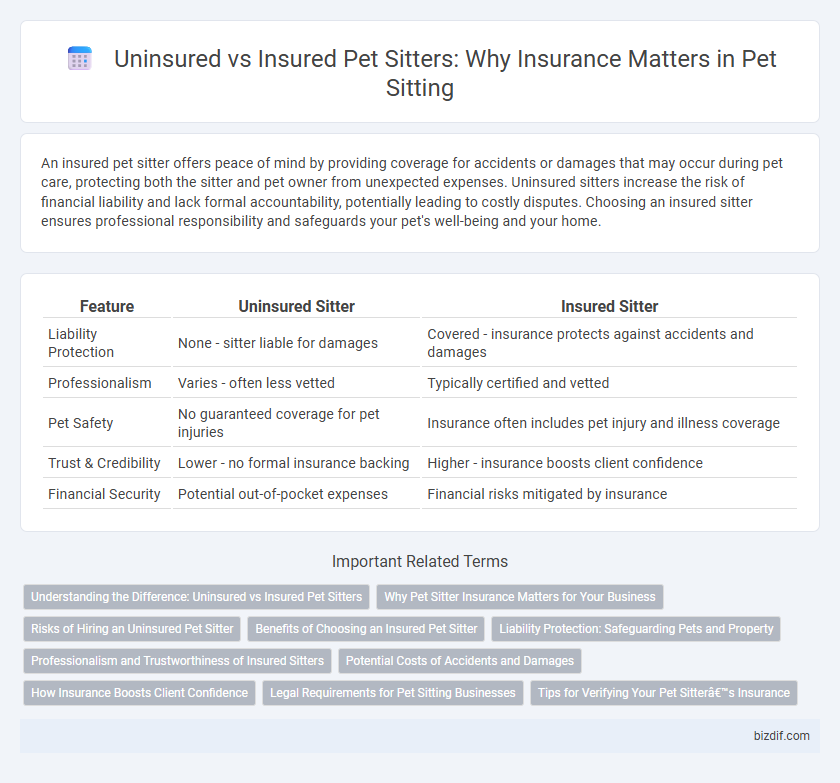

An insured pet sitter offers peace of mind by providing coverage for accidents or damages that may occur during pet care, protecting both the sitter and pet owner from unexpected expenses. Uninsured sitters increase the risk of financial liability and lack formal accountability, potentially leading to costly disputes. Choosing an insured sitter ensures professional responsibility and safeguards your pet's well-being and your home.

Table of Comparison

| Feature | Uninsured Sitter | Insured Sitter |

|---|---|---|

| Liability Protection | None - sitter liable for damages | Covered - insurance protects against accidents and damages |

| Professionalism | Varies - often less vetted | Typically certified and vetted |

| Pet Safety | No guaranteed coverage for pet injuries | Insurance often includes pet injury and illness coverage |

| Trust & Credibility | Lower - no formal insurance backing | Higher - insurance boosts client confidence |

| Financial Security | Potential out-of-pocket expenses | Financial risks mitigated by insurance |

Understanding the Difference: Uninsured vs Insured Pet Sitters

Choosing between an uninsured pet sitter and an insured pet sitter significantly impacts liability and financial protection for pet owners. Insured pet sitters carry liability insurance that covers potential damages or accidents, providing peace of mind and reducing risks associated with pet care. Uninsured sitters may save money upfront but expose owners to potential out-of-pocket expenses if incidents occur during pet sitting services.

Why Pet Sitter Insurance Matters for Your Business

Pet sitter insurance protects your business from potential liabilities such as pet injuries, property damage, or accidents during visits, ensuring financial security and professional credibility. Uninsured sitters face significant risks, including out-of-pocket expenses and legal claims that can jeopardize their livelihood. Insured sitters often attract more clients by demonstrating responsibility and trustworthiness, which enhances business growth and client retention.

Risks of Hiring an Uninsured Pet Sitter

Hiring an uninsured pet sitter exposes clients to significant financial and legal risks, as any accidents or injuries to pets during care may not be covered, resulting in costly medical bills or liability claims. Without insurance, pet owners may also face difficulties seeking compensation if property damage occurs. Insured pet sitters provide essential protection, ensuring accountability and peace of mind throughout pet care services.

Benefits of Choosing an Insured Pet Sitter

Choosing an insured pet sitter ensures financial protection against accidents or damages that may occur during pet care, safeguarding both the owner and sitter from unforeseen costs. Insured sitters typically adhere to higher professional standards and accountability, offering peace of mind through verified coverage. This reliability reduces risks associated with liability, making insured pet sitters a safer and more responsible choice for pet owners.

Liability Protection: Safeguarding Pets and Property

Insured pet sitters provide vital liability protection that safeguards pets and property against accidental injury or damage during their care. Uninsured sitters leave pet owners exposed to financial risks, as any harm or loss could result in costly personal liability claims. Choosing an insured sitter ensures coverage for medical expenses and property repairs, offering peace of mind and security.

Professionalism and Trustworthiness of Insured Sitters

Insured pet sitters demonstrate higher professionalism and trustworthiness by providing financial protection against accidents or damages during pet care. Their insurance coverage offers peace of mind to pet owners, ensuring responsibility and accountability in handling pets. This commitment to protecting both pets and property distinguishes insured sitters as reliable and credible caregivers.

Potential Costs of Accidents and Damages

Uninsured pet sitters expose owners to significant financial risks, as any accidents or damages during care may result in out-of-pocket expenses for veterinary bills or property repair. Insured pet sitters provide a safety net by covering costs related to unexpected incidents, reducing the financial burden on pet owners. Choosing an insured sitter ensures protection against liabilities arising from injury, illness, or damage while pets are under their supervision.

How Insurance Boosts Client Confidence

Insured pet sitters provide clients with financial protection against potential accidents or damages, increasing trust and reliability. Insurance coverage demonstrates professionalism and commitment to responsible care, making clients feel more secure entrusting their pets. This assurance often leads to higher client retention and positive referrals in the pet sitting industry.

Legal Requirements for Pet Sitting Businesses

Pet sitting businesses must comply with local legal requirements that often mandate liability insurance to protect against potential damages or accidents. Uninsured sitters face significant risks, including personal financial liability and potential legal penalties if an incident occurs during pet care. Insured sitters benefit from professional coverage that enhances credibility, ensures compliance with regulations, and provides protection for both the sitter and pet owner.

Tips for Verifying Your Pet Sitter’s Insurance

Verify your pet sitter's insurance by requesting a copy of their policy and confirming coverage details with the insurer directly to ensure liability protection. Check if the insurance includes general liability, property damage, and professional indemnity specific to pet care services. Ask for references or reviews that specifically mention insurance to gauge the sitter's reliability and professionalism in handling accidents or emergencies.

Uninsured sitter vs Insured sitter Infographic

bizdif.com

bizdif.com