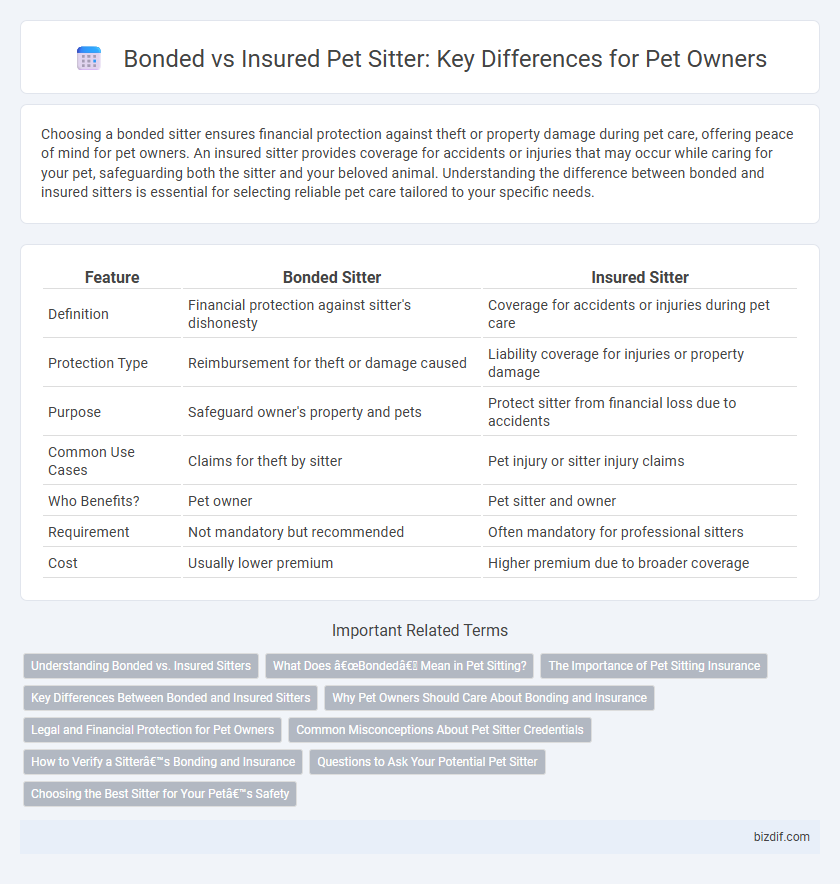

Choosing a bonded sitter ensures financial protection against theft or property damage during pet care, offering peace of mind for pet owners. An insured sitter provides coverage for accidents or injuries that may occur while caring for your pet, safeguarding both the sitter and your beloved animal. Understanding the difference between bonded and insured sitters is essential for selecting reliable pet care tailored to your specific needs.

Table of Comparison

| Feature | Bonded Sitter | Insured Sitter |

|---|---|---|

| Definition | Financial protection against sitter's dishonesty | Coverage for accidents or injuries during pet care |

| Protection Type | Reimbursement for theft or damage caused | Liability coverage for injuries or property damage |

| Purpose | Safeguard owner's property and pets | Protect sitter from financial loss due to accidents |

| Common Use Cases | Claims for theft by sitter | Pet injury or sitter injury claims |

| Who Benefits? | Pet owner | Pet sitter and owner |

| Requirement | Not mandatory but recommended | Often mandatory for professional sitters |

| Cost | Usually lower premium | Higher premium due to broader coverage |

Understanding Bonded vs. Insured Sitters

Bonded sitters have a surety bond that protects pet owners from financial loss caused by the sitter's negligence or theft, offering reimbursement up to a specified limit. Insured sitters carry liability insurance that covers accidents or injuries occurring during pet care, protecting both the sitter and owner from costly claims. Understanding these distinctions helps pet owners choose the appropriate protection based on risks associated with pet sitting services.

What Does “Bonded” Mean in Pet Sitting?

A bonded pet sitter has obtained a surety bond that provides financial protection to clients if the sitter causes theft or property damage while on the job. This bond acts as a protection guarantee, reimbursing pet owners for losses up to the bond's coverage limit, ensuring trust and security during pet care. Unlike insurance, bonding does not cover accidents or injuries but specifically safeguards against dishonest acts by the sitter.

The Importance of Pet Sitting Insurance

Pet sitting insurance covers liabilities and potential damages during pet care, protecting both the sitter and the pet owner from unexpected expenses. A bonded sitter has a financial guarantee that can reimburse clients if theft or loss occurs, while an insured sitter possesses comprehensive liability coverage for accidents or injuries. Choosing a pet sitter with both bonding and insurance ensures maximum security and peace of mind throughout the pet sitting service.

Key Differences Between Bonded and Insured Sitters

Bonded sitters have a surety bond that protects clients against financial loss due to theft or dishonesty, ensuring reimbursement if the sitter causes damage or takes possessions. Insured sitters carry liability insurance that covers injuries or accidents occurring while pet sitting, protecting both the client and sitter from potential legal and medical expenses. Understanding the difference helps pet owners choose sitters who offer financial protection tailored to their specific concerns, whether property safety or personal liability.

Why Pet Owners Should Care About Bonding and Insurance

Bonded sitters provide financial protection to pet owners by ensuring reimbursement for losses caused by the sitter, such as theft or property damage. Insured sitters carry liability insurance that covers injuries or accidents involving pets during care, reducing financial risk for owners. Understanding the distinction between bonded and insured sitters helps pet owners choose reliable caregivers who offer security and peace of mind.

Legal and Financial Protection for Pet Owners

A bonded sitter offers a financial guarantee protecting pet owners against theft or property damage caused by the sitter, providing a refund if claims are validated. An insured sitter carries liability insurance that covers accidents or injuries to pets during care, shielding owners from potential medical or legal expenses. Choosing a bonded and insured sitter ensures comprehensive legal and financial protection for pet owners, minimizing risks associated with pet sitting services.

Common Misconceptions About Pet Sitter Credentials

Many pet owners misinterpret the terms "bonded" and "insured," believing they offer the same protection, but bonded sitters have a surety bond that protects clients against employee theft, whereas insured sitters carry liability insurance covering accidents or injuries during pet care. Bonding reimburses clients if the sitter steals or damages property, while insurance provides financial coverage for pet-related incidents and property damage. Understanding these distinctions ensures pet owners select the right sitter credentials for comprehensive protection.

How to Verify a Sitter’s Bonding and Insurance

Verify a sitter's bonding and insurance by requesting official documentation from the sitter or agency, such as a bonding certificate and insurance policy details, to ensure coverage. Contact the bonding company directly to confirm the validity and coverage limits of the bond provided. For insurance verification, reach out to the insurer to validate the sitter's liability policy and confirm it includes coverage for pet sitting services.

Questions to Ask Your Potential Pet Sitter

When interviewing a potential pet sitter, ask if they are bonded, which provides financial protection if your property is damaged or stolen during their service. Inquire whether they carry liability insurance to cover accidents or injuries that may occur while caring for your pet. Understanding the distinction between bonded and insured sitters helps ensure comprehensive protection for both your belongings and your pet's well-being.

Choosing the Best Sitter for Your Pet’s Safety

Selecting a bonded pet sitter ensures protection against theft or property damage, providing financial security if the sitter mishandles your belongings during pet care. Choosing an insured sitter offers coverage for accidents or injuries that may occur to your pet or the sitter, safeguarding both parties from potential medical or liability expenses. Prioritize a pet sitter who is both bonded and insured to maximize your pet's safety and minimize risks associated with unforeseen incidents.

Bonded sitter vs Insured sitter Infographic

bizdif.com

bizdif.com