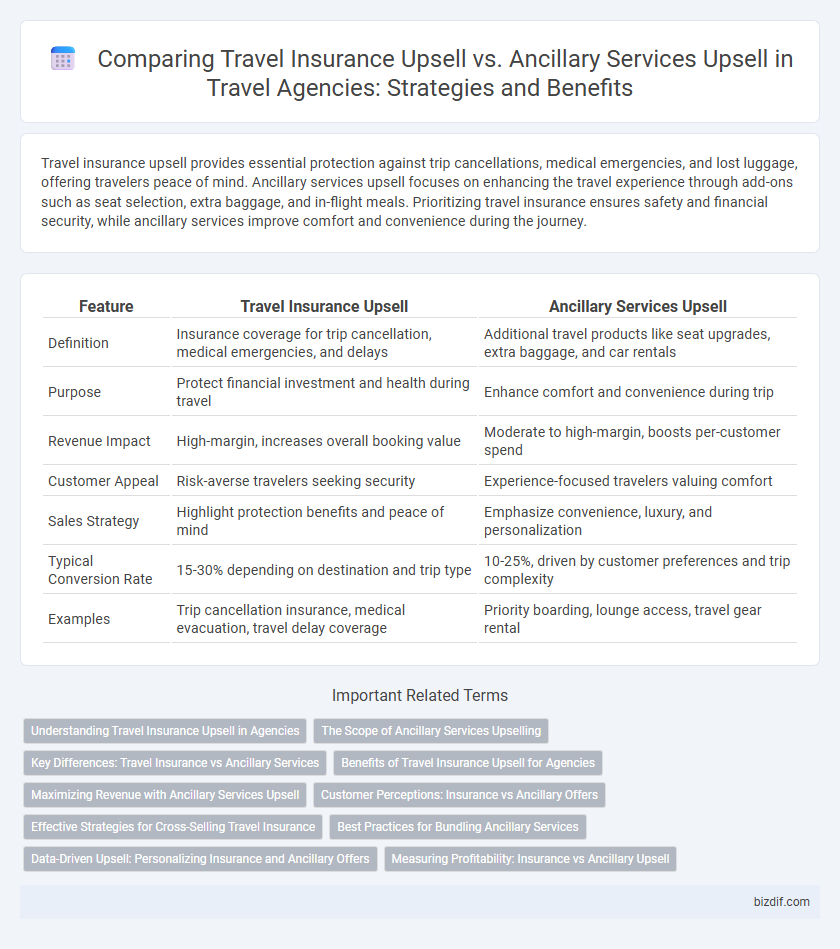

Travel insurance upsell provides essential protection against trip cancellations, medical emergencies, and lost luggage, offering travelers peace of mind. Ancillary services upsell focuses on enhancing the travel experience through add-ons such as seat selection, extra baggage, and in-flight meals. Prioritizing travel insurance ensures safety and financial security, while ancillary services improve comfort and convenience during the journey.

Table of Comparison

| Feature | Travel Insurance Upsell | Ancillary Services Upsell |

|---|---|---|

| Definition | Insurance coverage for trip cancellation, medical emergencies, and delays | Additional travel products like seat upgrades, extra baggage, and car rentals |

| Purpose | Protect financial investment and health during travel | Enhance comfort and convenience during trip |

| Revenue Impact | High-margin, increases overall booking value | Moderate to high-margin, boosts per-customer spend |

| Customer Appeal | Risk-averse travelers seeking security | Experience-focused travelers valuing comfort |

| Sales Strategy | Highlight protection benefits and peace of mind | Emphasize convenience, luxury, and personalization |

| Typical Conversion Rate | 15-30% depending on destination and trip type | 10-25%, driven by customer preferences and trip complexity |

| Examples | Trip cancellation insurance, medical evacuation, travel delay coverage | Priority boarding, lounge access, travel gear rental |

Understanding Travel Insurance Upsell in Agencies

Travel insurance upsell in travel agencies centers on educating clients about comprehensive coverage options, emphasizing protection against trip cancellations, medical emergencies, and lost luggage. This strategy increases agency revenue by bundling essential insurance products tailored to individual travel itineraries and risk profiles. Unlike ancillary services upsell, which promotes add-ons like seat upgrades or tours, travel insurance focuses on risk management and financial security for travelers.

The Scope of Ancillary Services Upselling

Ancillary services upselling in travel agencies encompasses a wider scope than travel insurance alone, offering customers options like airport transfers, lounge access, seat selection, and in-flight meals. This broader range of services enhances the travel experience by providing added convenience and comfort beyond basic coverage. By targeting diverse traveler needs, ancillary upselling drives higher revenue and customer satisfaction through personalized offers.

Key Differences: Travel Insurance vs Ancillary Services

Travel insurance upsell primarily offers protection against trip cancellations, medical emergencies, and lost luggage, providing financial security and peace of mind to travelers. In contrast, ancillary services upsell includes add-ons like airport transfers, priority boarding, extra baggage, and in-flight meals that enhance convenience and comfort. Both increase revenue for travel agencies but serve different customer needs: risk management vs. enhanced travel experience.

Benefits of Travel Insurance Upsell for Agencies

Travel insurance upsell increases agency revenue by offering customers essential protection against trip cancellations, medical emergencies, and lost baggage, enhancing client trust and satisfaction. It reduces agency liability and improves customer retention through comprehensive coverage options tailored to diverse traveler needs. By integrating travel insurance, agencies differentiate their services and create a reliable safety net that encourages repeat business and positive reviews.

Maximizing Revenue with Ancillary Services Upsell

Maximizing revenue through ancillary services upsell involves offering travelers add-ons such as airport transfers, guided tours, and lounge access, which enhance the overall travel experience and significantly boost profit margins. Unlike travel insurance upsells that primarily focus on risk mitigation, ancillary services provide tangible value and personalized options, increasing customer satisfaction and retention. Leveraging data-driven insights to tailor these offers maximizes conversion rates and drives higher average transaction values for travel agencies.

Customer Perceptions: Insurance vs Ancillary Offers

Customers often perceive travel insurance as a vital safety net that provides financial protection against trip cancellations, medical emergencies, and unforeseen interruptions, enhancing their sense of security. Ancillary services, such as seat upgrades, extra baggage, and in-flight amenities, are viewed more as convenience or luxury enhancements rather than essential needs. Emphasizing clear benefits and risk mitigation in insurance upsells typically results in higher acceptance rates compared to ancillary service offers, which depend more on individual preferences and discretionary spending.

Effective Strategies for Cross-Selling Travel Insurance

Implement personalized recommendations using customer travel profiles to highlight the benefits of travel insurance, increasing uptake rates. Leverage real-time booking data to present timely insurance offers during the checkout process, enhancing conversion through contextual relevance. Train agents to communicate the financial protection and peace of mind travel insurance provides, reinforcing value alongside ancillary services like seat upgrades or extra baggage.

Best Practices for Bundling Ancillary Services

Offering travel insurance as part of an ancillary services bundle increases customer confidence while simplifying the purchasing process. Best practices for bundling ancillary services include combining travel insurance with airport transfers, priority boarding, and baggage handling to enhance perceived value and convenience. Implementing tiered packages tailored to trip types and traveler profiles maximizes uptake and boosts overall revenue.

Data-Driven Upsell: Personalizing Insurance and Ancillary Offers

Data-driven upsell strategies in travel agencies leverage customer profiles and booking history to personalize travel insurance and ancillary service offers, resulting in increased conversion rates. By analyzing spending patterns and trip details, agencies can tailor insurance products to specific risks while recommending relevant ancillary services such as priority boarding or lounge access. This targeted approach enhances customer satisfaction and maximizes revenue per booking by delivering timely, relevant upsell options.

Measuring Profitability: Insurance vs Ancillary Upsell

Measuring profitability between travel insurance upsell and ancillary services upsell involves analyzing key metrics like conversion rates, average transaction value, and customer retention impact. Travel insurance often yields higher margins per sale due to its essential nature and risk coverage, while ancillary services such as baggage fees, in-flight meals, and seat upgrades contribute through volume and repeat purchases. Effective data tracking and customer segmentation enable agencies to optimize upsell strategies for maximum revenue and sustained profitability.

Travel insurance upsell vs Ancillary services upsell Infographic

bizdif.com

bizdif.com