transactions, secure payment processing, and often protect both parties through escrow services. Choosing between the two depends on the freelancer's need for autonomy versus the convenience and security provided by the platform.

Table of Comparison

| Feature | Self-Invoicing | Platform-Mediated Payments |

|---|---|---|

| Control | Full control over billing and payment terms | Platform sets payment terms and schedules |

| Payment Speed | Depends on client's payment process | Typically faster with automated disbursements |

| Fees | Lower fees, usually only payment processing costs | Platform commission and processing fees apply |

| Compliance | Freelancer responsible for tax and legal compliance | Platform handles tax and regulatory compliance |

| Invoice Management | Manual creation and tracking of invoices | Automated invoicing and payment tracking |

| Dispute Resolution | Handled directly between freelancer and client | Platform offers mediation and support services |

| Transparency | High transparency, freelancer controls all data | Moderate, platform controls transaction data |

Introduction: Understanding Freelance Payment Methods

Freelance payment methods primarily include self-invoicing and platform-mediated payments, each offering distinct advantages in transaction control and security. Self-invoicing allows freelancers to manage billing directly with clients, enhancing customization and record accuracy, while platform-mediated payments provide built-in safeguards, automated processing, and dispute resolution. Understanding these methods helps freelancers optimize cash flow management and reduce payment delays in the gig economy.

What Is Self-Invoicing in Freelancing?

Self-invoicing in freelancing refers to a process where freelancers generate and submit their own invoices directly to clients without intermediary platforms. This method allows for greater control over billing details, payment terms, and timing while requiring freelancers to manage tax compliance and record-keeping independently. Self-invoicing can enhance financial transparency and streamline cash flow management for freelancers handling multiple clients or long-term contracts.

How Platform-Mediated Payments Work

Platform-mediated payments operate by connecting freelancers and clients through an intermediary that handles invoicing, payment processing, and compliance with tax regulations. When a job is completed, the platform generates an invoice, collects the payment from the client, deducts fees or taxes, and then disburses the net amount to the freelancer. This system ensures transparency, reduces payment delays, and provides a secure financial transaction environment, benefiting both parties in the freelancing ecosystem.

Pros and Cons of Self-Invoicing

Self-invoicing empowers freelancers with full control over billing, enabling customization and transparency in payment terms, which can enhance client trust and cash flow management. However, this method demands rigorous administrative effort to track payments and ensure timely follow-ups, increasing the risk of errors and delayed income. Freelancers face challenges in tax compliance and accounting accuracy without automated platform support, which can complicate financial record-keeping and increase the likelihood of disputes.

Advantages and Drawbacks of Platform Payments

Platform-mediated payments offer streamlined transaction processes, automated tax withholdings, and enhanced security, reducing administrative burden for freelancers. However, fees charged by platforms can significantly reduce net earnings, and payment schedules may be rigid, limiting cash flow flexibility. Dependence on platform infrastructure also exposes freelancers to risks of account suspension or changing payment policies.

Tax Implications: Self-Invoicing vs Platform Payments

Self-invoicing allows freelancers to maintain direct control over tax reporting, requiring careful documentation of expenses and income to comply with tax authorities. Platform-mediated payments typically simplify tax reporting by issuing consolidated 1099 or equivalent forms, but may limit deductions due to less detailed expense tracking. Understanding the tax implications of self-invoicing versus platform payments is crucial for optimizing deductions and ensuring accurate tax filings.

Payment Security and Dispute Resolution

Self-invoicing empowers freelancers with direct control over payment terms and timelines, enhancing transparency but potentially increasing the risk of delayed payments without a formal dispute mechanism. Platform-mediated payments offer robust payment security through escrow services and automatic release upon project completion, reducing payment disputes via integrated conflict resolution systems. Freelancers benefit from platform protection policies that ensure timely payments and provide structured mediation, which is often lacking in self-invoicing arrangements.

Fees and Cost Comparison for Freelancers

Self-invoicing allows freelancers to control their billing process, often avoiding platform fees and retaining a larger portion of their earnings, but requires managing invoice creation and payment tracking. Platform-mediated payments typically charge service fees ranging from 5% to 20%, which cover secure payment processing, dispute resolution, and client management, reducing administrative burdens. Comparing fees, freelancers must evaluate the cost-effectiveness of self-invoicing versus the convenience and additional services provided by platforms like Upwork, Fiverr, or Freelancer.com.

Choosing the Right Payment Method for Your Freelance Business

Choosing the right payment method for your freelance business depends on factors such as control, fees, and tax compliance. Self-invoicing offers freelancers full autonomy over payment schedules and client interactions but requires diligent bookkeeping and tax management. Platform-mediated payments, provided by services like Upwork or Fiverr, streamline transactions and offer built-in dispute resolution while often charging service fees and limiting direct client relationships.

Future Trends in Freelance Payment Solutions

Future trends in freelance payment solutions highlight increasing adoption of blockchain technology and smart contracts to ensure secure, transparent, and instant transactions. Self-invoicing is evolving with automated tools that integrate expense tracking and tax compliance, reducing administrative burdens for freelancers. Platform-mediated payments continue to enhance user experience by incorporating multi-currency support and faster cross-border processing, catering to the global freelance economy.

Self-Invoicing vs Platform-Mediated Payments Infographic

bizdif.com

bizdif.com