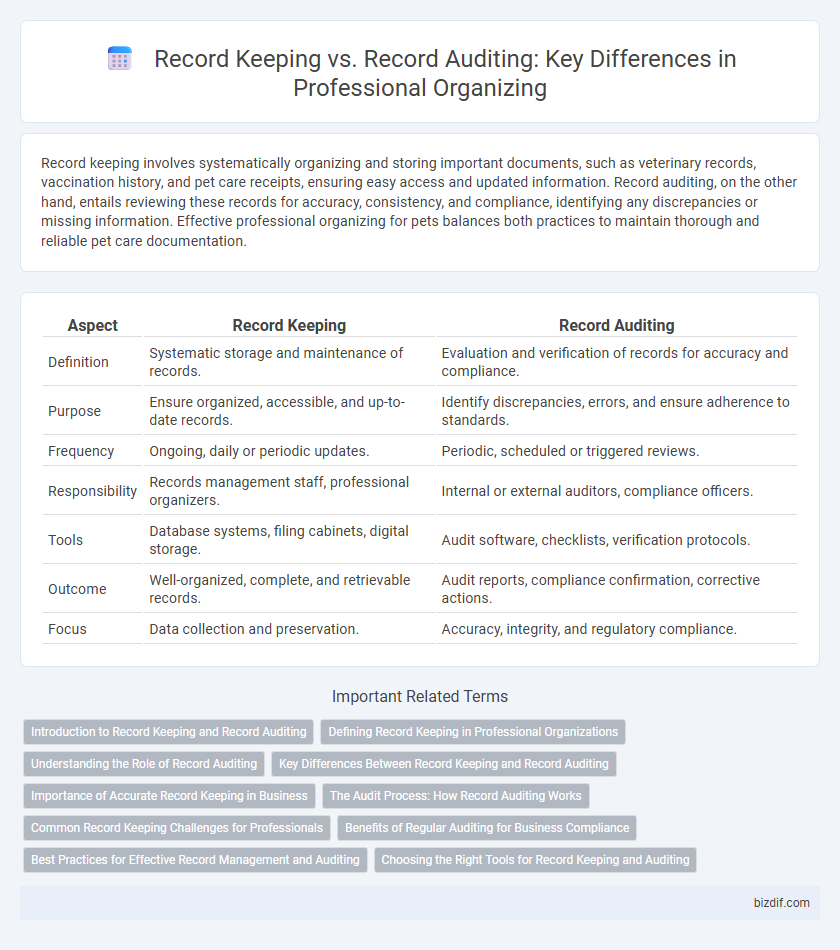

Record keeping involves systematically organizing and storing important documents, such as veterinary records, vaccination history, and pet care receipts, ensuring easy access and updated information. Record auditing, on the other hand, entails reviewing these records for accuracy, consistency, and compliance, identifying any discrepancies or missing information. Effective professional organizing for pets balances both practices to maintain thorough and reliable pet care documentation.

Table of Comparison

| Aspect | Record Keeping | Record Auditing |

|---|---|---|

| Definition | Systematic storage and maintenance of records. | Evaluation and verification of records for accuracy and compliance. |

| Purpose | Ensure organized, accessible, and up-to-date records. | Identify discrepancies, errors, and ensure adherence to standards. |

| Frequency | Ongoing, daily or periodic updates. | Periodic, scheduled or triggered reviews. |

| Responsibility | Records management staff, professional organizers. | Internal or external auditors, compliance officers. |

| Tools | Database systems, filing cabinets, digital storage. | Audit software, checklists, verification protocols. |

| Outcome | Well-organized, complete, and retrievable records. | Audit reports, compliance confirmation, corrective actions. |

| Focus | Data collection and preservation. | Accuracy, integrity, and regulatory compliance. |

Introduction to Record Keeping and Record Auditing

Record keeping involves systematically organizing and maintaining accurate documents, files, and data to ensure easy retrieval and compliance with regulations. Record auditing refers to the thorough examination and verification of these records to assess accuracy, completeness, and adherence to established standards. Both processes are essential in professional organizing to enhance operational efficiency and support decision-making.

Defining Record Keeping in Professional Organizations

Record keeping in professional organizations involves systematically capturing, organizing, and storing documents and data to ensure easy retrieval and compliance with regulatory standards. It prioritizes accuracy, consistency, and security of records such as contracts, financial statements, and client information. Effective record keeping supports operational efficiency and forms the foundation for comprehensive record auditing processes.

Understanding the Role of Record Auditing

Record auditing involves systematically reviewing and verifying records to ensure accuracy, compliance, and completeness, whereas record keeping primarily focuses on the organized storage and maintenance of these documents. Effective record auditing identifies discrepancies, errors, or redundancies that may compromise data integrity in professional organizing systems. This process enhances accountability and supports regulatory adherence, making it a critical component in efficient information management.

Key Differences Between Record Keeping and Record Auditing

Record keeping involves systematically collecting, storing, and maintaining accurate and organized records for easy access and reference. Record auditing focuses on examining and verifying those records to ensure compliance, accuracy, and completeness, often identifying discrepancies or errors. Key differences include the purpose--maintenance versus evaluation--and the timing, with record keeping being ongoing and record auditing occurring periodically or as needed.

Importance of Accurate Record Keeping in Business

Accurate record keeping ensures reliable data management, streamlines financial tracking, and supports compliance with legal and regulatory standards. Proper documentation facilitates efficient record auditing by providing a clear, organized trail that helps identify discrepancies and optimize business operations. Maintaining precise records enhances decision-making, reduces errors, and safeguards the company's financial integrity.

The Audit Process: How Record Auditing Works

Record auditing involves systematically reviewing and verifying the accuracy, completeness, and compliance of stored documents to ensure organizational integrity. The audit process includes cross-referencing records, identifying discrepancies, and evaluating adherence to regulatory standards for improved data reliability. Effective record auditing enhances transparency, supports decision-making, and mitigates risks associated with poor documentation management.

Common Record Keeping Challenges for Professionals

Professional organizers often encounter common record keeping challenges such as inconsistent data entry, inadequate categorization, and lack of standardized procedures. These issues complicate the record auditing process by creating discrepancies and reducing data accuracy. Effective record auditing depends on meticulous, organized records that enable quick identification of errors and compliance verification.

Benefits of Regular Auditing for Business Compliance

Regular record auditing ensures ongoing compliance with industry regulations, reducing the risk of legal penalties and financial discrepancies. It enhances data accuracy and accountability, enabling businesses to identify and rectify errors or inconsistencies promptly. Maintaining audited records supports transparent reporting and strengthens stakeholder trust in business operations.

Best Practices for Effective Record Management and Auditing

Effective record management involves systematic organization, accurate classification, and secure storage of documents to ensure easy retrieval and compliance with legal requirements. Record auditing focuses on regularly reviewing and verifying records for accuracy, completeness, and adherence to established policies, thereby identifying discrepancies and potential risks. Implementing best practices like digital backups, standardized indexing, and scheduled audits enhances data integrity and supports informed decision-making in professional organizing.

Choosing the Right Tools for Record Keeping and Auditing

Effective professional organizing involves selecting specialized software like QuickBooks or Expensify for precise record keeping, ensuring data accuracy and easy access. For record auditing, tools such as AuditBoard or TeamMate provide robust features to review compliance and identify discrepancies efficiently. Integrating cloud-based platforms like Google Workspace enhances collaboration and real-time updates, streamlining both record keeping and auditing processes.

record keeping vs record auditing Infographic

bizdif.com

bizdif.com