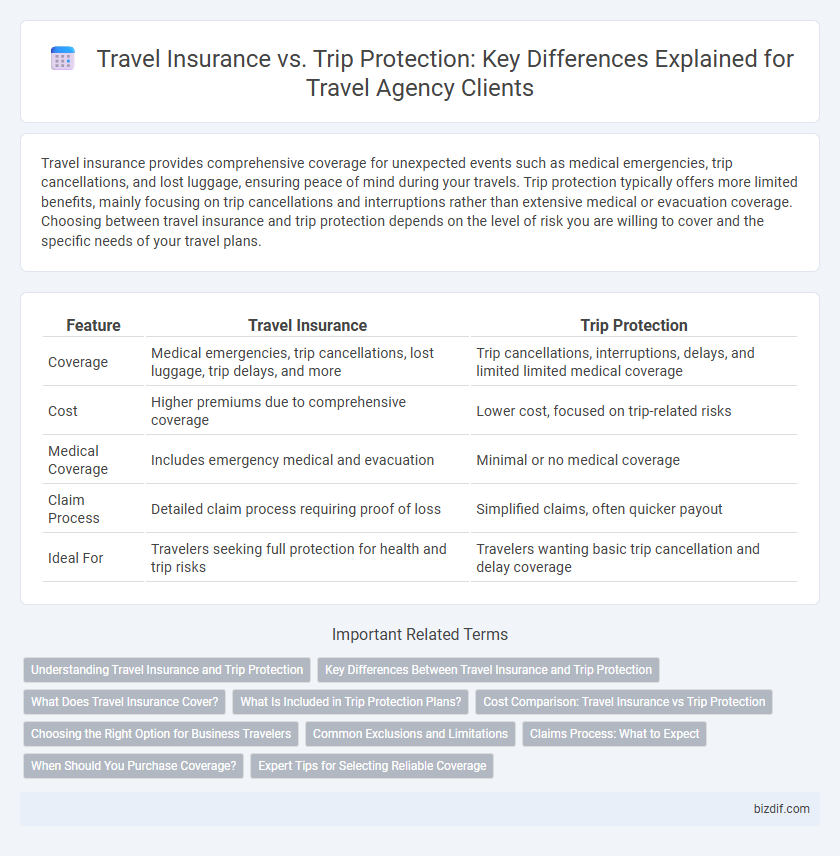

Travel insurance provides comprehensive coverage for unexpected events such as medical emergencies, trip cancellations, and lost luggage, ensuring peace of mind during your travels. Trip protection typically offers more limited benefits, mainly focusing on trip cancellations and interruptions rather than extensive medical or evacuation coverage. Choosing between travel insurance and trip protection depends on the level of risk you are willing to cover and the specific needs of your travel plans.

Table of Comparison

| Feature | Travel Insurance | Trip Protection |

|---|---|---|

| Coverage | Medical emergencies, trip cancellations, lost luggage, trip delays, and more | Trip cancellations, interruptions, delays, and limited limited medical coverage |

| Cost | Higher premiums due to comprehensive coverage | Lower cost, focused on trip-related risks |

| Medical Coverage | Includes emergency medical and evacuation | Minimal or no medical coverage |

| Claim Process | Detailed claim process requiring proof of loss | Simplified claims, often quicker payout |

| Ideal For | Travelers seeking full protection for health and trip risks | Travelers wanting basic trip cancellation and delay coverage |

Understanding Travel Insurance and Trip Protection

Travel insurance provides comprehensive coverage for unexpected events such as medical emergencies, trip cancellations, and lost luggage, ensuring financial protection during travel disruptions. Trip protection plans often focus on specific trip-related issues like delays and cancellations but may not include medical coverage. Understanding the distinctions between travel insurance and trip protection helps travelers select the right option to safeguard their investment and health abroad.

Key Differences Between Travel Insurance and Trip Protection

Travel insurance provides comprehensive coverage including trip cancellation, medical emergencies, lost luggage, and travel delays, whereas trip protection primarily focuses on refund or reimbursement for trip interruptions and cancellations. Travel insurance typically requires detailed underwriting and may cover emergency medical treatment internationally, while trip protection plans often offer simpler, more affordable options with limited coverage. Understanding these distinctions helps travelers choose the right protection based on their risk tolerance, trip cost, and healthcare needs abroad.

What Does Travel Insurance Cover?

Travel insurance typically covers unforeseen events such as trip cancellations, medical emergencies, lost luggage, and flight delays, offering financial reimbursement and assistance during travel disruptions. It also includes coverage for emergency evacuations, accidental death, and trip interruptions due to illness or natural disasters. Understanding these protections helps travelers select appropriate plans tailored to their destination and activities, ensuring comprehensive security during their journey.

What Is Included in Trip Protection Plans?

Trip protection plans typically include coverage for trip cancellations, interruptions, and delays, reimbursing non-refundable expenses due to unforeseen events like illness or severe weather. They often offer benefits such as baggage loss, emergency medical assistance, and 24/7 travel support to provide peace of mind during your journey. Many plans also cover travel supplier bankruptcy, missed connections, and personal liability, ensuring comprehensive protection tailored to various travel scenarios.

Cost Comparison: Travel Insurance vs Trip Protection

Travel insurance generally offers more comprehensive coverage including medical emergencies, trip cancellations, and lost luggage, often at a higher premium ranging from 4% to 10% of the trip cost. Trip protection plans tend to be more affordable, averaging 1% to 5% of the total trip price but usually provide limited benefits such as trip delay and basic cancellation coverage. Evaluating the cost comparison, travelers must assess whether the broader protection of travel insurance justifies the increased expense compared to the budget-friendly trip protection options.

Choosing the Right Option for Business Travelers

Business travelers should prioritize travel insurance for comprehensive coverage against medical emergencies, trip cancellations, and lost luggage, ensuring peace of mind during demanding schedules. Trip protection often focuses on travel disruptions like delays and interruptions but may lack extensive medical or liability coverage needed for international business trips. Evaluating policy specifics, including coverage limits and exclusions, helps business travelers select the optimal protection aligned with their destination risks and travel frequency.

Common Exclusions and Limitations

Travel insurance and trip protection plans often exclude coverage for pre-existing medical conditions, high-risk activities such as extreme sports, and trip cancellations due to pandemics or government travel bans. Limitations frequently include coverage caps on medical expenses, baggage loss, and trip interruption claims, as well as requirements to purchase the plan within a specific timeframe after booking. Understanding these common exclusions and limitations helps travelers choose the right policy to ensure comprehensive protection for their trip.

Claims Process: What to Expect

Travel insurance claims typically require detailed documentation such as medical reports, receipts, and proof of trip cancellation or interruption, with reviews conducted by insurance adjusters to validate coverage eligibility. Trip protection plans often offer simpler claims processes focused on reimbursement for prepaid travel expenses, emphasizing customer support for rapid resolution. Understanding the specific requirements and timelines outlined by the provider ensures smoother claim approvals and faster reimbursements.

When Should You Purchase Coverage?

Purchase travel insurance or trip protection as soon as you book your trip to maximize coverage benefits, including cancellation due to unforeseen events or pre-existing conditions. Early purchase ensures protection against non-refundable expenses and travel interruptions caused by emergencies such as illness, natural disasters, or airline bankruptcies. Delaying coverage risks losing eligibility for certain benefits and limits your ability to file claims for incidents occurring before policy purchase.

Expert Tips for Selecting Reliable Coverage

Travel insurance provides comprehensive coverage for medical emergencies, trip cancellations, and lost belongings, while trip protection often focuses on non-refundable expenses and limited reimbursements. Experts recommend evaluating individual needs, destination risks, and policy exclusions to select reliable coverage tailored for your travel plans. Thoroughly comparing providers' reputations, claim processes, and customer reviews ensures optimal protection and peace of mind during your journey.

Travel insurance vs Trip protection Infographic

bizdif.com

bizdif.com