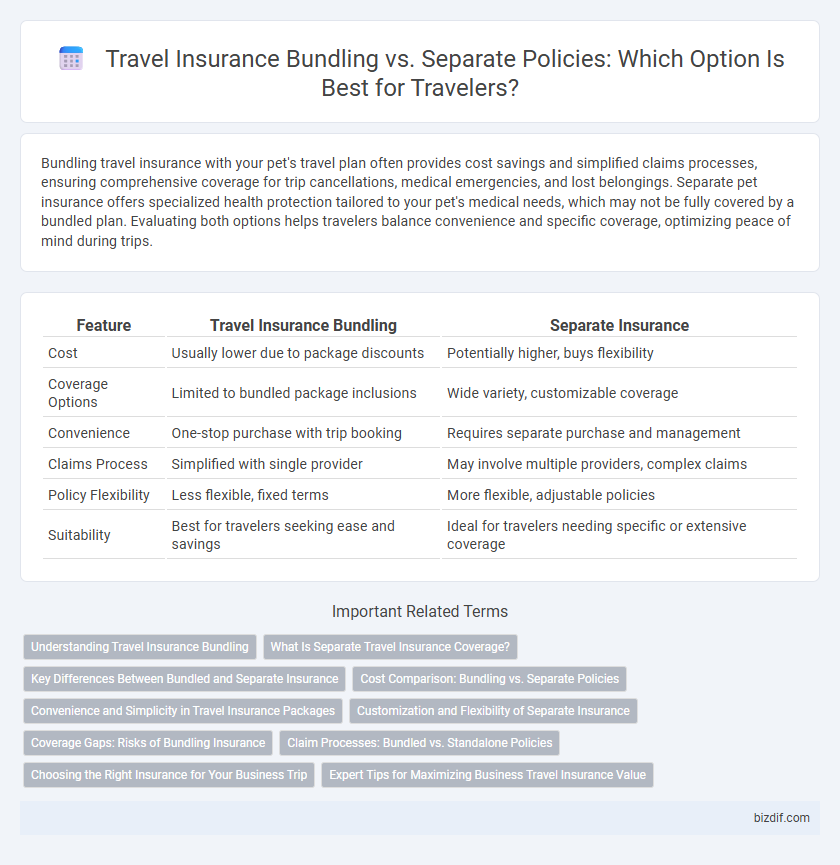

Bundling travel insurance with your pet's travel plan often provides cost savings and simplified claims processes, ensuring comprehensive coverage for trip cancellations, medical emergencies, and lost belongings. Separate pet insurance offers specialized health protection tailored to your pet's medical needs, which may not be fully covered by a bundled plan. Evaluating both options helps travelers balance convenience and specific coverage, optimizing peace of mind during trips.

Table of Comparison

| Feature | Travel Insurance Bundling | Separate Insurance |

|---|---|---|

| Cost | Usually lower due to package discounts | Potentially higher, buys flexibility |

| Coverage Options | Limited to bundled package inclusions | Wide variety, customizable coverage |

| Convenience | One-stop purchase with trip booking | Requires separate purchase and management |

| Claims Process | Simplified with single provider | May involve multiple providers, complex claims |

| Policy Flexibility | Less flexible, fixed terms | More flexible, adjustable policies |

| Suitability | Best for travelers seeking ease and savings | Ideal for travelers needing specific or extensive coverage |

Understanding Travel Insurance Bundling

Travel insurance bundling offers comprehensive coverage by combining multiple insurance policies such as trip cancellation, medical, and baggage protection into one package, often resulting in cost savings and simplified claims processing. Choosing bundled travel insurance ensures seamless coordination between coverage types, reducing gaps that might occur with separate policies. Travelers seeking convenience and thorough protection typically benefit from bundling, as it provides a unified plan tailored to diverse travel risks.

What Is Separate Travel Insurance Coverage?

Separate travel insurance coverage refers to purchasing an independent policy that is not bundled with your travel booking, offering tailored protection for trip cancellations, medical emergencies, and lost luggage. This option allows travelers to choose specific coverage limits and provider benefits that best suit their individual needs and risk profile. Separate insurance can often provide more comprehensive and customizable options compared to bundled packages offered by airlines or travel agencies.

Key Differences Between Bundled and Separate Insurance

Travel insurance bundling typically offers convenience and cost savings by integrating coverage with the overall travel package, often including trip cancellation, medical emergencies, and baggage loss in a single policy. Separate insurance allows travelers to customize coverage based on specific needs, potentially accessing specialized plans such as adventure sports or extended medical. Key differences include pricing flexibility, coverage options, and claims process efficiency, with bundled policies streamlining administration and separate policies offering tailored protection.

Cost Comparison: Bundling vs. Separate Policies

Travel insurance bundling typically reduces overall costs by combining coverage for multiple trip components into a single policy, often resulting in lower premiums compared to purchasing separate policies. Separate insurance policies may offer tailored protection for specific risks but usually increase total expenses due to multiple administrative fees and overlapping coverage. Reviewing policy details carefully ensures travelers maximize savings and avoid redundant costs when choosing between bundled or separate travel insurance options.

Convenience and Simplicity in Travel Insurance Packages

Travel insurance bundling offers unparalleled convenience by combining multiple coverage options into a single, easy-to-manage policy that simplifies claim processes and reduces paperwork. Separate insurance policies often require travelers to handle multiple providers, increasing complexity and the risk of gaps in coverage. Bundled packages streamline protection, making it easier for travelers to understand their benefits and ensure comprehensive coverage without the hassle.

Customization and Flexibility of Separate Insurance

Separate travel insurance offers greater customization and flexibility by allowing travelers to select specific coverage tailored to their unique needs, such as trip cancellation, medical emergencies, or baggage loss. Unlike bundled policies, separate insurance enables comparison of different providers, ensuring optimal protection and cost-effectiveness. This approach suits travelers with specialized requirements or those seeking personalized policy limits and add-ons.

Coverage Gaps: Risks of Bundling Insurance

Travel insurance bundling may leave coverage gaps by combining policies with limited protection for specific risks such as trip cancellations, medical emergencies, or lost luggage. Separate insurance policies often provide more comprehensive and specialized coverage, reducing the chances of encountering unexpected exclusions. Travelers should carefully compare policy details to identify potential gaps and ensure full protection during their trip.

Claim Processes: Bundled vs. Standalone Policies

Travel insurance bundling streamlines the claim process by consolidating coverage under a single provider, reducing paperwork and expediting approvals. Standalone policies may require separate claims submissions, leading to potential delays and increased documentation requirements. Choosing bundled insurance often ensures faster resolution and more cohesive support during travel disruptions.

Choosing the Right Insurance for Your Business Trip

Choosing the right insurance for your business trip involves comparing travel insurance bundling options with separate insurance policies to ensure comprehensive coverage. Bundled travel insurance often combines trip cancellation, medical emergencies, and baggage protection, offering convenience and cost savings. Separate insurance policies allow customization for specific risks, such as professional liability or equipment coverage, tailored to business travel needs.

Expert Tips for Maximizing Business Travel Insurance Value

Travel insurance bundling with trip packages often offers cost savings and streamlined claims processing for business travelers, enhancing overall coverage efficiency. Separate insurance policies may provide tailored protection specific to high-risk business activities or international assignments, allowing for customized risk management. Expert tips include evaluating policy terms carefully, prioritizing comprehensive coverage for cancellations, medical emergencies, and lost luggage, and comparing bundled versus standalone plans to maximize value and minimize potential coverage gaps.

Travel insurance bundling vs Separate insurance Infographic

bizdif.com

bizdif.com