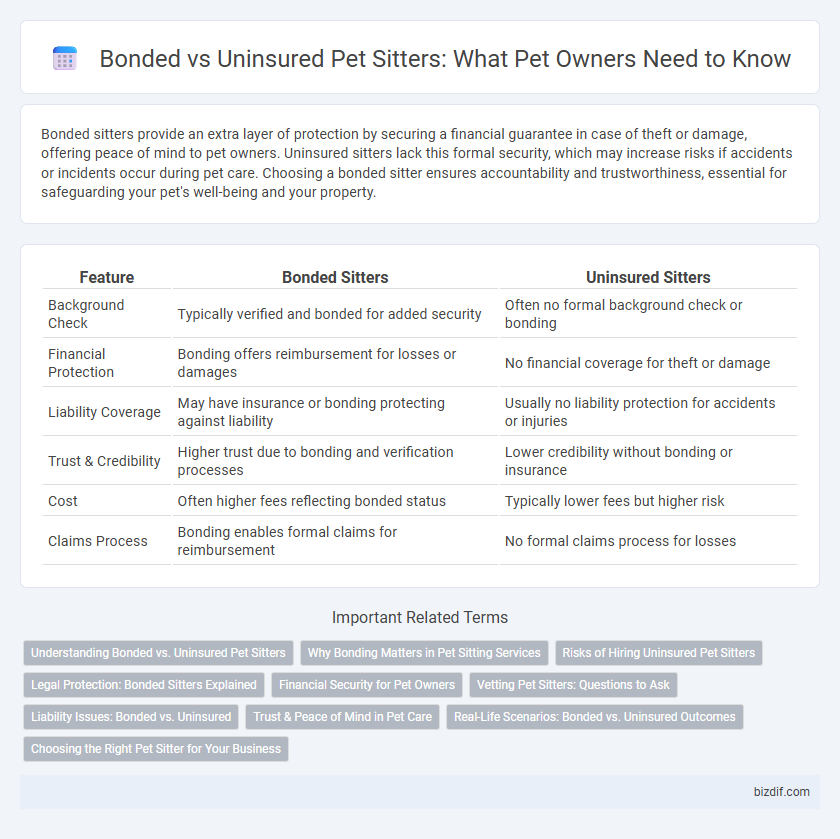

Bonded sitters provide an extra layer of protection by securing a financial guarantee in case of theft or damage, offering peace of mind to pet owners. Uninsured sitters lack this formal security, which may increase risks if accidents or incidents occur during pet care. Choosing a bonded sitter ensures accountability and trustworthiness, essential for safeguarding your pet's well-being and your property.

Table of Comparison

| Feature | Bonded Sitters | Uninsured Sitters |

|---|---|---|

| Background Check | Typically verified and bonded for added security | Often no formal background check or bonding |

| Financial Protection | Bonding offers reimbursement for losses or damages | No financial coverage for theft or damage |

| Liability Coverage | May have insurance or bonding protecting against liability | Usually no liability protection for accidents or injuries |

| Trust & Credibility | Higher trust due to bonding and verification processes | Lower credibility without bonding or insurance |

| Cost | Often higher fees reflecting bonded status | Typically lower fees but higher risk |

| Claims Process | Bonding enables formal claims for reimbursement | No formal claims process for losses |

Understanding Bonded vs. Uninsured Pet Sitters

Bonded pet sitters provide financial protection to clients by securing a surety bond that covers theft or damage, ensuring trust and peace of mind. Uninsured sitters lack this financial safeguard, increasing risk for pet owners in case of accidents, injuries, or property damage during pet care services. Choosing bonded sitters reduces liability and guarantees compensation if any mishaps occur, making them a safer option for responsible pet management.

Why Bonding Matters in Pet Sitting Services

Bonded pet sitters provide financial protection by having a surety bond that covers theft or damage, ensuring client assets are safeguarded. This bonding gives pet owners peace of mind, knowing that any loss caused by the sitter's negligence is reimbursed. In contrast, uninsured sitters offer no such guarantee, increasing the risk and potential liability for pet owners during pet sitting services.

Risks of Hiring Uninsured Pet Sitters

Hiring uninsured pet sitters poses significant risks including liability for veterinary expenses or property damage caused during the pet sitting period. Without insurance, pet owners may face out-of-pocket costs if the sitter fails to provide adequate care or if accidents occur. Bonded sitters, by contrast, offer financial protection and peace of mind through coverage that mitigates these potential liabilities.

Legal Protection: Bonded Sitters Explained

Bonded pet sitters provide legal protection by ensuring compensation for clients if a sitter causes theft or property damage during the service. This bond acts as a financial guarantee, giving pet owners peace of mind compared to uninsured sitters who lack such coverage. Choosing a bonded sitter minimizes legal risks and reinforces trust by holding the sitter accountable through a professional bonding agency.

Financial Security for Pet Owners

Bonded pet sitters provide financial security for pet owners by offering protection against theft, property damage, or other losses, ensuring compensation in case of unforeseen incidents. Uninsured sitters lack this financial safeguard, which can expose pet owners to potential out-of-pocket expenses for damages or accidents during pet care. Choosing bonded sitters enhances trust and minimizes financial risks associated with pet sitting services.

Vetting Pet Sitters: Questions to Ask

When vetting pet sitters, confirming if they are bonded ensures financial protection against theft or damages, which offers peace of mind for pet owners. Asking whether a sitter carries liability insurance is crucial, as uninsured sitters may leave owners vulnerable to costly accidents or injuries during pet care. Prioritize sitters who provide proof of bonding and insurance to guarantee reliable and accountable pet sitting services.

Liability Issues: Bonded vs. Uninsured

Bonded pet sitters provide a financial guarantee that protects clients against theft or damage, reducing liability concerns in case of mishaps. Uninsured sitters lack this coverage, potentially leaving pet owners responsible for any losses or incidents that occur during care. Choosing a bonded sitter ensures peace of mind by transferring liability risks away from pet owners.

Trust & Peace of Mind in Pet Care

Bonded sitters provide a financial safety net that protects pet owners against potential loss or damage, offering enhanced trust and peace of mind during pet care. Uninsured sitters lack this formal security, increasing the risk and uncertainty for pet owners when entrusting their beloved animals. Choosing a bonded sitter ensures accountability and confidence, reinforcing a reliable pet care experience.

Real-Life Scenarios: Bonded vs. Uninsured Outcomes

Bonded pet sitters provide financial protection if they cause damage or theft during a pet sitting assignment, ensuring pet owners are reimbursed for losses, whereas uninsured sitters leave owners vulnerable to out-of-pocket expenses. In real-life scenarios, bonded sitters have resolved claims swiftly, maintaining client trust and accountability, while uninsured sitters often result in costly disputes with no guaranteed compensation. Choosing bonded sitters reduces risks associated with property damage and liability, offering peace of mind through verified coverage.

Choosing the Right Pet Sitter for Your Business

Choosing the right pet sitter for your business involves understanding the distinction between bonded sitters and uninsured sitters, where bonded sitters provide financial protection against theft or damage, enhancing client trust and business credibility. Uninsured sitters lack this protection, increasing liability risks and potential financial losses for your business. Prioritizing bonded pet sitters not only safeguards your company but also assures pet owners of professional, reliable care.

Bonded sitters vs Uninsured sitters Infographic

bizdif.com

bizdif.com