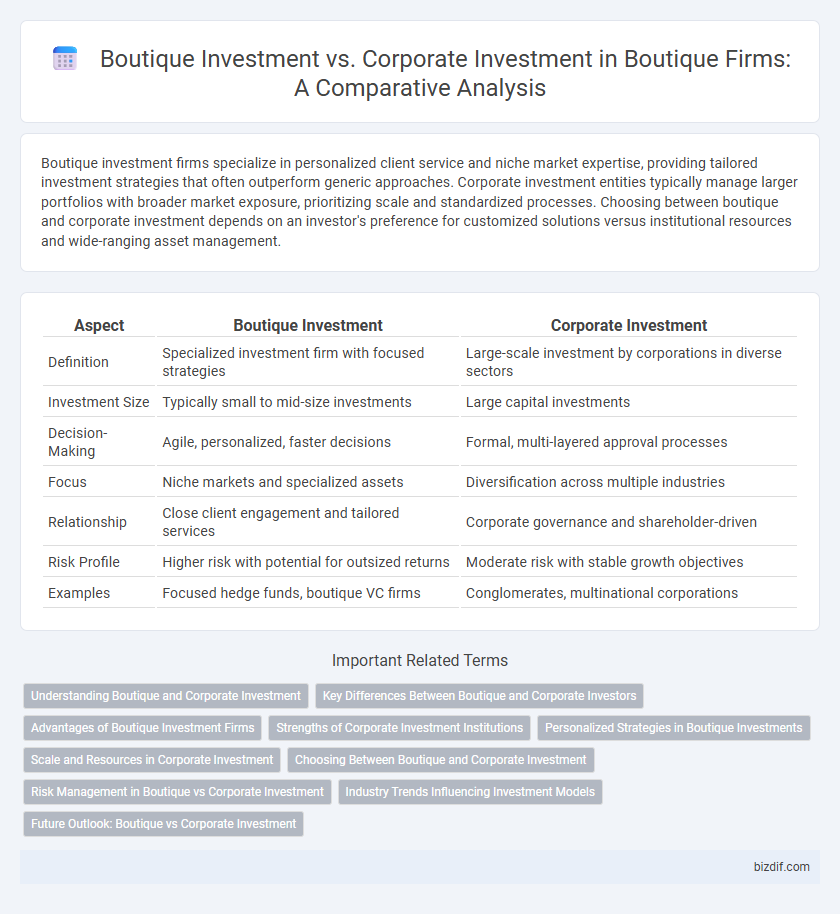

Boutique investment firms specialize in personalized client service and niche market expertise, providing tailored investment strategies that often outperform generic approaches. Corporate investment entities typically manage larger portfolios with broader market exposure, prioritizing scale and standardized processes. Choosing between boutique and corporate investment depends on an investor's preference for customized solutions versus institutional resources and wide-ranging asset management.

Table of Comparison

| Aspect | Boutique Investment | Corporate Investment |

|---|---|---|

| Definition | Specialized investment firm with focused strategies | Large-scale investment by corporations in diverse sectors |

| Investment Size | Typically small to mid-size investments | Large capital investments |

| Decision-Making | Agile, personalized, faster decisions | Formal, multi-layered approval processes |

| Focus | Niche markets and specialized assets | Diversification across multiple industries |

| Relationship | Close client engagement and tailored services | Corporate governance and shareholder-driven |

| Risk Profile | Higher risk with potential for outsized returns | Moderate risk with stable growth objectives |

| Examples | Focused hedge funds, boutique VC firms | Conglomerates, multinational corporations |

Understanding Boutique and Corporate Investment

Boutique investment firms specialize in tailored financial services, offering personalized portfolio management and niche market expertise, often focusing on high-net-worth individuals or specific industries. Corporate investment arms, on the other hand, typically operate with larger capital pools, prioritizing broad-scale investments aligned with corporate strategic objectives and long-term growth. Understanding the distinction involves recognizing boutique firms' agility and customization versus corporate investments' scale and integration within corporate structures.

Key Differences Between Boutique and Corporate Investors

Boutique investments prioritize personalized service, niche market expertise, and tailored investment strategies, often focusing on specialized sectors or regional opportunities. Corporate investors typically leverage scale, extensive resources, and standardized processes to manage large, diversified portfolios, emphasizing risk mitigation and broad market exposure. The key differences lie in boutique investors' agility and customized approach versus corporate investors' emphasis on size, structure, and institutional frameworks.

Advantages of Boutique Investment Firms

Boutique investment firms offer specialized expertise and personalized client service, enabling tailored investment strategies that align closely with individual investor goals. These firms typically maintain a flexible decision-making process and avoid conflicts of interest seen in larger corporate investments, resulting in greater transparency and trust. Their niche focus often leads to deeper market insights and innovative approaches, providing distinct competitive advantages over broader corporate investment entities.

Strengths of Corporate Investment Institutions

Corporate investment institutions benefit from extensive financial resources and access to institutional-grade deals, enabling large-scale, diversified portfolios with reduced risk exposure. Their established networks and industry expertise facilitate strategic partnerships and market influence, accelerating growth and innovation in invested companies. Rigorous due diligence and compliance frameworks enhance investment security and long-term value creation compared to boutique firms.

Personalized Strategies in Boutique Investments

Boutique investments prioritize personalized strategies by tailoring portfolio management to the unique goals and risk tolerances of individual clients, unlike corporate investments that often apply standardized approaches across large client bases. These specialized firms leverage deep sector expertise and nimble decision-making to deliver customized asset allocations and specialized financial products. Clients benefit from direct access to senior investment professionals and bespoke service models designed to enhance portfolio performance and client satisfaction.

Scale and Resources in Corporate Investment

Corporate investment typically involves significantly larger scale and greater resources compared to boutique investment firms, enabling extensive capital deployment and access to comprehensive support systems. These resources include dedicated teams for operational improvements, legal, marketing, and financial advisory services that boutique firms may lack. The scale of corporate investment also allows for diversified portfolio management and risk mitigation strategies that smaller boutique firms cannot easily replicate.

Choosing Between Boutique and Corporate Investment

Choosing between boutique and corporate investment firms depends on the level of personalized service and specialized expertise desired. Boutique investment firms often provide tailored strategies and closer client relationships, while corporate investment firms offer broader resources and extensive market reach. Evaluating specific financial goals, risk tolerance, and preference for customized solutions aids in selecting the optimal investment partner.

Risk Management in Boutique vs Corporate Investment

Boutique investments emphasize personalized risk management strategies tailored to niche markets, enabling more agile responses to market volatility compared to corporate investment firms. Corporate investments rely on standardized, large-scale risk management frameworks that can be less flexible but provide extensive resources and diversified risk exposure. The focused approach of boutiques often results in deeper due diligence and proactive mitigation of specific sector risks, contrasting with the broad, systematic risk controls used by corporate entities.

Industry Trends Influencing Investment Models

Boutique investment firms emphasize specialized, industry-focused expertise, allowing them to capitalize on niche market trends and deliver tailored strategies aligned with evolving sector dynamics. Corporate investment models often prioritize scale and diversification, responding to broad economic cycles and shifting regulatory landscapes. Recent trends show increasing investor preference for boutiques due to their agility in adapting to technological advancements, sustainability demands, and customized client solutions.

Future Outlook: Boutique vs Corporate Investment

Boutique investment firms are poised for significant growth driven by their specialized expertise, personalized client service, and agility in niche markets, which appeals to investors seeking tailored strategies. Corporate investment arms benefit from substantial capital resources, extensive networks, and comprehensive risk management, positioning them for large-scale projects and innovation-driven sectors. Future trends indicate boutiques will increasingly capture market share through specialization and flexibility, while corporate investments will leverage technology and integration to maintain dominance in broad, high-impact ventures.

Boutique Investment vs Corporate Investment Infographic

bizdif.com

bizdif.com