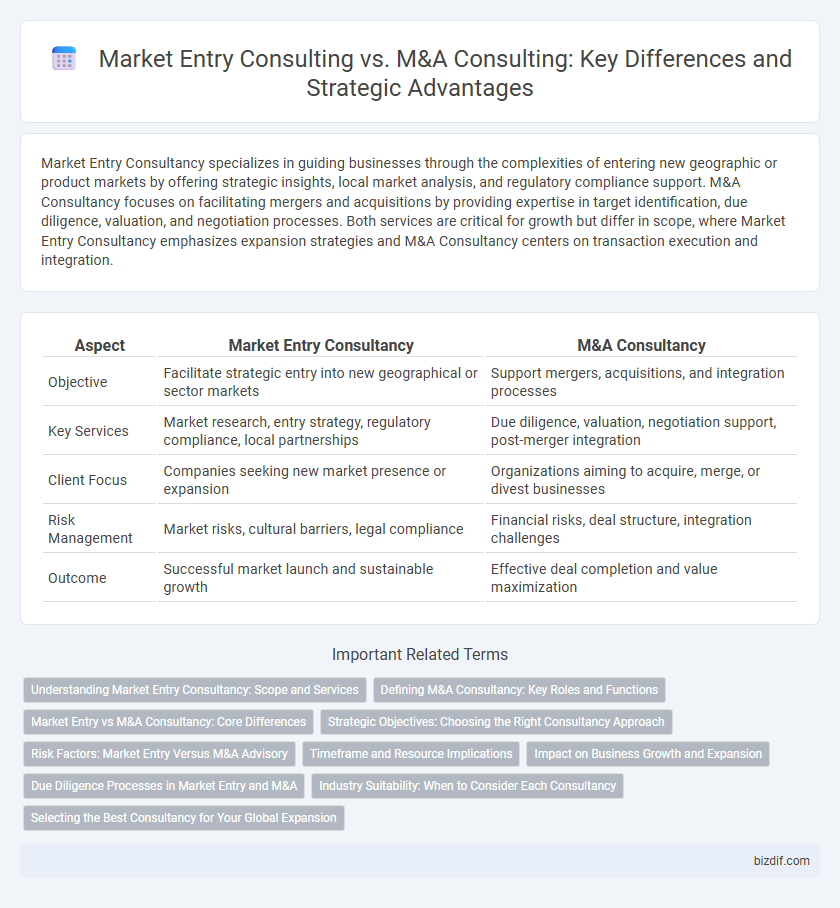

Market Entry Consultancy specializes in guiding businesses through the complexities of entering new geographic or product markets by offering strategic insights, local market analysis, and regulatory compliance support. M&A Consultancy focuses on facilitating mergers and acquisitions by providing expertise in target identification, due diligence, valuation, and negotiation processes. Both services are critical for growth but differ in scope, where Market Entry Consultancy emphasizes expansion strategies and M&A Consultancy centers on transaction execution and integration.

Table of Comparison

| Aspect | Market Entry Consultancy | M&A Consultancy |

|---|---|---|

| Objective | Facilitate strategic entry into new geographical or sector markets | Support mergers, acquisitions, and integration processes |

| Key Services | Market research, entry strategy, regulatory compliance, local partnerships | Due diligence, valuation, negotiation support, post-merger integration |

| Client Focus | Companies seeking new market presence or expansion | Organizations aiming to acquire, merge, or divest businesses |

| Risk Management | Market risks, cultural barriers, legal compliance | Financial risks, deal structure, integration challenges |

| Outcome | Successful market launch and sustainable growth | Effective deal completion and value maximization |

Understanding Market Entry Consultancy: Scope and Services

Market entry consultancy focuses on guiding businesses through the initial phases of entering new geographic or industry markets by providing comprehensive market research, competitive analysis, and strategic planning. Services often include identifying target customer segments, assessing regulatory requirements, and developing market entry strategies such as joint ventures, franchising, or direct investment. This contrasts with M&A consultancy, which centers on facilitating mergers, acquisitions, and divestitures to optimize corporate growth and restructuring.

Defining M&A Consultancy: Key Roles and Functions

M&A consultancy specializes in guiding companies through mergers and acquisitions by providing strategic advice, due diligence, and valuation services tailored to maximize transaction value. These consultants assess target companies' financial health, identify synergies, and manage negotiation processes to ensure seamless integration and regulatory compliance. Their expertise includes risk assessment, deal structuring, and post-merger integration to support successful market expansion and growth.

Market Entry vs M&A Consultancy: Core Differences

Market Entry Consultancy focuses on strategies for businesses to establish a presence in new geographic or sector markets, emphasizing market research, regulatory compliance, and localization tactics. M&A Consultancy specializes in advising companies on mergers and acquisitions, including target identification, due diligence, valuation, and post-merger integration to maximize synergy and minimize risk. The core differences lie in Market Entry Consultancy facilitating market expansion and growth opportunities, while M&A Consultancy centers around transactional support and strategic consolidation.

Strategic Objectives: Choosing the Right Consultancy Approach

Market Entry Consultancy focuses on identifying optimal geographic and demographic segments, aligning business models with local regulations and consumer behavior to establish a successful market presence. M&A Consultancy prioritizes due diligence, valuation accuracy, and post-merger integration strategies to maximize synergy realization and mitigate financial risks. Selecting the right consultancy approach depends on whether the strategic objective is organic growth through new market penetration or accelerated expansion via acquisition.

Risk Factors: Market Entry Versus M&A Advisory

Market Entry Consultancy focuses on identifying regulatory compliance, cultural adaptation, and local competition risks when entering new geographic or product markets. M&A Consultancy emphasizes risks related to due diligence, valuation inaccuracies, integration challenges, and potential legal liabilities in mergers and acquisitions. Understanding these distinct risk factors is crucial for businesses to tailor strategies and mitigate potential losses effectively.

Timeframe and Resource Implications

Market Entry Consultancy typically involves shorter timeframes and requires fewer internal resources as it focuses on strategic planning and initial market analysis to facilitate smooth entry. M&A Consultancy demands extensive due diligence, negotiation, and integration efforts, resulting in longer project durations and significant resource allocation from legal, financial, and operational teams. The complexity and scale of M&A engagements make resource commitments substantially higher compared to the more streamlined processes in Market Entry Consultancy.

Impact on Business Growth and Expansion

Market Entry Consultancy specializes in analyzing new markets, regulatory environments, and consumer behavior to strategically position businesses for sustainable growth and competitive advantage. M&A Consultancy focuses on identifying acquisition targets, conducting due diligence, and facilitating seamless integration to accelerate expansion and enhance market share. Both services drive business growth, with Market Entry Consultancy enabling organic expansion and M&A Consultancy offering rapid scale through strategic transactions.

Due Diligence Processes in Market Entry and M&A

Due diligence in Market Entry Consultancy emphasizes analyzing local regulations, cultural factors, and competitive landscapes to ensure a smooth market integration. In contrast, M&A Consultancy due diligence focuses on financial audits, legal compliance, and risk assessments to validate the target company's value and liabilities. Both processes require deep expertise but differ in scope, with market entry prioritizing operational feasibility while M&A zeroes in on financial and legal scrutiny.

Industry Suitability: When to Consider Each Consultancy

Market Entry Consultancy is ideal for businesses aiming to explore new geographic markets or launch innovative products, especially in sectors like technology, consumer goods, and healthcare where market dynamics rapidly evolve. M&A Consultancy suits industries such as finance, pharmaceuticals, and manufacturing, where strategic acquisitions and mergers drive growth, consolidation, and competitive advantage. Companies should assess their growth objectives, industry volatility, and regulatory landscapes to determine whether strategic market entry or merger and acquisition advisory best aligns with their expansion goals.

Selecting the Best Consultancy for Your Global Expansion

Market Entry Consultancy specializes in tailored strategies for launching your brand in new international markets, emphasizing local market analysis, regulatory compliance, and consumer behavior insights. M&A Consultancy focuses on guiding businesses through mergers and acquisitions, including due diligence, valuation, and integration processes to maximize synergy and operational efficiency. Selecting the best consultancy depends on your global expansion goals--whether prioritizing organic market penetration or growth through strategic acquisitions.

Market Entry Consultancy vs M&A Consultancy Infographic

bizdif.com

bizdif.com