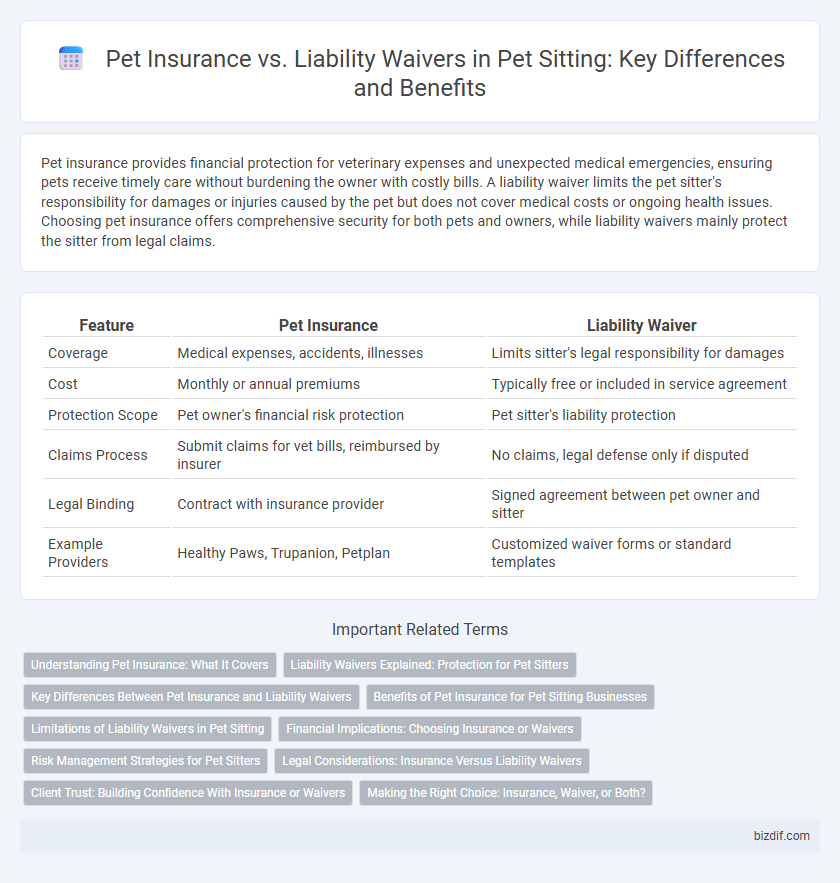

Pet insurance provides financial protection for veterinary expenses and unexpected medical emergencies, ensuring pets receive timely care without burdening the owner with costly bills. A liability waiver limits the pet sitter's responsibility for damages or injuries caused by the pet but does not cover medical costs or ongoing health issues. Choosing pet insurance offers comprehensive security for both pets and owners, while liability waivers mainly protect the sitter from legal claims.

Table of Comparison

| Feature | Pet Insurance | Liability Waiver |

|---|---|---|

| Coverage | Medical expenses, accidents, illnesses | Limits sitter's legal responsibility for damages |

| Cost | Monthly or annual premiums | Typically free or included in service agreement |

| Protection Scope | Pet owner's financial risk protection | Pet sitter's liability protection |

| Claims Process | Submit claims for vet bills, reimbursed by insurer | No claims, legal defense only if disputed |

| Legal Binding | Contract with insurance provider | Signed agreement between pet owner and sitter |

| Example Providers | Healthy Paws, Trupanion, Petplan | Customized waiver forms or standard templates |

Understanding Pet Insurance: What It Covers

Pet insurance typically covers veterinary expenses for accidents, illnesses, and sometimes routine care, providing financial protection against unexpected medical costs. It often includes coverage for diagnostics, surgeries, medications, and hospitalization, tailored to the pet's breed and health history. Liability waivers, in contrast, do not cover medical expenses but serve to protect pet sitters from legal claims related to pet behavior or property damage.

Liability Waivers Explained: Protection for Pet Sitters

Liability waivers offer pet sitters crucial legal protection by clearly outlining the owner's responsibilities and limiting the sitter's risk in case of accidents or injuries during pet care. Unlike pet insurance, which provides financial coverage for veterinary expenses, liability waivers focus on reducing legal claims and disputes arising from pet behavior or unforeseen incidents. Implementing a comprehensive liability waiver safeguards pet sitters by ensuring that clients acknowledge potential risks and agree not to hold the sitter liable for certain damages or injuries.

Key Differences Between Pet Insurance and Liability Waivers

Pet insurance provides coverage for unexpected medical expenses related to a pet's health, including accidents, illnesses, and routine care, while liability waivers protect pet sitters from legal claims or financial responsibility if the pet causes damage or injury during the sitting period. Pet insurance benefits the pet owner by reducing out-of-pocket veterinary costs, whereas liability waivers primarily shield the service provider from lawsuits or property damage claims. Understanding these key differences is crucial for pet owners and sitters to ensure appropriate protection and risk management tailored to their specific needs.

Benefits of Pet Insurance for Pet Sitting Businesses

Pet insurance for pet sitting businesses covers unexpected veterinary expenses, reducing financial risk and enhancing client trust through demonstrated care commitment. Unlike liability waivers, pet insurance provides direct coverage for medical treatment costs, ensuring continuous service even during emergencies. This insurance also improves business credibility, attracting more clients who prioritize pet safety and responsible care.

Limitations of Liability Waivers in Pet Sitting

Liability waivers in pet sitting often fail to provide comprehensive protection against all financial risks, leaving pet sitters vulnerable to claims exceeding the waiver's scope. Unlike pet insurance, waivers do not cover medical expenses or accidental injuries to pets, limiting their effectiveness in mitigating costly incidents. Many jurisdictions may not fully enforce liability waivers, increasing the potential for legal disputes and out-of-pocket expenses for pet sitters.

Financial Implications: Choosing Insurance or Waivers

Pet insurance offers comprehensive financial protection by covering veterinary bills, illness, and injury costs during pet sitting, reducing out-of-pocket expenses for both the sitter and owner. Liability waivers limit legal responsibility for damages or injuries but do not cover medical expenses, potentially resulting in significant financial risk if pet-related incidents occur. Evaluating the scope of coverage, potential costs, and risk exposure is crucial when deciding between investing in pet insurance or relying solely on liability waivers for financial security.

Risk Management Strategies for Pet Sitters

Pet insurance provides financial protection against unexpected veterinary costs, ensuring pet sitters can cover medical emergencies without incurring personal expenses. Liability waivers limit legal responsibility by having clients acknowledge and accept risks inherent in pet sitting, reducing the chance of costly lawsuits. Combining both strategies offers comprehensive risk management, safeguarding pet sitters from financial loss and legal disputes.

Legal Considerations: Insurance Versus Liability Waivers

Pet insurance provides financial coverage for veterinary expenses and unforeseen medical emergencies, safeguarding both pet owners and pet sitters from significant out-of-pocket costs. Liability waivers aim to limit the pet sitter's legal responsibility for injuries or damages but may not fully protect against all legal claims in court. Understanding state-specific laws and ensuring clear, written agreements are essential to effectively manage risks in pet sitting arrangements.

Client Trust: Building Confidence With Insurance or Waivers

Pet insurance provides comprehensive coverage for unexpected veterinary expenses, enhancing client trust by demonstrating a pet sitter's commitment to pet safety and well-being. Liability waivers protect sitters from legal claims but may raise concerns for clients about financial responsibility in emergencies. Offering both options transparently builds confidence, reassuring clients that their pets are cared for under clear and responsible agreements.

Making the Right Choice: Insurance, Waiver, or Both?

Choosing between pet insurance and a liability waiver requires evaluating the scope of coverage and financial protection each offers; pet insurance typically covers veterinary expenses for illness or injury, while liability waivers protect pet sitters from legal claims related to pet behavior or accidents. Incorporating both can provide comprehensive protection, ensuring medical costs are covered and potential legal liabilities are minimized. Pet sitters should assess their risk tolerance, client trust levels, and service complexity to tailor the right combination for optimal security.

Pet insurance vs Liability waiver Infographic

bizdif.com

bizdif.com