Payroll administration ensures accurate and timely compensation by managing employee salaries, taxes, and deductions, while benefits administration focuses on managing employee perks such as health insurance, retirement plans, and wellness programs. Both functions are critical within HR consulting to maintain compliance and enhance employee satisfaction, but payroll deals primarily with financial transactions, whereas benefits administration emphasizes employee well-being and long-term value. Effective HR consulting integrates these processes to streamline operations and deliver a comprehensive employee experience.

Table of Comparison

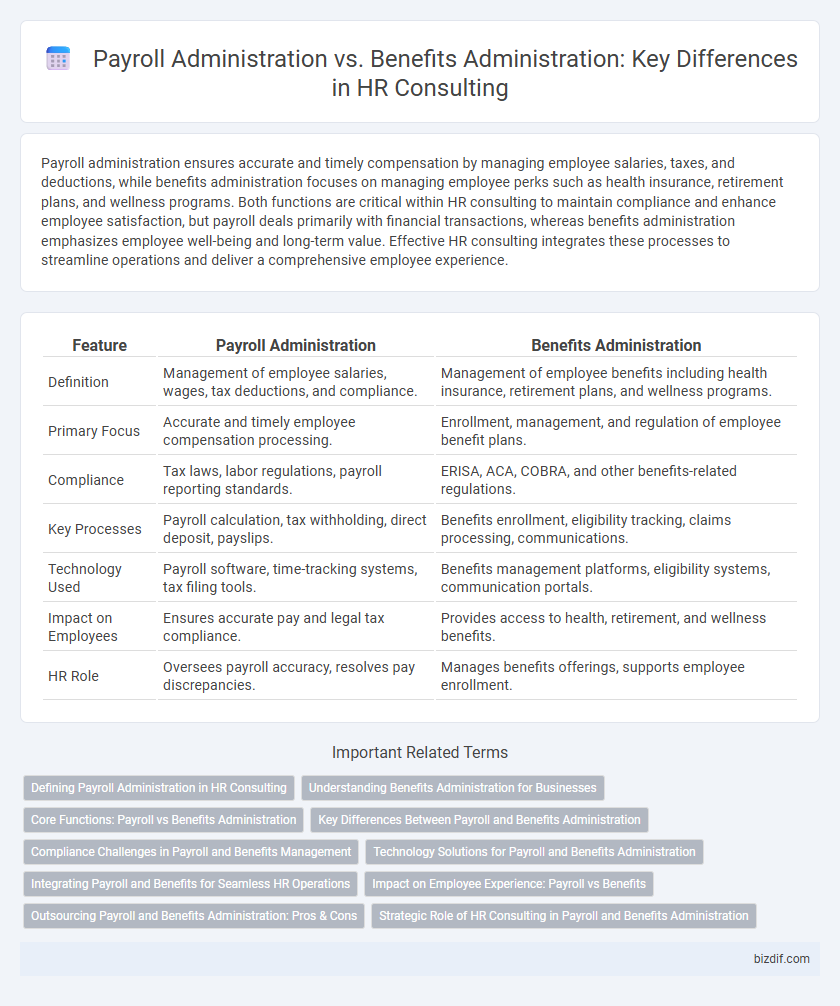

| Feature | Payroll Administration | Benefits Administration |

|---|---|---|

| Definition | Management of employee salaries, wages, tax deductions, and compliance. | Management of employee benefits including health insurance, retirement plans, and wellness programs. |

| Primary Focus | Accurate and timely employee compensation processing. | Enrollment, management, and regulation of employee benefit plans. |

| Compliance | Tax laws, labor regulations, payroll reporting standards. | ERISA, ACA, COBRA, and other benefits-related regulations. |

| Key Processes | Payroll calculation, tax withholding, direct deposit, payslips. | Benefits enrollment, eligibility tracking, claims processing, communications. |

| Technology Used | Payroll software, time-tracking systems, tax filing tools. | Benefits management platforms, eligibility systems, communication portals. |

| Impact on Employees | Ensures accurate pay and legal tax compliance. | Provides access to health, retirement, and wellness benefits. |

| HR Role | Oversees payroll accuracy, resolves pay discrepancies. | Manages benefits offerings, supports employee enrollment. |

Defining Payroll Administration in HR Consulting

Payroll administration in HR consulting involves managing employee compensation, including salary calculation, tax deductions, and timely disbursement of wages. It ensures compliance with legal regulations such as tax laws and labor standards while maintaining accurate payroll records. Efficient payroll administration is essential for minimizing errors, reducing financial risks, and enhancing employee satisfaction.

Understanding Benefits Administration for Businesses

Benefits administration involves managing employee compensation packages beyond salaries, including health insurance, retirement plans, and paid time off, which are essential for attracting and retaining talent. This function requires thorough knowledge of compliance with regulations such as ERISA and the Affordable Care Act, ensuring legal adherence and minimizing risks. Effective benefits administration enhances employee satisfaction and supports business objectives through tailored plan design and clear communication strategies.

Core Functions: Payroll vs Benefits Administration

Payroll administration focuses on accurate calculation, timely processing, and compliance with tax regulations for employee wages, deductions, and reporting requirements. Benefits administration manages employee eligibility, enrollment, and maintenance of health insurance, retirement plans, and other non-wage compensations. Both functions require detailed record-keeping and adherence to legal standards, but payroll emphasizes financial transactions while benefits prioritize employee entitlements and plan management.

Key Differences Between Payroll and Benefits Administration

Payroll administration involves managing employee compensation, tax withholdings, and compliance with labor laws, ensuring accurate and timely salary disbursements. Benefits administration focuses on managing employee benefits such as health insurance, retirement plans, and paid time off, facilitating enrollment, eligibility, and claims processing. The key differences lie in payroll handling financial transactions and compliance, while benefits administration manages non-wage compensations and employee well-being programs.

Compliance Challenges in Payroll and Benefits Management

Payroll administration faces compliance challenges related to accurate tax withholding, timely wage payments, and adherence to labor laws such as the Fair Labor Standards Act (FLSA). Benefits administration must navigate complex regulatory frameworks including the Employee Retirement Income Security Act (ERISA), Affordable Care Act (ACA), and COBRA continuation coverage requirements. Both payroll and benefits management require robust recordkeeping and regular audits to mitigate risks of non-compliance and costly penalties.

Technology Solutions for Payroll and Benefits Administration

Technology solutions for payroll administration streamline salary processing, tax calculations, and compliance tracking using automated software platforms like ADP and Paychex. Benefits administration technology simplifies employee benefits enrollment, eligibility verification, and claims management through integrated tools such as Zenefits and Gusto. Leveraging cloud-based HR technology enhances accuracy, reduces manual errors, and provides real-time data analytics for both payroll and benefits management.

Integrating Payroll and Benefits for Seamless HR Operations

Integrating payroll and benefits administration streamlines HR operations by ensuring accurate deductions, timely payments, and comprehensive employee data management. Centralized systems reduce errors and improve compliance with tax regulations and benefits reporting requirements. Optimized integration drives efficiency, enhances employee satisfaction, and supports strategic HR decision-making.

Impact on Employee Experience: Payroll vs Benefits

Effective payroll administration ensures timely and accurate salary payments, directly influencing employee satisfaction and trust in the organization. Benefits administration enhances employee experience by providing access to health insurance, retirement plans, and wellness programs, contributing to overall job satisfaction and retention. Balancing payroll accuracy with comprehensive benefits management creates a positive workplace environment that drives employee engagement and loyalty.

Outsourcing Payroll and Benefits Administration: Pros & Cons

Outsourcing payroll administration reduces errors and ensures compliance with tax regulations through specialized expertise, streamlining employee compensation processing. Conversely, benefits administration outsourcing enhances plan management efficiency and employee access to support but may limit direct employer control over customized benefits. Both options present cost-saving potential and scalability benefits while requiring careful vendor selection to balance data security and service quality.

Strategic Role of HR Consulting in Payroll and Benefits Administration

HR consulting plays a strategic role in payroll and benefits administration by ensuring compliance with labor laws while optimizing cost-efficiency and employee satisfaction. Expert consultants integrate advanced payroll systems with benefit management platforms to streamline processes and enhance data accuracy, reducing administrative burdens. Strategic HR advisory supports organizations in designing competitive benefits packages that attract talent and improve retention, aligning with overall business goals.

Payroll Administration vs Benefits Administration Infographic

bizdif.com

bizdif.com