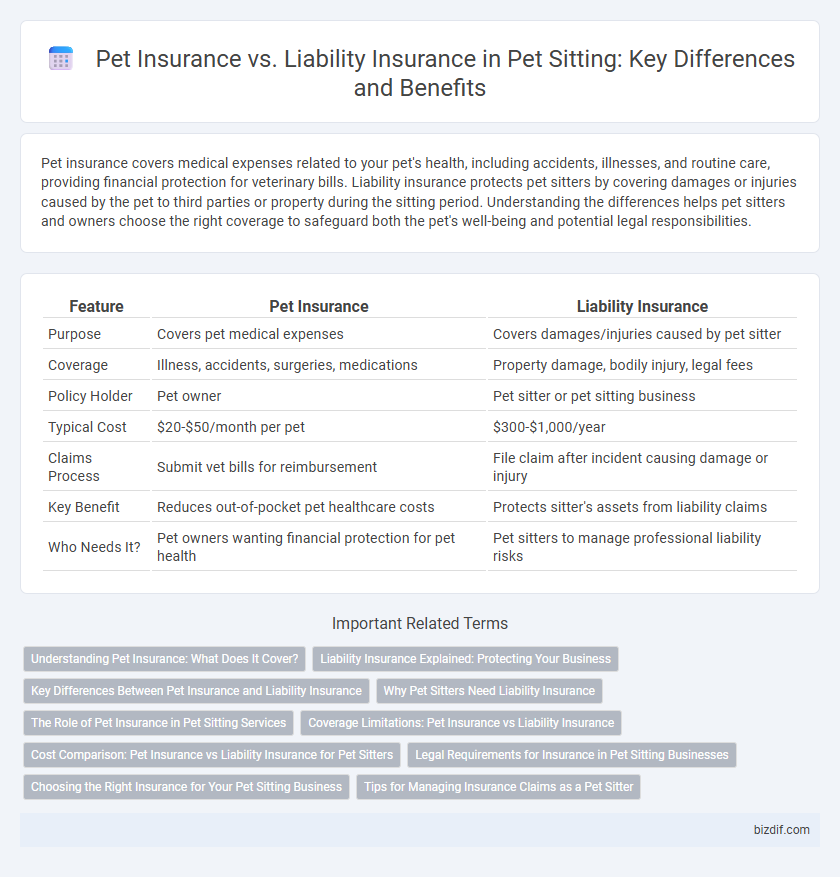

Pet insurance covers medical expenses related to your pet's health, including accidents, illnesses, and routine care, providing financial protection for veterinary bills. Liability insurance protects pet sitters by covering damages or injuries caused by the pet to third parties or property during the sitting period. Understanding the differences helps pet sitters and owners choose the right coverage to safeguard both the pet's well-being and potential legal responsibilities.

Table of Comparison

| Feature | Pet Insurance | Liability Insurance |

|---|---|---|

| Purpose | Covers pet medical expenses | Covers damages/injuries caused by pet sitter |

| Coverage | Illness, accidents, surgeries, medications | Property damage, bodily injury, legal fees |

| Policy Holder | Pet owner | Pet sitter or pet sitting business |

| Typical Cost | $20-$50/month per pet | $300-$1,000/year |

| Claims Process | Submit vet bills for reimbursement | File claim after incident causing damage or injury |

| Key Benefit | Reduces out-of-pocket pet healthcare costs | Protects sitter's assets from liability claims |

| Who Needs It? | Pet owners wanting financial protection for pet health | Pet sitters to manage professional liability risks |

Understanding Pet Insurance: What Does It Cover?

Pet insurance primarily covers veterinary expenses, including accidents, illnesses, surgeries, and routine care such as vaccinations and check-ups, protecting pet owners from high medical bills. Liability insurance, on the other hand, addresses damages or injuries a pet might cause to others or their property, providing financial protection against lawsuits. Understanding these distinctions helps pet sitters and owners choose the appropriate coverage to safeguard their pets and personal assets.

Liability Insurance Explained: Protecting Your Business

Liability insurance protects pet sitting businesses by covering legal costs and damages if a pet sitter is held responsible for accidents or injuries involving pets or clients. Unlike pet insurance, which covers the pet's health, liability insurance safeguards the business owner against claims of property damage, bodily injury, or negligence. This coverage is essential for pet sitters to ensure financial security and maintain trust with clients.

Key Differences Between Pet Insurance and Liability Insurance

Pet insurance covers veterinary expenses for illness, injury, and preventive care specific to pets, ensuring financial support for medical treatments. Liability insurance protects pet sitters from legal claims related to pet-inflicted injuries or property damage during the care period, covering legal fees and settlements. While pet insurance focuses on pet health costs, liability insurance safeguards against third-party damages linked to pet sitting services.

Why Pet Sitters Need Liability Insurance

Liability insurance protects pet sitters from financial losses related to accidents, injuries, or property damage that occur while caring for pets. Unlike pet insurance, which covers medical expenses for the animal, liability insurance covers legal fees and claims if a client's pet causes harm or damage. Securing liability insurance is essential for pet sitters to safeguard their business and maintain professional credibility.

The Role of Pet Insurance in Pet Sitting Services

Pet insurance in pet sitting services covers medical expenses for pets during the sitter's care, providing financial protection against unexpected health issues or injuries. This insurance enhances trust between pet sitters and pet owners by ensuring pets receive necessary veterinary treatment without burdening the sitter. Unlike liability insurance, which protects sitters from claims related to property damage or bodily injury, pet insurance specifically addresses the pet's health needs during the service period.

Coverage Limitations: Pet Insurance vs Liability Insurance

Pet insurance primarily covers veterinary expenses for illnesses, injuries, and routine care but does not protect against property damage or bodily injury caused by pets. Liability insurance, on the other hand, provides financial protection for claims arising from pet-related incidents such as bites or property damage, covering legal fees and settlements up to the policy limits. Understanding the distinct coverage limitations of pet insurance versus liability insurance is essential for pet sitters to ensure comprehensive risk management.

Cost Comparison: Pet Insurance vs Liability Insurance for Pet Sitters

Pet insurance for pet sitters typically costs between $30 and $50 per month, covering veterinary bills and pet health emergencies, while liability insurance averages $400 to $600 annually, protecting against third-party claims such as property damage or injury. Pet insurance premiums vary based on the type, age, and breed of the animal, whereas liability insurance rates depend on coverage limits and business size. Choosing between pet insurance and liability insurance requires weighing the direct health protection for pets against broader legal and financial coverage for the sitter's business risks.

Legal Requirements for Insurance in Pet Sitting Businesses

Pet sitting businesses must comply with specific legal requirements regarding insurance to protect against potential risks. Liability insurance is often mandatory as it covers damages or injuries caused to pets or third parties during pet sitting services, while pet insurance generally serves as optional coverage for the pets themselves. Understanding the distinction and securing appropriate liability coverage ensures legal compliance and safeguards the business from financial liabilities related to accidents or property damage.

Choosing the Right Insurance for Your Pet Sitting Business

Pet sitting businesses should carefully evaluate pet insurance and liability insurance to protect against different risks: pet insurance covers veterinary expenses if pets under their care get injured or ill, while liability insurance protects against claims of property damage or bodily injury caused by the sitter. Selecting the right insurance involves assessing the scope of coverage, policy limits, exclusions, and premiums to match the specific needs and scale of the pet sitting operation. A combined policy approach often provides comprehensive protection, ensuring both pet health incidents and client liability claims are financially covered.

Tips for Managing Insurance Claims as a Pet Sitter

Pet sitters should maintain detailed records of pet care activities and incidents to streamline insurance claims for both pet insurance and liability insurance. Understanding policy coverage specifics, such as medical expenses for pets and third-party injury protection, helps ensure accurate and timely claim submissions. Prompt communication with insurance providers and clear documentation significantly reduces claim processing delays and increases the likelihood of reimbursement.

Pet insurance vs Liability insurance Infographic

bizdif.com

bizdif.com